Cango Inc. has been pivoted from car trading to Bitcoin mining, targeting 50 EH/s in early 2025.

Lots of deep diving

The following guest posts are posted by bitcoinminingStock.io, a one-stop hub for all of Bitcoin Mining Stocks, Educational Tools and Industry Insights. It was originally published on March 25, 2025, but was declared by Cindy Feng, author of bitcoinminingstock.io.

It’s been weeks since I delved into a deep last name into a lesser known name in the Bitcoin mining space. I was a little quiet. Especially because the sector was sluggish, but he is recovering from a lower-level injury (a reminder to listen to the body when it comes to physical activity and not push it too hard).

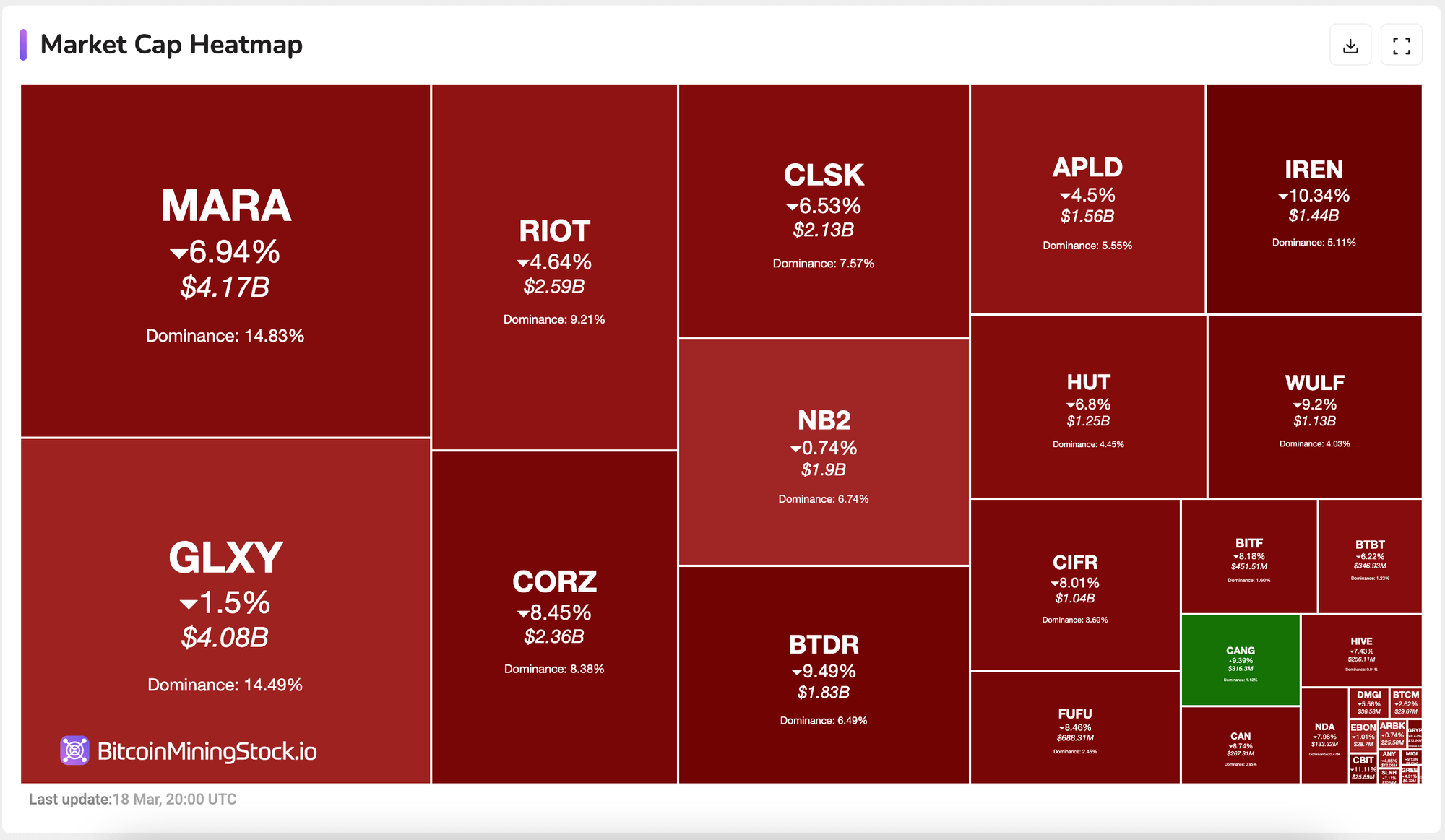

In the second article in this series, I want to talk about it. Cango Inc. (NYSE: CANG). why? While the entire mining sector has been recently assaulted, Cango had some strong daysit will boost Share the announcement of buyback And a Non-binding acquisition offer.

