Blockchain technology and decentralized platforms have introduced new ways to invest and raise capital. This evolution is creating what we now call the Internet Capital Market (ICM). This Internet Capital Market vs. Traditional Finance (TRADFI) comparison guide explores how these two systems compare in several key areas, including infrastructure, accessibility, regulation, speed, and investment opportunities. Here’s what you need to know in 2025:

In this guide:

- In short, ICM vs. tradefi

- Internet Capital Market vs. Traditional Finance: A Basic Concept

- Types of musical instruments available

- ICM vs. Tradfi: Capital raises

- Accessibility and participation

- Regulation and monitoring

- Security, Risks and User Responsibility

- ICM vs. tradfi: similarities

- Which is better?

- FAQ

In short, ICM vs. tradefi

Internet Capital Market vs. Traditional Finance: A Basic Concept

These markets operate on distributed ledger technology and aim to be more efficient, accessible and global than traditional finance. In an ICM project, you create on-chain managed tokens (such as Solana’s fast blockchain) and run through code without a central intermediary. This means that the ICM platform runs 24/7 on a distributed infrastructure.

Meanwhile, traditional finance represents an established financial system managed by banks, stock exchanges and other centralized facilities.

They rely on centralized servers and networks, from stock exchange data centers to bank mainframes. These systems are relatively robust, but are inherently constrained as they operate within set business hours and require intermediaries to verify and resolve transactions.

At TRADFI, intermediaries manage transactions and financial services under strict government surveillance. This centralized model provides stability and consumer protection, but also requires higher fees to entry for some participants, slower processes, and barriers.

Types of musical instruments available

In ICMS, the main device is digital tokens. Typically, it is an alternative token that represents an idea, project, or community. These tokens come in a variety of flavors, but do not have any formal ownership or obligations.

What they have in common is that they are speculative assets that do not have legal rights unique to their holders. Owning an ICM token does not provide dividends, voting rights, or claims on the company’s assets. Instead, their value is driven by network effects, potential future utilities, and market hype, rather than established cash flows.

In contrast, traditional finance offers a wide range of financial products. Stocks (stocks) often represent ownership of a company that has the right to vote and potential dividends.

Debt certificates, such as bonds, offer fixed interest and repayment promises. There are also hybrids (such as convertible bonds, convertible bonds), pool investments (mutual funds, ETFs), and derivatives (options, futures, swaps) for hedging and speculation.

Each asset type in TRADFI has a defined structure and legal framework. For example, bondholders have contractual claims, and shareholders have governance rights as part of their owners.

Compared to ICM’s all-purpose tokens, Tradfi’s diverse products have evolved to meet a variety of financial needs (e.g. capital raising, revenue generation, risk management).

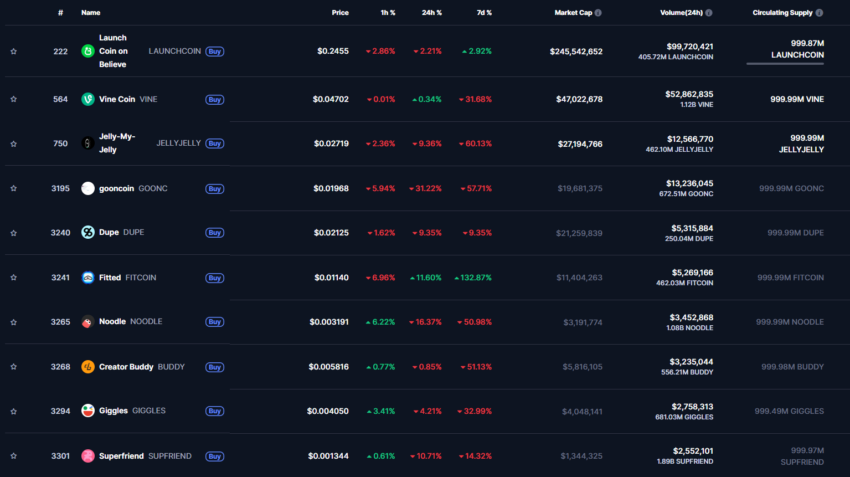

Top ICM Token: COINMARKETCAP

ICM vs. Tradfi: Capital raises

The Internet Capital Market operates on decentralized rails. Anyone can tokenize digital ideas and raise capital without relying on banks or regulators.

ICM Startup Process

Conceptualization: The creator identifies the Internet-native ideas to tokenize.

Creating a token: Using platforms such as Believe and Pump.fun, creators will send basic information (token names, tickers, etc.) to create tokens. This process does not require coding or formal approval.

- Market initialization: Platforms establish a market for tokens and often use bonding curves to determine pricing dynamics.

- Community Engagement: Creators promote tokens and attract participants through social media and other channels.

- Transactions and Liquidity: Once a certain market capitalization threshold is reached, the token will be listed on a decentralized exchange (DEXS) to allow for a wider range of transactions.

