This is a segment of the Supply Shock Newsletter. Subscribe to read the full edition.

Greetings, Happy 41st birthday to Ross Ulbricht!

Now, rehashing the Silk Road timeline doesn’t seem entirely useful, from a secret psychedelic lab in a Texas cabin off-grid to a global secret manipulation with six employees.

Besides, many years The history of bitcoin Readers are already walking through the event that led to Ulbricht’s dramatic arrest in 2013 at the San Francisco Public Library.

Anyone who missed last year’s email can find it in our archives – it’s definitely worth reading!

But remember: telling the story misses a happy ending. Written before President Trump forgives Ulbriccht earlier this year, he released him from double living prison after nearly a decade of service.

Let’s pay tribute instead to celebrate Ulbricht’s first birthday since the release method He integrated Bitcoin payments into the Silk Road for reasons that have been largely lost in modern cryptography.

This week’s Bitcoin legend.

Silk Road Founder Ross Ulbricht | freeross.org modified by BlockWorks

I will not turn back

Bitcoin was a clear fit to the Silk Road. It separates global payments independently from both government and corporate management and corporate management, infusing users with financial self-power that goes beyond real-world cash.

“All transactions that take place outside the state-controlled ties are victory for the individuals participating in the transaction,” Ulbricht wrote in 2012.

What suited his vision was the out-of-control nature of Bitcoin. This is worth complementing the hidden existence of the Silk Road through the TOR.

Ulbricht fully understood that Bitcoin transfers were immutable. This property, coupled with its pseudonymity, forms the basis for what makes Bitcoin extremely interesting as the currency of underground activity, autonomy.

Applied in the right way – with strict OPSEC in mind – Bitcoin allows for true freedom of commerce on the Silk Road.