Bitcoin Mining Stock Heat Map (Live Update)

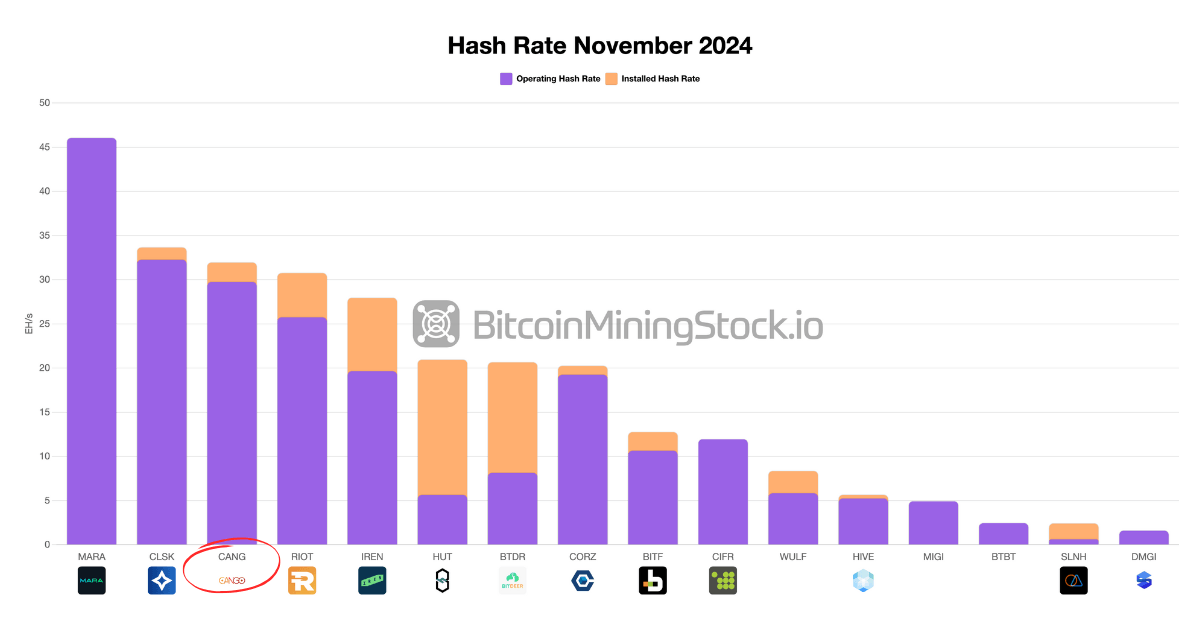

But here was my eyes. Just a few months ago, this was a car trading platform that still had limited growth potential. Now it becomes a target 50 eh/s Early this year, 32 eh/s already online.

So, how does this bold pivot work? And can Cango quietly become a major player in the space? Let’s dive in.

Company overview

Cango Inc. (NYSE: CANG) began as a Shanghai-based auto finance company and later established itself as a key player in China’s auto trading services. By the second half of 2023, the company had shifted its focus from its domestic market to promoting sales in China from China. Then, in November 2024, CANGO announced its entry into Bitcoin mining and began operations at 32 EH/s online hashrate. The scale and immediacy of this movement have surprised many investors. Mara and CleanSparkand make it The third largest public bitcoin miner Due to the capacity developed at the time.

Public Miner Hashrate Overview

The mining acquisition agreement was being directed 50 eh/s In total, the remaining 18 EH/S, which are expected to be online in the first quarter of 2025, will be subject to the performance standards outlined in the contract. In particular, the infrastructure was not built from scratch. Cango has acquired operational ASIC fleet directly from BitmainBitmain affiliates also continue to manage the operation and maintenance of their machines within third-party hosting facilities.

