The Cryptocurrency market was quite stable despite the global macroeconomic headwind that shook the traditional market last week. The price of Etherrium did not enjoy slogans such as other large assets, which ended in the first quarter of April to the first quarter of April.

The second largest Cryptocurrency is the last before it loses $ 1,800 last week. However, the latest warm chain data suggests that Etherrium prices may be close to the floor and are preparing for a rebound in the next few weeks.

If the metrics rise, Etherrium prices are ready to come back.

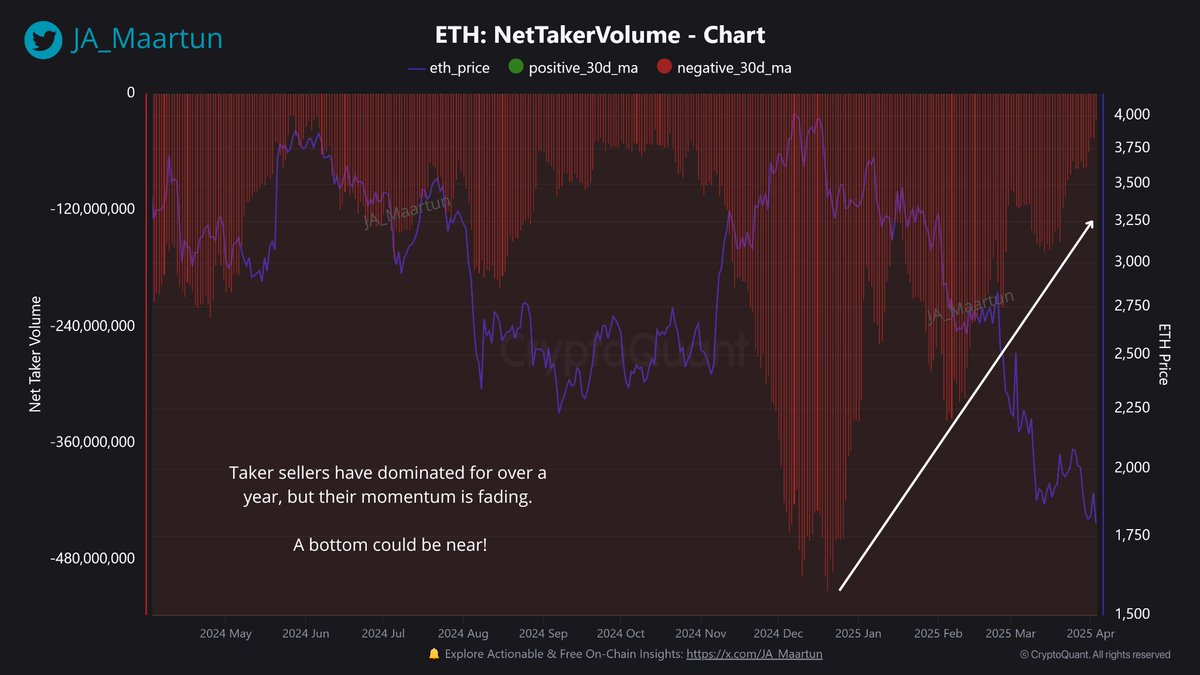

MAARTUNN, a chain analyst from the recent post on the X platform, shared a new insight into Etherrium investors’ activities for the exchange of central response. According to Crypto Pundit, the latest hot chain shift suggests that a new floor can brew the price of Etherrium.

The relevant indicators here are pure quantity metrics, tracking the difference between Taker sales in the volume and specific asset markets (in this case Ethereum, in this case). This thermal indicator can be used to measure the strength of sales or purchase pressure in the market.

If the pure quantity is positive, the aggressive purchase activity (taker purchase) indicates that it is an overwhelming Taker Sells. The negative metrics mean that the taker sales volume is higher than the volume of takers. This is usually a weak signal.

MAARTUNN pointed out that aggressive sales activities in their posts have surpassed purchasing activities in the Etherum market for more than a year. However, the hot -chain analyst seems to have been weakened over the last few weeks and lost some steams.

Source: @JA_Maartun on XAs you can see in the chart above, pure Type Volume forms a higher lowest level despite the fact that Etherrium prices create a new low lowest level. This classic strength difference Altcoin suggests that you can experience optimistic reversal beyond the floor.

At the time of this article, ETH tokens are about $ 1,806, reflecting the price increase of about 1%over the last 24 hours.

Ethics whales refine their shares

Interestingly, the conflicting hot chain data also appears, showing that an important investor known as a whale offset assets. The investor Cohort affects market epidemiology due to a significant stake and is usually monitored by other investors.

Source: @ali_charts on X

Encryption analyst ALI Martinez said in a April 4 post that whales (10,000 to 100,000 coins) sold more than 500,000 ETH tokens for the last 48 hours. Considering the size of this selling and the influence of investors, this activity can be a weak road block for the recovery of Etherrium prices.

The price of ETH on the daily timeframe | Source: ETHUSDT chart on TradingView

Istock’s main image, TradingView chart

Editorial process focuses on providing thorough research, accurate and prejudice content. We support the strict sourcing standard and each page is diligent in the top technology experts and the seasoned editor’s team. This process ensures the integrity, relevance and value of the reader’s content.