Cryptocurrency Asset Manager Grayscale is preparing to wager some of its large ether holdings. This is a move that could show confidence that US regulators will soon allow penetration within products traded on exchanges.

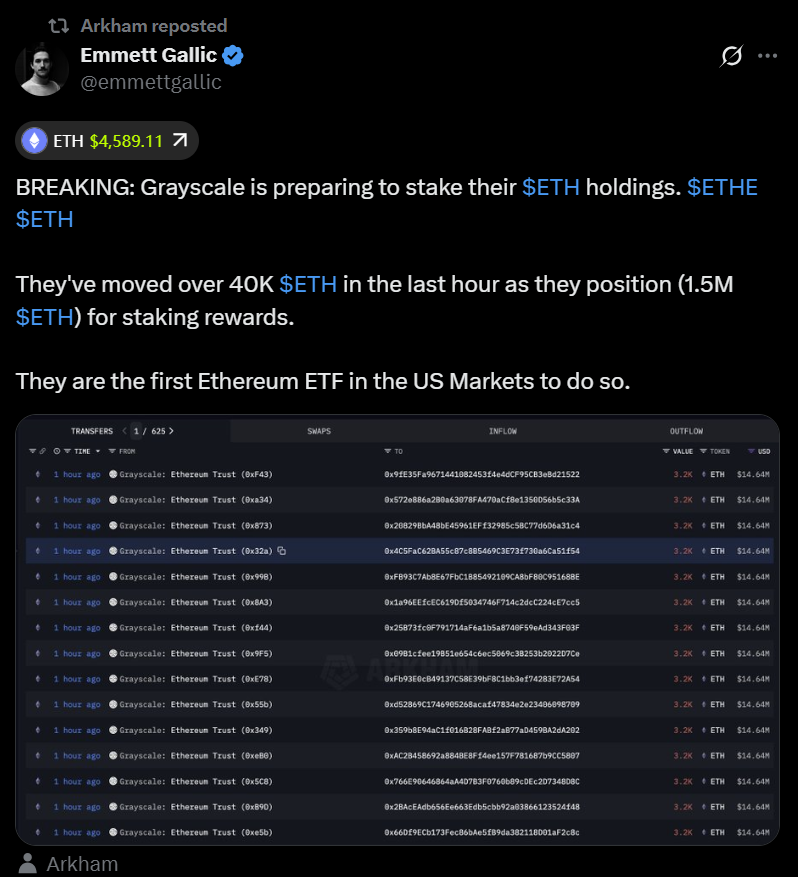

On-chain data from Arkham Intelligence showed that Grayscale transferred over 40,000 ether (ETH) on Thursday. Arkham noted that if confirmed, Grayscale will be the first US Ethereum ETF sponsor to wager its holdings.

sauce: Emmett Garrick

Grayscale’s Ethereum Trust (Ethe) manages more than 106 million ETH, covering more than $4.8 billion. The company launched ETHE as a private placement vehicle in 2017, and in 2024 it launched the low-cost Ethereum Mini Trust (ETH) through a partial spinoff of Ethe assets.

The development follows a decision by the U.S. Securities and Exchange Commission (SEC) this year to delay the decision on whether Grayscale funds can incorporate ETH staking. Since then, Regualtor has provided additional clarity, indicating that some forms of liquid staking may not fall under that jurisdiction.

Grayscale has submitted proposals to enable staking, but the SEC has not yet approved them. Existing spot ether ETFs do not include staking features.

The move tracked by Arkham came the day after the SEC approved the Grayscale Digital Large Cap Fund. This is a multi-asset Crypto ETP that offers exposure to Bitcoin (BTC), Ether, XRP (XRP), Solana (SOL), and Cardano (ADA). This product allows investors to obtain a variety of crypto exposures without having to purchase individual tokens directly.

Related: Ethereum Unstaking Keue becomes a “parabolic”: What does it mean for price?

ETH staking ETFs could be a market game changer, analysts say

Analysts have long argued that staking approval within us could lead to a new wave of institutional demand for etheric ETFs, allowing investors to earn rewards rather than simply passively retaining assets.

10x Research Head Markus Thielen told Cointelegraph in July that staking of Ethereum ETFs “can change the market dramatically.”

The debate is that demand for ether will be accelerated. This year, the influx of SPOT ETFs has skyrocketed, but the amount of ETH held on the exchange fell to its lowest level in three years in early September.

Ether exchange reserves across all crypto exchanges. sauce: Encryption

magazine: Meet the co-founders of Ethereum and Polkadot, who weren’t Time Magazine