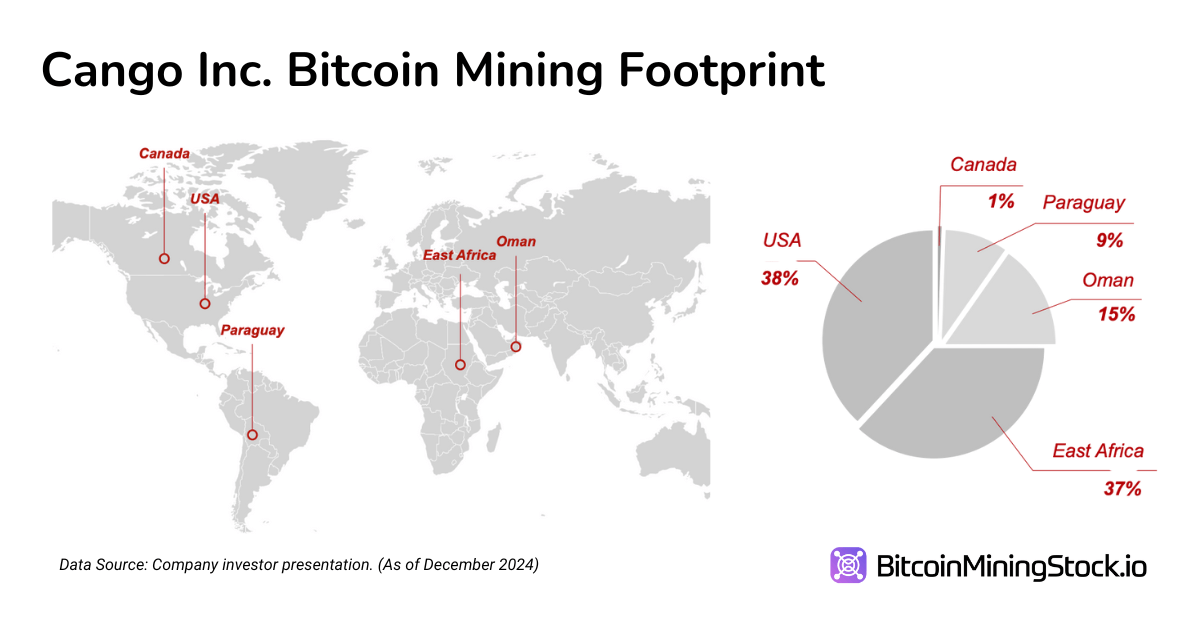

According to company disclosures, CANGO mainly hosts its fleet US, East Africa, Oman, Paraguay – This will be revealed from China’s ongoing crypto restrictions.

Financial highlights

Transforming revenue and profitability

The impact of pivots on Cango’s Bitcoin mining is clearly reflected in the latest financial results. In the fourth quarter of 2024, the company reported Revenue 668 million RMB ($91.5 million), a 414% year-on-year increase. This growth was almost completely driven Bitcoin mining, Which of It accounted for 98% of total revenue. In contrast, the Automotive Trading segment, once a core business at Cango, contributed to RMB15 million ($2.1 million). This signal that this legacy segment is effectively phased out.

