Bitcoin’s price fell below $90,300 and is currently trading around $89,900 after a steep decline that saw its 30-day loss balloon to 16%. Traders are divided on whether to expect another rebound or brace for further losses.

But the charts and on-chain data point to one simple idea. This means that if Bitcoin price does not regain significant levels soon, the next bottom could be even lower, perhaps below $80,000.

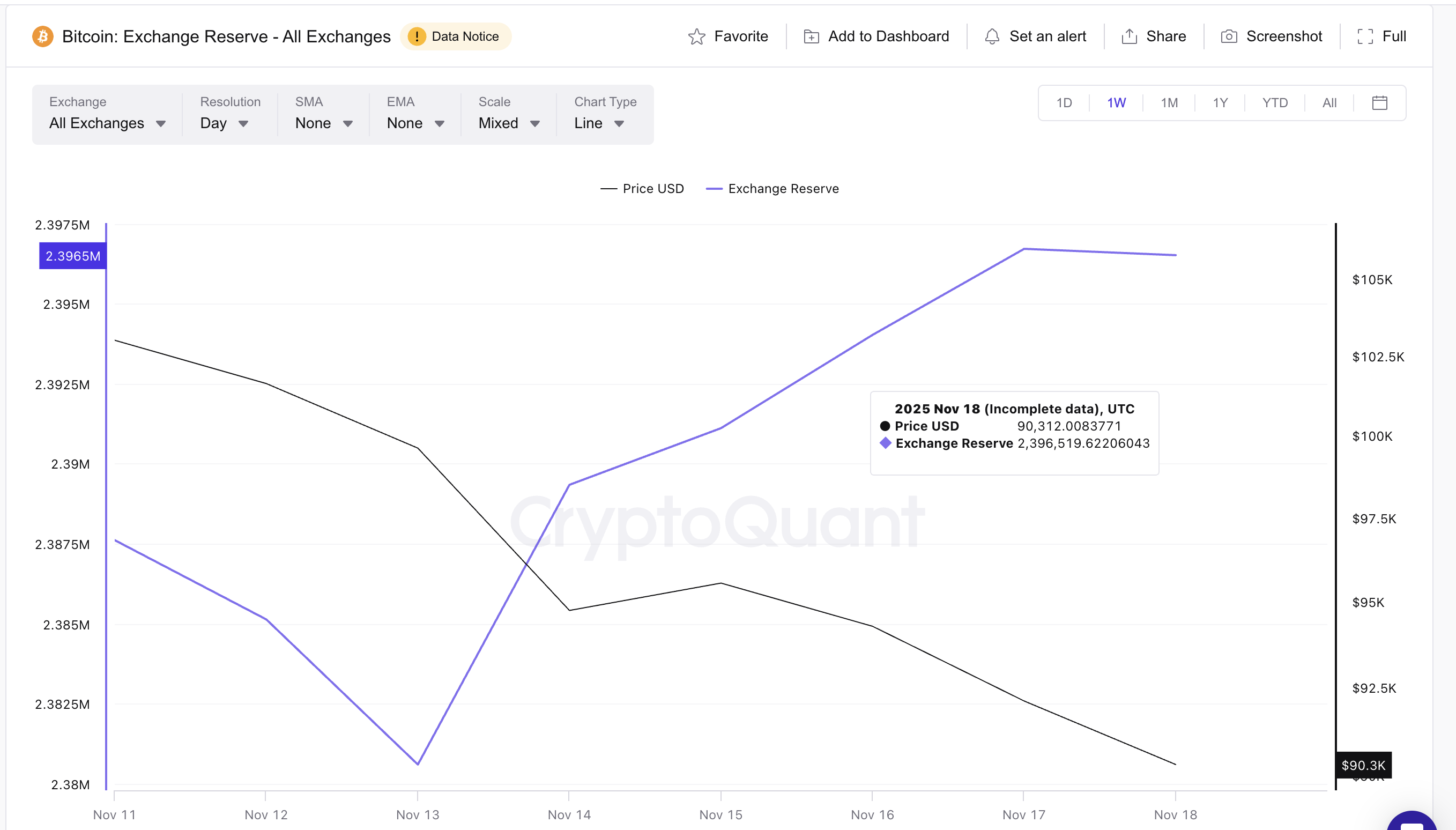

Spot selling occurs as foreign exchange reserves increase sharply

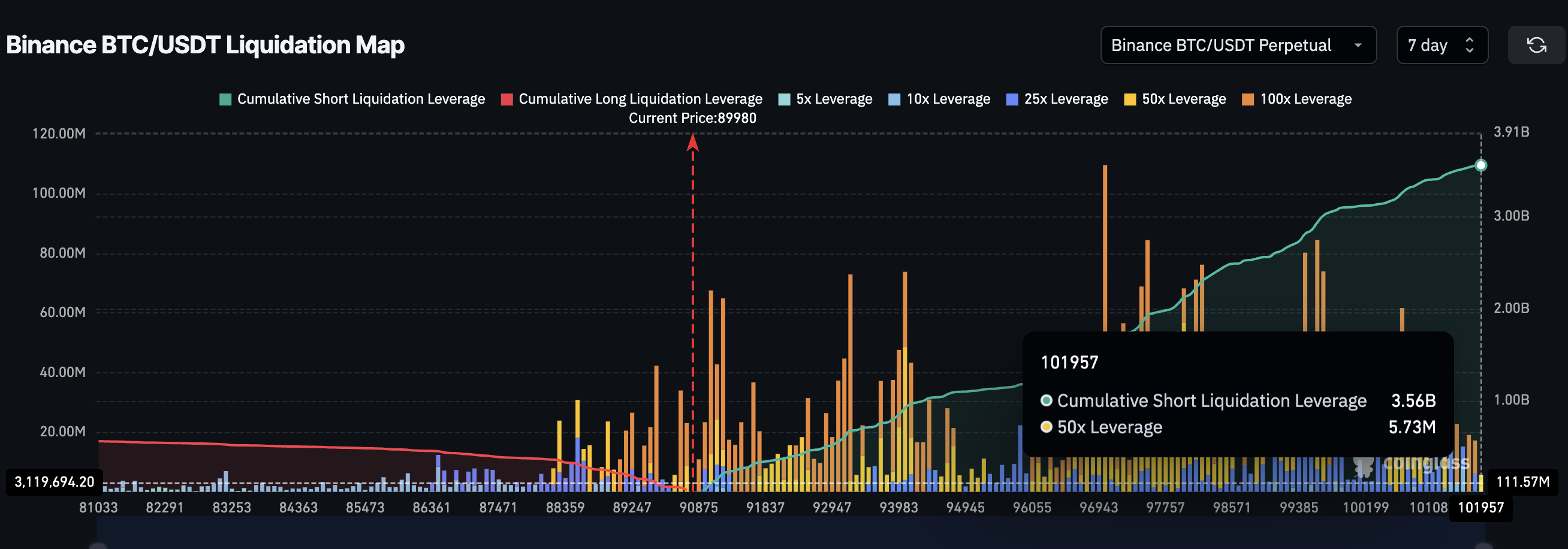

Selling pressure has changed its nature. Previous BTC declines were mainly caused by prolonged liquidations, but their strength has been waning. Looking at Binance alone, the long liquidation amount of BTC/USDT is approximately $558 million, and the short amount is approximately $3.56 billion. This is more than 6x, indicating that the long side has already been deleveraged. As the liquidation fades, price declines begin to indicate actual selling rather than forced selling.

Liquidation Map: Coin Glass

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

This is exactly what exchange reserves confirm.

From November 13th to November 18th, Bitcoin reserves across all exchanges increased from 2,380,595 BTC to 2,396,519 BTC. This means that 15,924 BTC moved to the exchange in 5 days. Converted to the current BTC price, this is equivalent to approximately $1.43 billion.

This is the highest inflow in recent weeks and indicates a deliberate spot sell-off, perhaps a panic exit. Holders are moving their coins to exchanges for sale or preparation for sale.

BTC Exchange Reserve Rise: CryptoQuant

The transition from liquidation-driven declines to spot-driven declines is important because the declines are typically not only more controlled but also more sustained. This also explains why Bitcoin price remains under pressure even after leverage cools.

