Ethereum is barely crossing the critical $3,000 level as the broader cryptocurrency market battles extreme selling pressure. Fears remain high, liquidity is declining and investors are bracing for greater volatility. But despite the decline, some analysts argue that this environment is starting to look like a classic oversold setup that has historically provided long-term players with powerful accumulation opportunities.

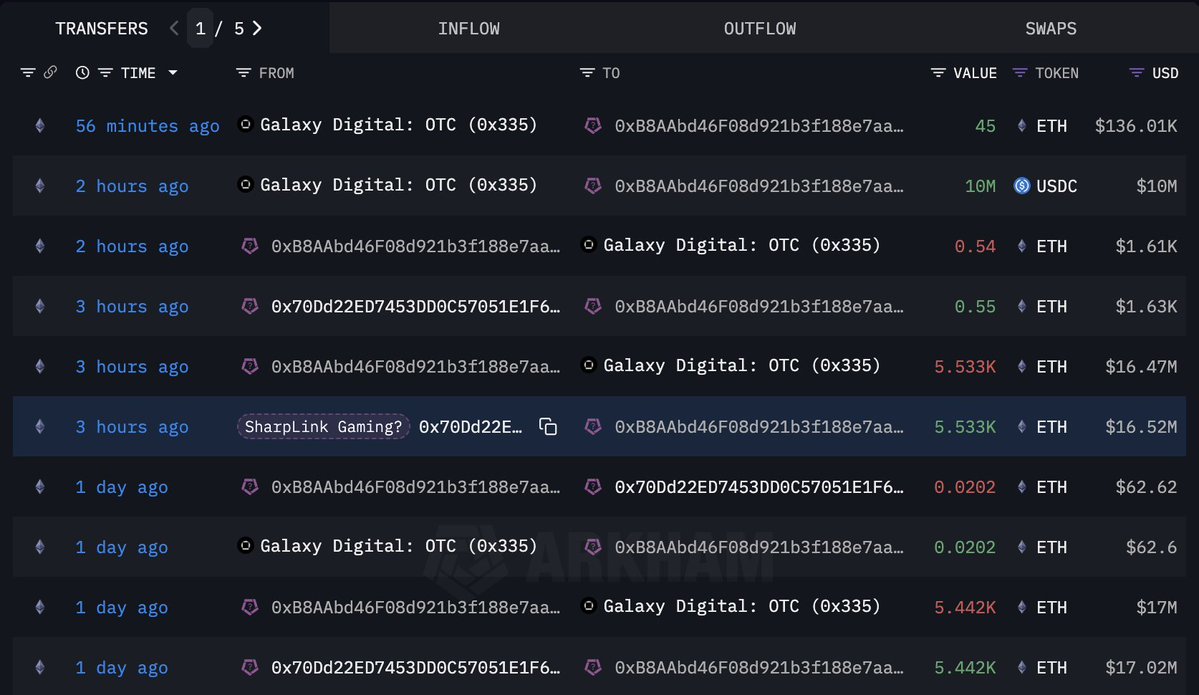

What’s even more interesting is that new data from Lookonchain has revealed unusual on-chain activity involving wallets potentially linked to SharpLink Gaming. The move sparked intense speculation across markets. This is because large OTC trades often imply strategic repositioning of institutional participants rather than panic selling.

This activity is noticeable at moments when Ethereum is testing key support levels and sentiment is overwhelmingly bearish. The fact that significant OTC flows are still occurring suggests that smart money is operating beneath the surface even as retail panic grips public markets.

SharpLink connected wallet sparks sell-off speculation

A wallet potentially linked to SharpLink Gaming (address), according to new data from Lookonchain. 0x70dd) has executed a series of large-scale transactions that are gaining attention across the Ethereum market. In the last two days, the wallet transferred 10,975 ETH, worth approximately $33.5 million, to the Galaxy Digital OTC wallet. Soon after, 10 million USDC was returned from the same OTC address, raising questions about the nature of this movement.

Lookonchain publicly asks the question floating around among analysts: Is SharpLink Gaming selling ETH? The transaction is similar to a structured OTC sale, where large holders offload assets without affecting the public order book, but there has been no confirmation yet that the funds belong directly to the company. However, the timing of the transfer is attracting attention. Ethereum is trading near a key support zone around $3,000, with liquidity tightening across the market as panic selling accelerates.

While large OTC flows like these often represent strategic repositioning rather than emotional selling, they can still shape market sentiment. If this was indeed a sale, it adds to the story that the institution reduced its exposure during the adjustment process. If it were simply a Treasury reorganization, the impact may be much less than it appears. The market is currently watching closely.

$3,000 support tested as momentum weakens

Ethereum is hovering just above the critical $3,000 support area, which has become a battleground between buyers seeking to defend the trend and sellers seeking a deeper decline. The daily chart shows a clear and sustained downward trend that began after ETH failed to regain the $4,000 region in late October. Since then, lower highs and lower lows have defined the price movement, with ETH unable to break above its 50-day moving average. This is a sign of weakening momentum.

The 100-day and 200-day moving averages are also showing a downward trend, reinforcing the bear market structure. Prices are currently hovering below all major moving averages, which is often a precursor to extended corrections in past cycles. However, the $3,000 to $2,950 range has acted as a strong demand area several times throughout the year, and buyers are attempting to defend it once again.

The candle has a long, low wick forming near this level, suggesting that some dip buyers are involved, but confidence is still limited. If ETH decisively loses $3,000, the next notable support level would be around $2,750-$2,800. On the other hand, a recovery of the 50-day MA near $3,400 would be the first sign of a potential change in momentum after several weeks of selling.

Featured image from ChatGPT, chart from TradingView.com

editing process for focuses on providing thoroughly researched, accurate, and unbiased content. We adhere to strict sourcing standards and each page is diligently reviewed by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of the content for readers.