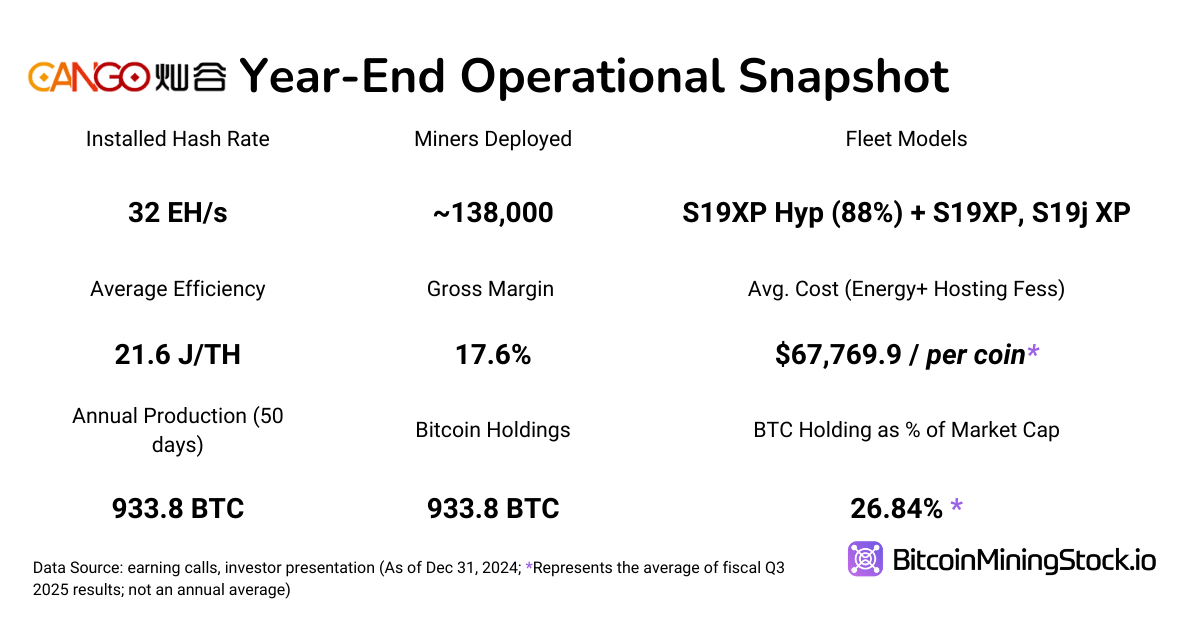

Despite the sudden rise in revenue, Profitability remains an important issue. Cango Post 17.6% total margin In Q4, we are significantly below our peers who have similar operational scales. For comparison, CleanSparkworks at comparable hashrate ranges, 57% total margin In the same period. This suggests that Cango’s cost structure is not optimized. Dependency on third-party hostingand exposure Higher energy costs They are two main attributes.

Company’s Average Bitcoin production cost I was standing $67,769 per BTC(Cash costs include energy and hosting fees). This diagram turns Cango High-end cost curve Among the large public miners we track – many of them report All-in costs in the $50,000 range. Until Cango secures a low-cost infrastructure or negotiates a more advantageous hosting term, Margin profiles may continue to be under pressureEven if revenue growth continues.

Balance Sheet and Liquidity

Cango has entered 2025 Strong fluidity positionreported RMB2.5 billion ($345 million) and short-term investments as of December 31, 2024, up from RMB1.7 billion ($232.9 million) the previous year. This substantial reserve provides a meaningful buffer for continuous expansion and cushioning to potential volatility in the Bitcoin market. However, the company’s Total debt also rose sharplyan increase of 126% from the previous year to 1888 million ($258 million). This rise was driven primarily by infringed costs and other current liabilities related to mining acquisition and related operations.

Cango is currently liquid enough to fund short-term growth, but pressure is currently shifting to improve its operational margins. Without stronger cash flow generation, the company may need to ultimately seek it External capital,danger Increased equity dilution or leverage.

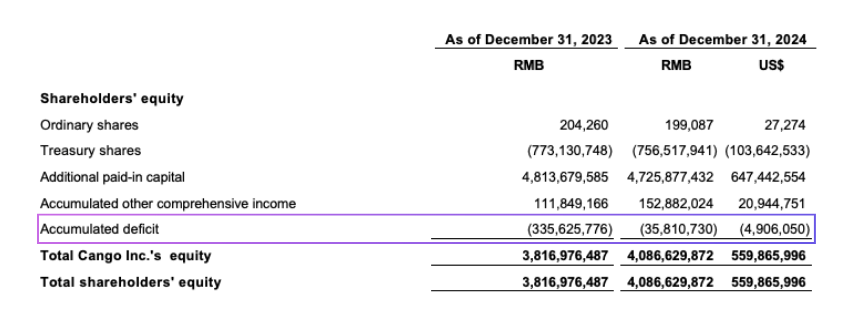

Please take a closer look Equity structure We highlight these trade-offs. Shareholder stock increased to 7.1% ($559.9 million) year-on-year, mainly due to net profit of 299.8 million ($41.1 million) in 2024.

but, A $144 million share base Components of the $400 million mining machine acquisition It had a major impact on the stock structure. It expanded total capital, but also diluted existing shareholders. seller, Currently, stockholders collectively My own Approximately 40% of the company After the transition. This change in ownership is reflected in a decline in additional payroll capital from RMB481 million to RMB4.733 million to RMB4.743 billion, which refers to stock redistribution rather than fresh capital inflows.

