Hyperliquid’s native token, the hype is nearing an all-time high, fueled by decentralized derivative exchanges that capture more than 80% of the permanent futures market in the chain.

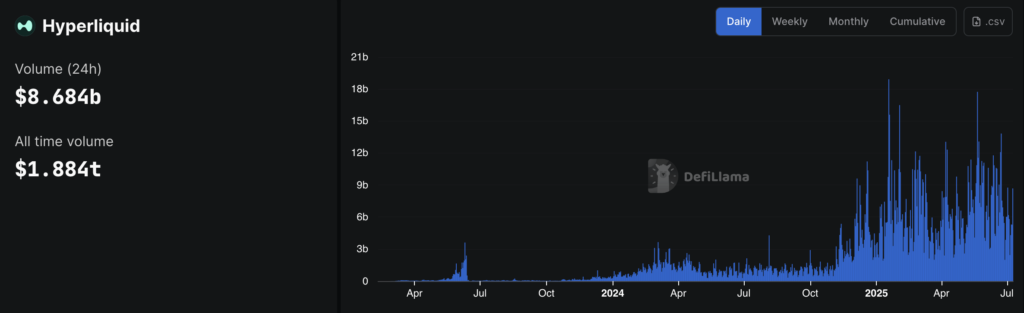

The platform has seen an average daily trading volume increase to a consistent range of $2-6 billion. This is a surge in line with our new partnership with Phantom wallets and recent network upgrades. Over the past 24 hours, it has surged to $8.4 billion, breaking $1.88 trillion in life.

However, while the average has been strong since the 2024 breakout, trading volumes are still well below the all-time high of $18 billion.

For each Defillama data, the decentralized exchange orders the majority of the permanent market, with its total value (TVL) exceeding $480 million. This growth places high lipids ahead of their competitors in a decentralized financial environment.

The platform rise is built on its own Layer-1 blockchain that utilizes on-chain order books, distinguishing it from many other decentralized exchanges that rely on automated market maker models. The infrastructure is designed to provide high throughput and low latency trading, reflecting centralized exchange performance.

It is the platform’s “real yield” model that drives investor optimism, where revenue from trading fees is distributed to hype tokenstakers. High lipids charge candidates 0.025% fees and 0.002% of manufacturers, and the collected fees are used to buy back and burn the tokens of hype, creating deflationary pressure.

The mechanism directly links the value of the token to the trading volume of the platform. High-Degree of Freedom Provider (HLP) Vault is an integral part of this ecosystem, allowing users to provide liquidity and gain a share of the platform’s revenue.

Hyperliquid’s recent partnership with Phantom is a Solana-based wallet with over 15 million users, featuring a significant number of new traders on the high lipid platform, further increasing trading volume and liquidity.

Exchange co-founder Jeff Yan emphasizes a user-centric approach. In an interview with chain catcher, Yang said, “We wanted to create something that people actually want to use, not just to cultivate agriculture.” This philosophy appears to resonate within the Defi community, with the platform’s user base growing to over 500,000 and total deposits of over $88 billion.

The recent CoreWriter upgrade, released last week, has also eradicated bullish sentiment. This allows HypereVM distributed applications to interact directly with the permanent exchange of Hypercore. Hypercore was released in March to enable seamless asset transfer and smart contract development within the high lipid ecosystem, combining centralized exchange performance with distributed finance capabilities.

Despite rapid growth, high lipids face challenges. In March 2025, the platform experienced a security breaches. The incident, with exploits related to HLP safes, led to nearly $12 million in cumulative losses for liquidity providers.

Hyperliquid’s hype token is currently trading at around $41.60, and has grown nearly 7% over the past 24 hours as the platform’s basic strengths and strategic initiatives continue to attract market attention.

Its market advantage, sustainable yield models, and expanding user base through key partnerships moves exchanges from strength to strength as a scary player in the chain-derived sector.