Filecoin (FIL), a leading cryptocurrency in the decentralized storage space, is showing strong signs of recovery in November 2025. Although prices are still well below previous cycle peaks, market sentiment has clearly changed. Investors are now more focused on projects with real-world applications.

What’s making investors optimistic about FIL’s future? Here are some highlights.

Filecoin trading demand surges in November

Filecoin (FIL) is a decentralized blockchain project designed to create an open data storage marketplace. This allows users to rent or lease storage capacity globally, eliminating the need for centralized providers such as Google Drive, Amazon S3, and Dropbox.

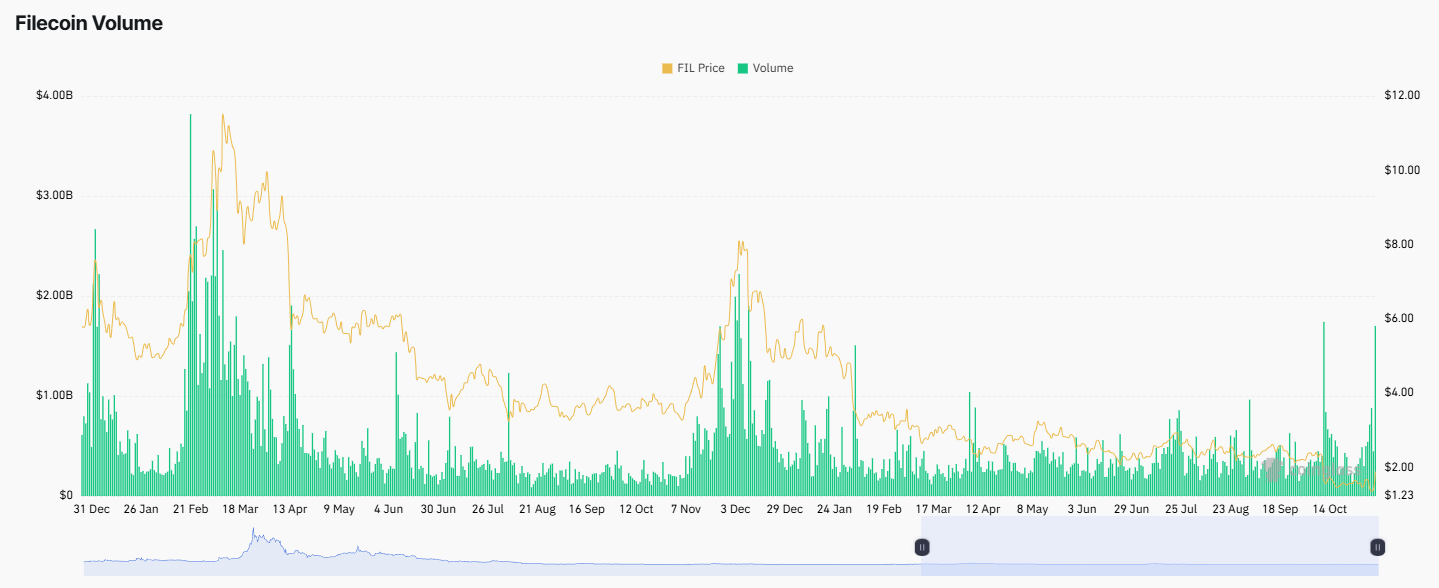

Filecoin’s price soared nearly 60% in the first week of November, with 24-hour trading volume exceeding $1.4 billion, according to BeInCrypto data.

Filecoin price and volume. Source: Coinglass

Historically, such high volumes have only occurred a few times in the past two years. Whenever volume exceeded $1 billion, a strong increase in price followed, as was seen in February 2024 and December 2024.

The return to $1 billion in daily trading volume in November reflects increased market activity and renewed investor interest. Market sentiment has also changed dramatically.

Investors increasingly prefer projects with practical use cases that survive multiple cycles. This trend explains the recent rise in altcoins such as Zcash (ZEC), Dash (DASH), and Internet Computer (ICP).

