Since its founding in 2018, Ledn has funded over $10 billion in Bitcoin-backed loans in over 100 countries.

Need liquidity? Borrow Bitcoin to maintain your holdings

“Never sell your Bitcoin.” These were the words of Donald Trump during his keynote speech to a crowd of 8,000 people at the Bitcoin Conference in Nashville, Tennessee in July 2024. This is a well-worn mantra in the Bitcoin community and the main reason Bitcoin loans exist.

Assuming a Bitcoin price of $430 in 2015 and $87,300 in 2024, the cryptocurrency has enjoyed a compound annual return of approximately 80% from 2015 to 2024. Few, if any, assets can match that performance over the long term.

And that’s exactly why smart investors never sell. They buy the push and hold Bitcoin (BTC). However, a dilemma often arises. What happens when an investor needs cash to make a purchase but doesn’t have it on hand? This is where Bitcoin loans come into play.

Companies like Ledn offer loans that use Bitcoin as collateral. Essentially, borrowers can access cash without liquidating their BTC. The entire process can be completed in a few hours and no credit check is required. Here’s a step-by-step overview of what that process looks like.

Step 1: Submit your interest rate, KYC, and Bitcoin loan application

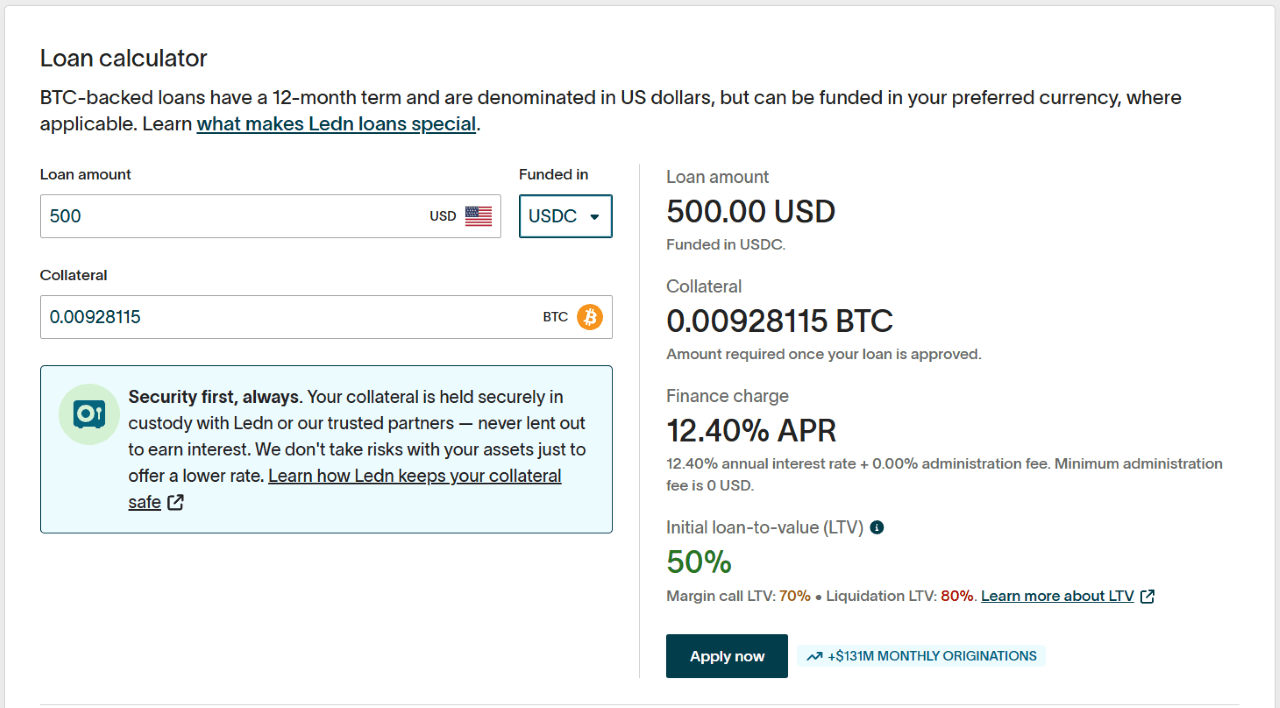

Ledn’s home page currently shows an annual percentage rate (APR) of 12.40% for Bitcoin loans. For investors, it makes sense to borrow at that low interest rate rather than sell a high-yield asset like BTC, which, as mentioned above, yields returns of around 80% per year. The possibility of triggering a taxable event is also a strong deterrent to selling when cash is needed.