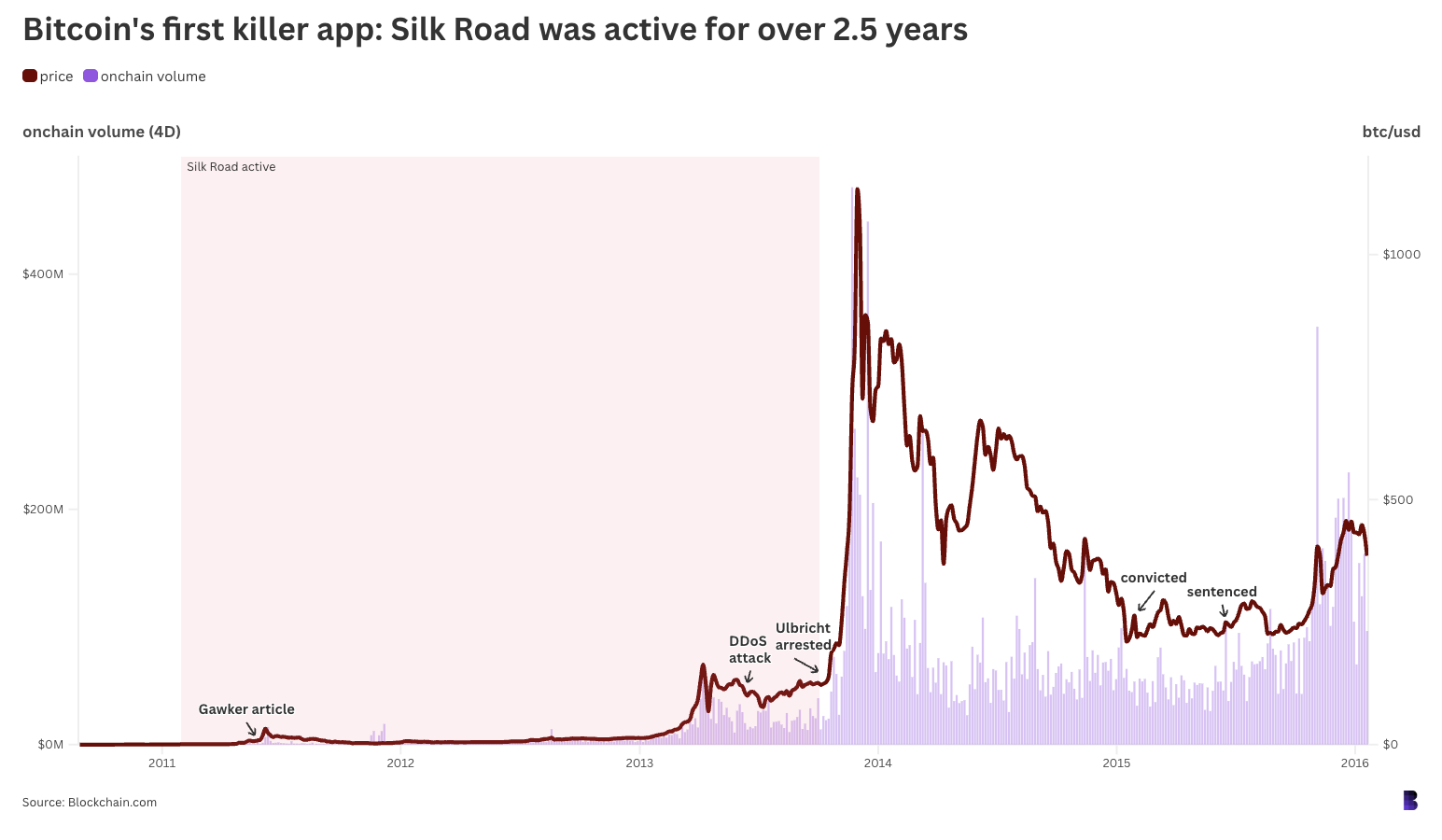

The Silk Road was active in one of Bitcoin’s first Great Bull Runs, but was defeated for the first time just before reaching $1,000. (On-chain volume = not only Silk Road, but total on-chain volume.

Ulbricht “intended as a platform about giving people the freedom to make their choices and to pursue their own happiness, but they thought it was appropriate for each individual.”

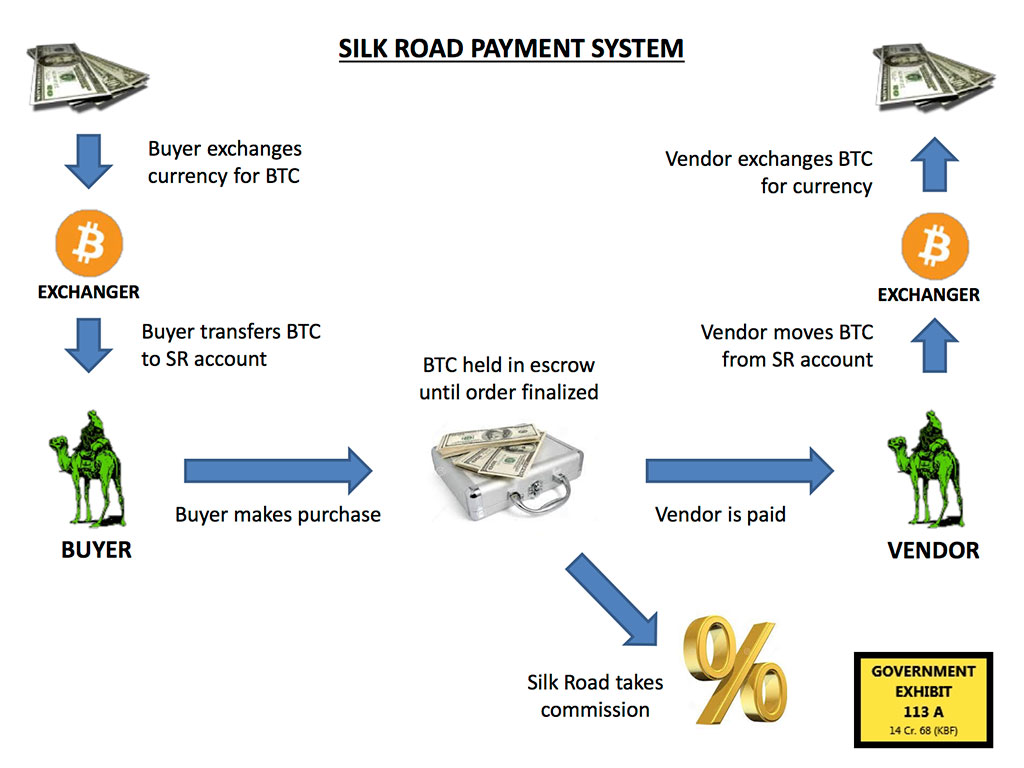

The Silk Road needed guardrails to accept only Bitcoin for payments. Quality control was crowdsourced via a public review system, and to protect users from fraud, Ulbricht has deployed Silk Road as the mediator of all transactions on the platform.

It meant escrow. In the automated system, whenever a purchase was made, the buyer’s Bitcoin payments were temporarily held in a wallet controlled by a Silk Road administrator, including Ulbricht.

The Silk Road then informed the seller that the payment had been received and the seller was able to proceed with the shipment. Once the package arrived on the other side, the buyer submitted a confirmation to the Silk Road site, after which Bitcoin was released to the seller, and the seller pulled the coin into his wallet.

Moderators handled disputes manually on a case-by-case basis via the ticker system, similar to how Amazon, eBay, and Airbnb work today.

There is no doubt that these processes are plagued by the assumption of trust. Both buyers and sellers had to trust that the Silk Road would not disappear with all Bitcoin, and that the Silk Road was well equipped to protect the user fund.