“Look, Filecoin has woken up after months of silence, rising over 50% in 24 hours as the DePIN and AI storage narratives collide. For years, people have dismissed it as outdated infrastructure, but the truth is that AI requires large-scale, decentralized, and fast storage. That’s what FIL was built for before it was cool,” said investor Justin Wu.

Grayscale’s Filecoin (FIL) holdings reach new highs

Further evidence of Filecoin’s growing visibility can be seen in Grayscale’s actions. Grayscale Investments, one of the world’s largest cryptocurrency funds, has been steadily accumulating FIL over the past two years. In November, its holdings reached an all-time high of over 2.2 million tokens.

Grayscale Investment FIL Holdings. Source: Coinglass

Interestingly, Grayscale continued to increase its FIL position even though the token price fell from over $10 to less than $2. For the fund, this decline appeared to be an opportunity to further accumulate this altcoin.

Grayscale Filecoin Trust is one of the first investment vehicles to allow investors to gain exposure to Filecoin (FIL) in the form of securities. This provides a way to participate in the performance of FIL without directly dealing with the challenges of purchasing, storing, and securing tokens.

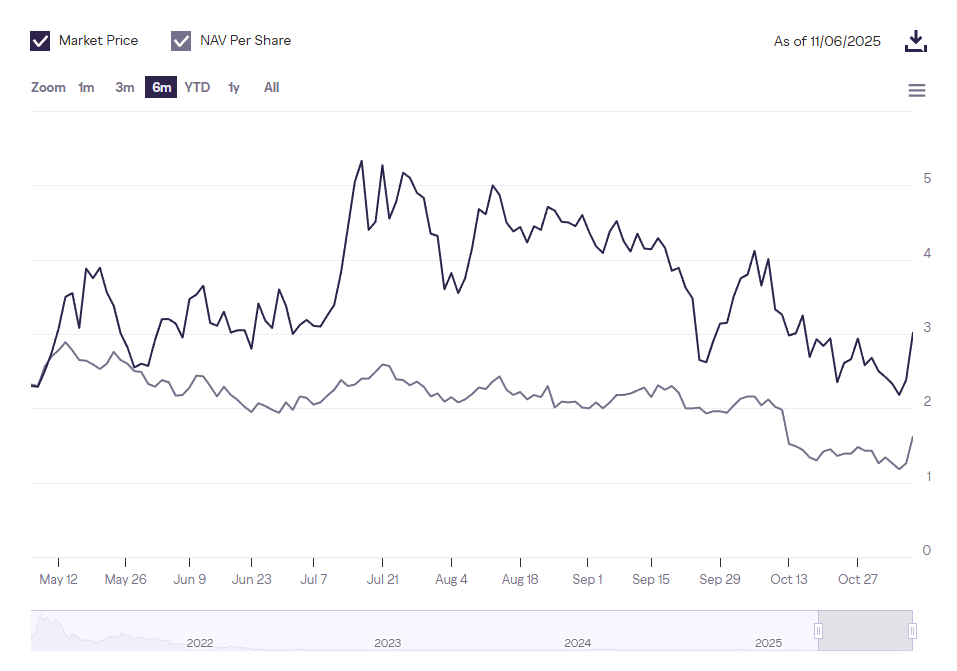

Performance of Grayscale Filecoin Trust. Source: Grayscale

Currently, Grayscale Filecoin Trust is trading above $3 per share, which is higher than the spot market price of FIL. On the other hand, the company’s NAV per share remains below the trust market price, and this situation has persisted for many years. This means that the trust’s shares are trading at a premium, meaning that investors are willing to pay more than the actual value of the assets held by the fund.

Analysts suggest that institutional investors often accept such premiums because they believe the underlying assets are worth that price, or sometimes more.

Despite these positive signs, Galaxy Research reports that FIL remains one of the worst performing altcoins in the top 100, down 99% from its peak. Therefore, recovery may take time and is unlikely to occur overnight.

The post Grayscale Filecoin (FIL) holdings reach record high as price shows signs of recovery appeared first on BeInCrypto.