Bitcoin price remains exposed due to weak support pocket

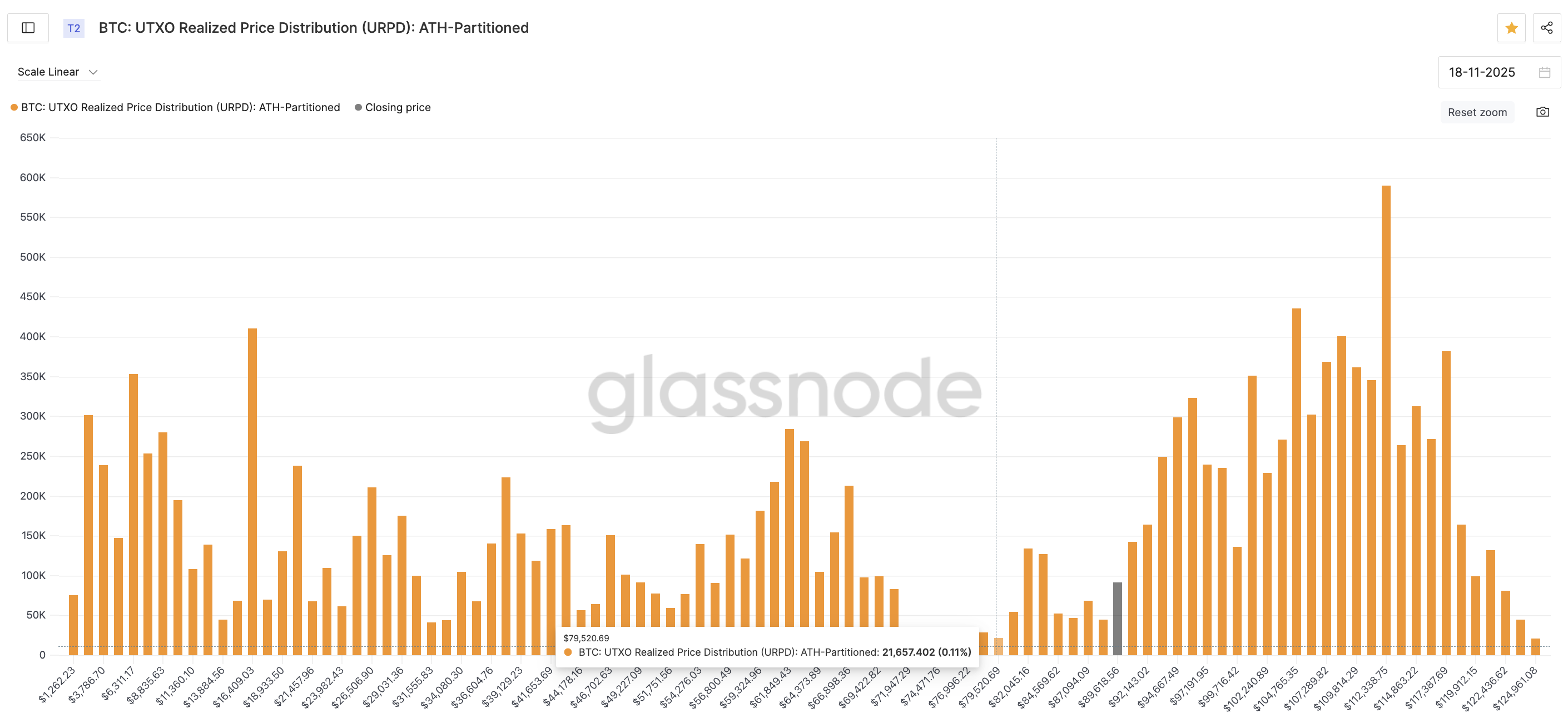

To understand where Bitcoin price stabilizes, we look at the UTXO Realized Price Distribution (URPD). URPD indicates where the holder last purchased the coin. These regions act like support clusters because people tend to stick to the prices they enter.

However, the area between $89,600 and $79,500 provides very thin support. Very few coins have last moved in this band, meaning there are fewer holders willing to protect it.

Major Bitcoin price support cluster: Glassnode

This explains why losing $90,300 is risky. If Bitcoin is unable to recover this level, the price will remain exposed to a broad weak zone extending to highs below $80,000 on the chart and URPD map.

Trend-based Fibonacci structures also support the same idea. Bitcoin has been falling inside the wedge since October 6th. The lower trend line is weak because there are only two clean touches. The price is moving towards that line again, and a break would bring the Fibonacci extension to the next real target at $79,600, breaking the trend line. This level almost perfectly matches the URPD gap.

According to the URPD cluster, short-term support near $82,000 to $84,500 is the last buffer before this zone. If Bitcoin continues to close below $90,300, these supports will be the next logical test.

Bitcoin Price Analysis: TradingView

A reversal is still possible, but it would require Bitcoin price to regain several levels in sequence. First comes $90,300, which would indicate that the market is rejecting the breakdown. After that, $96,800 is the next hurdle. And finally, above $100,900, near-term sentiment will turn bullish.

The post Bitcoin bottom could form below $80,000 if price fails to regain this level appeared first on BeInCrypto.