Characteristics

- Accessibility: Anyone with internet access and digital wallets are open.

- speed: Tokens can be launched and traded within a few minutes.

- Transparency: All transactions are recorded on the public blockchain.

- risk: High volatility and minimal regulatory oversight.

Tradfi IPO Process

- Preparation: Private companies attract investment banks to undertake IPOs.

- Regulatory compliance: The company will submit a registration statement (US Form S-1) that includes regulatory bodies such as the SEC.

- marketing: Roadshows will be held to attract institutional investors.

- Pricing: The underwriter sets the initial stock price based on the investor’s profits.

- Public transaction: The stock is listed on the stock exchange and allows public transactions.

Characteristics

- Regulations: Subject to strict regulatory requirements to protect investors.

- Transparency: Companies must disclose financial and other important information.

- access: Accessible primarily by institutional investors in IPOs. Retail investors will participate after listing.

Accessibility and participation

The Internet capital market is generally open to anyone with an internet connection and a digital wallet. Usually, no gatekeeper needs complicated documents, credit checks, or minimum account balances.

This inclusivity means that individuals around the world, and even individuals from regions where banks do not want to do so, can directly participate in investments and transactions. For example, the new token launch platform allows everyday retailers to purchase for early stage projects that are traditionally limited to certified investors and venture capital companies.

In contrast, traditional finance often has a higher barrier. Opening a brokerage or bank account may require identification, credit history checks, and minimum deposits.

Additionally, certain profitable opportunities (such as private equity, hedge funds, pre-allocation for IPOs, etc.) are usually only accessible to wealthy or institutional investors, and often the average person is on the sidelines.

Regulation and monitoring

In ICMS, most activities occur outside of traditional regulatory frameworks. An Internet Capital Market Token launch bypasses registration, disclosure and investor protection regulations that typically apply to stocks or bonds.

Meanwhile, traditional finance is heavily regulated to protect investors and ensure market integrity. Banks, brokers, and exchanges must be licensed and comply with strict regulations (such as KYC/AML, reporting requirements, capital reserves).

Public companies are required by law to publish audited financial statements and disclose important information. Regulatory bodies (such as SEC, FCA, central banks) punish fraud and insider trading and actively enforce rules.

In the event of a brokerage, there is also investor protection, such as bank account deposit insurance and compensation schemes. All this creates a safer and more predictable environment, but compliance costs and red tape can slow innovation and limit access.

Security, Risks and User Responsibility

ICM holds you a lot of responsibility. You hold and secure your token in your personal wallet. If you lose your private key or fall into a phishing scam, your funds will disappear forever. There is no bank helpline or insurance.

In contrast, traditional finance offers more safety nets. Depositing money in the stocks of banks and brokerages helps these institutions secure assets (regulators oversee them).

If you forget to log in, you can reset your access. Government deposit insurance if the bank fails May Cover your losses up to limit.

However, Tradfi’s investments are not yet completely risk-free. Companies can go bankrupt and markets can crash, but under regulatory clocks, fraud is completely rare.

Laws usually provide a means of remedy if misunderstood. For example, a lawsuit or regulator can sanction bad actors. And the typical volatility of a blue chip stock or bond is much lower than the typical volatility of a meme token.

In summary, TRADFI transfers most security obligations to institutions and regulations, while ICM shifts them as individuals.

ICM vs. tradfi: similarities

Despite all the differences, the internet’s capital and traditional finance share some core commonalities. Both are mechanisms that connect investors with opportunities. At their core, they lead from those with capital to those who need funds.

In both models, the supply and demand market sets asset prices, and participants speculate about future value. ICM token trading and stock trading in exchange with DEX experience similar dynamics of price discovery, liquidity offerings, and investor sentiment driving boom or bust. For this reason, some people tend to call ICMs trading against decentralized, democratized stock markets.

With all aspects in mind, both systems can generate wealth for investors or lose money on investors, and both look at bubbles and enthusiasts (e.g., the dot com bubble for Tradfi and ICM’s Meme Coin Frenzies.).

Each one relies on a certain level of trust. At TRADFI, we trust regulators and businesses, while at ICM we trust code and community. Ultimately, whether you’re buying tokens or stock, you’re taking risks to ideas with profits.

The basic principles of investment – diversification, due diligence, and risk management – apply to both areas.

Which is better?

It all depends on your priorities. If you prefer accessibility and innovation, Internet Capital Markets offers global reach and innovative opportunities with fewer intermediaries. However, if regulatory oversight and proven stability are more important to you, the established framework of traditional finance may give you greater confidence.

Simply put, each system has its trade-offs. One brings openness and rapid innovation, while the other guarantees structure and predictability. Accessibility, innovation, regulation, or stability – reflecting what’s most importantly will help you choose the financial path that best suits your needs.