This Silk Road payment flow chart was on display 113a during Ulbriccht trial.

Users also had to believe that moderators would properly manage conflicts. Sometimes mods had to provide potentially essential photo evidence, such as shipping labels and tracking information that needed to be protected against leaks and theft.

Anyway, the system worked. By the time the Fed closed the Silk Road, it sold 9.5 million btc (80% of Bitcoin’s circulation supply at the time), and in September 2013 it won 600,000 btc, worth $1.2 billion and $80 million respectively.

Still, Silk Road has integrated Bitcoin mostly in all the right ways. The platform automatically generates new Bitcoin addresses for all transactions, making it difficult to track. All transactions are also done via TOR, and when used correctly, they can hide the IP address.

If the Silk Road was being built today, maybe it would have had escrowed coins in a multi-sig wallet. At least that spreads some of the trust. Bitcoin Multisigs did not become effective until April 2012. This has been more than a year since the Silk Road was first released.

It suits your purpose

Putting these concerns aside, Bitcoin and only Bitcoin was able to do what Ulbricht needed.

This is especially true. There was a small portion of Bitcoin’s market capitalization and liquidity, given that there were only a handful of alternative cryptocurrencies, including Litecoin, Peercoin and Namecoin.

For example, let’s say the Silk Road was launched at Ethereum in 2025. Perhaps due to faster payments, more flexible escrow features, or Stablecoin support (Silk Road actually managed to lock the dollar value of Bitcoin at the time of purchase, minimizing the impact of price volatility).

In that case, hypothetical, one sanction on the Silk Road contract would quickly make the transaction somewhat difficult to process. In November, that figure exceeded 70%.

Needless to say, in reality, every major stubcoin has a feature built to allow the issuer to free up and confiscate the tokens at will, and can be done regularly on demand from law enforcement.

Such features clearly conflict with the concept of an independent libertarian marketplace, regardless of the forces held by Ulbricht and the rest of the Silk Road team on the platform.

The Silk Road heritage is as follows: For all the philosophical distances that separate “Bitcoin” from today’s “Bitcoin”, the idealistic platform Ulbriccht built was a divergent catalyst. It was a splitting point that split a huge fault line that now divides the space.

Through Bitcoin, the Silk Road undermined the traditional financial system and further critically undermined the entire social order. Ulbricht had no cosplay.

It’s a far cry from the ridiculous commercial transactions that stubcoins and their smart contract platforms that emerged in the wake of the end of the Silk Road are aiming to serve.

These systems have grown to strengthen Legacy Finance rather than unlocking Legacy Finance in the way Ulbricht wanted.

Unexpected outcome

Of course, even Bitcoin’s robust censorship resistance was not enough to protect Ulbricht from the US government. The same goes for other Silk Road operators and power users.

In total, 144,000 btc ($26 million, today $12.6 billion) was first seized from Ulbricht-controlled wallets, and an additional 120,000 BTC was added from two hackers who stole Bitcoin separately from the Silk Road during their activities.

In many years of well-known cases, tens of thousands of more coins may have been seized from users of the Silk Road.

There’s friction there. Bitcoin is clearly resistant to digital space, and Ulbricht was great enough to understand that the Silk Road could become the first killer crypto app. In many respects, there has never been a second best to date.

The same cannot be said for our physical meat space. The Ulbricht coin was literally taken by force from him and sold for relative pennies at current dollar value.

Second, the US government’s response to the Silk Road incident formed a playbook for what would become the Fed’s strategic Bitcoin sanctuary.

The seized coins will never be sold again. At this stage, the only way the reserve can get something bigger is for the authorities to seize even more coins from the sovereigns.

And these coins are of some value due to the implicit promise that they cannot be tampered with under normal circumstances.

No satisfactory irony can be squared, and when Bitcoin actually benefits the Treasury, it awkwardly appreciates having Ulbricht and Silk Road.

Luckily for Ulbricht, he received a much greater gift than any Bitcoin Stash – freedom – which is the happiest of his 41st birthday that I can imagine.

To Loss. Bitcoin could not be what it is today without him.

– David

Lizzo’s take from a Bitcoin historian

“What did you do this week?”

This was the US government subject of Elon Musk’s current infamous emails, but as David points out above, that same email can be sent to the crypto industry today.

Or maybe it’s Ross Ulbricht’s reaction to his perception this week. eBay is slow to verify his identity.

Is that a real user friction? An elaborate troll? Today’s hyper-comsexual internet, where Snoop Dogg could “give up smoke” there is a possibility that grills will be sold. Perhaps you can forgive your distrust. I hope Ross skipped the web descent into the maze of ref-links.

Still, it’s hard to help but think that Ross might be wondering what Bitcoin and Cryptocurred in his absence. As eBay’s example shows, despite the initial promise that Bitcoin will quell them, online commerce friction remains quite significant.