(Ledn’s standard LTV is 50%, allowing customers to borrow half the dollar value of Bitcoin / Ledn.io)

Bitcoin loans, including those offered by Ledn, tend to be over-collateralized, where the value of the collateral is greater than the amount borrowed. This protects Ledn from default if prices plummet. Loan-to-value (LTV) is the ratio of the loan amount divided by the value of the collateral. Ledn’s standard LTV is 50%, which allows customers to borrow half of the dollar value of their Bitcoin. Overcollateralization also allows borrowers to take out loans without credit checks, since the risk of default is already significantly reduced.

After checking terms like APR and LTV, deciding on your preferred currency, and adding a crypto address or bank account to receive proceeds from your loan, you’ll need to provide identification to meet know-your-customer (KYC) requirements. You can also submit a simple loan agreement later. Official approval turnaround time is 1-2 business days, but decisions are often made within minutes.

Step 2: Deposit collateral

Ledn requires borrowers to deposit Bitcoin collateral within 10 days of receiving loan approval. This process is simple and easy, especially when done using a Bitcoin.com wallet. BTC is simply sent from your personal wallet to your Ledn public address.

Step 3: Receive loan funds

Once a user receives loan proceeds, the loan will appear as “active” on the Ledn dashboard. The money will be deposited into your bank account or crypto wallet depending on the type of currency you choose in the first step. Some borrowers choose to deposit additional collateral to lower their LTV ratio.

Step 4: Loan repayment

(Ledn does not impose early repayment penalties on borrowers / Ledn.io)

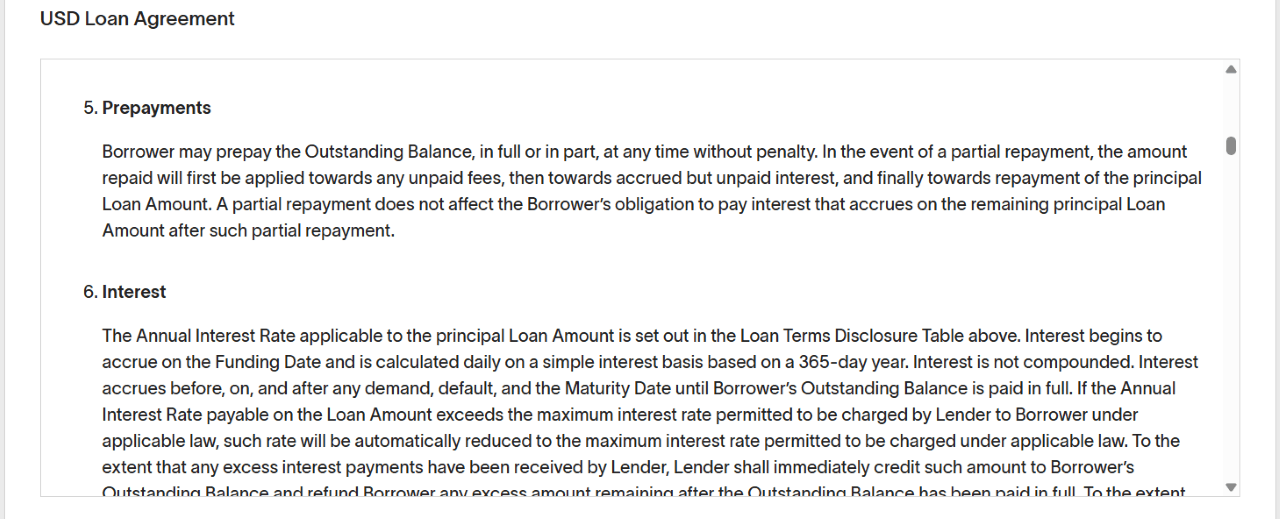

Whenever a borrower decides, they can use Bitcoin, USDC, or fiat currency to repay their outstanding loan. There is no penalty for early repayment. If your loan is not paid off after the standard 12-month loan period, you can still renew it if you meet the minimum criteria.

conclusion

It may seem strange at first for a borrower to seek a loan worth half the value of the required collateral, but Bitcoin is unique in that it boasts the highest returns in history. Higher returns than most borrowing costs. In addition to that, Ledn loan processing is relatively easy and quick, which makes the choice easy.