Finally, the company bought it back. 996,640 ADSS for $1.7 millionthe impact of buybacks on all shares was negligible. However, while current capital allocations remain firmly focused on scaling mining operations, it suggests that management views stocks as undervalued.

Evaluation modeling

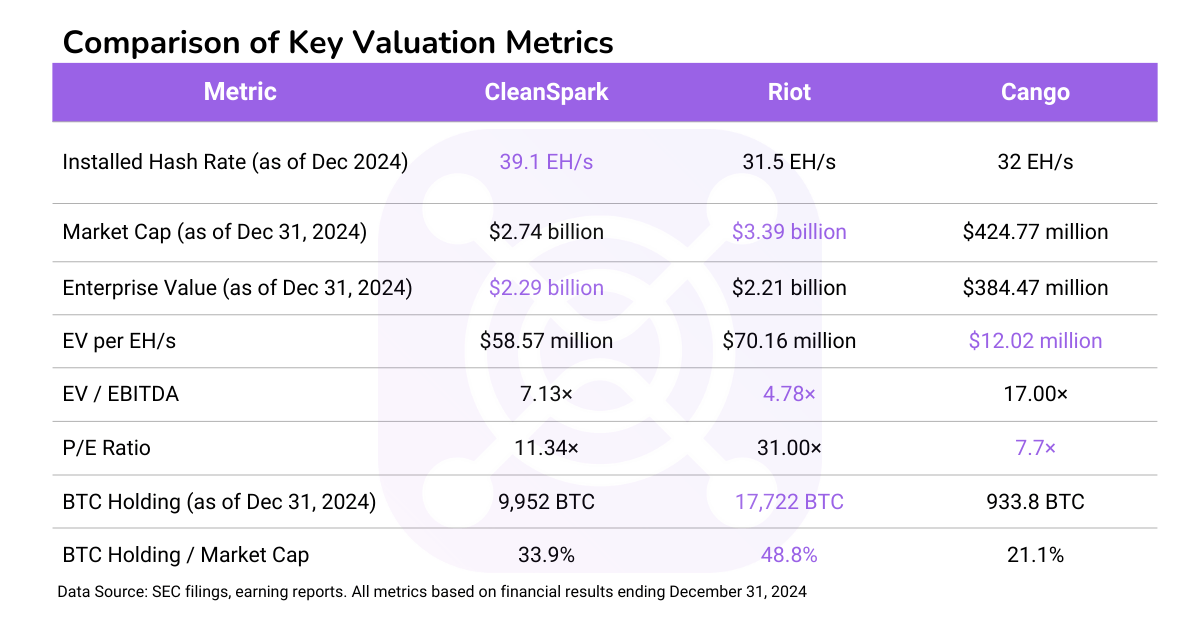

A key step in understanding Cango’s value is to benchmark it against Bitcoin miners of similar scales (e.g. Cleanspark, Riot). As of December 31, 2024Cango’s market capitalization is $424.77 million).

- Enterprise Value (EV): $229.2 million (market capital + debt – BTC holdings on cash and cash equivalents).

- EV/EBITDA Ratio: 17X ($384.47M/$228M)

- P/E: 7.7x

- P/S: 2.87X (Very Moderate Market Optimism on Revenue)

- Holds BTC / Market capitalization: 21.1%

Mining Operations and Efficiency

Cango is expected to roll out 32 EH/s by December 2024 and to 50 EH/s in the first quarter of 2025. Bitcoin Production Forecast for 2025:

- Production rate for the fourth quarter of 2024: 933.8 BTC only 50 days (November to December 2024).

- Updated January-February 2025: 1,010.9 BTC mining, 32 EH/s, a pace of approximately 500 BTC/month was confirmed.

- Scaling Projection: If 32 EH/S generates about 6,000 BTC per year, 50 EH/S should generate ~8,500 BTC, assuming a linear scaling model.

This projection is a Best Case Scenarioexcludes all variables, especially network difficulty. In reality, rising global hashrates and increasing mining competition can increase network difficulty, reducing Cango’s BTC output and affecting revenue forecasts. The company’s exposure to such fluctuations is material, given that almost all of its revenues are linked to mining.

Fleet efficiency is a concern. Cango reported Average 21.6 j/thIt consists of:

- 90% S19xp Hyd. Model (water-cooled, efficiency).

- 10% older model (higher power consumption, less competitive).

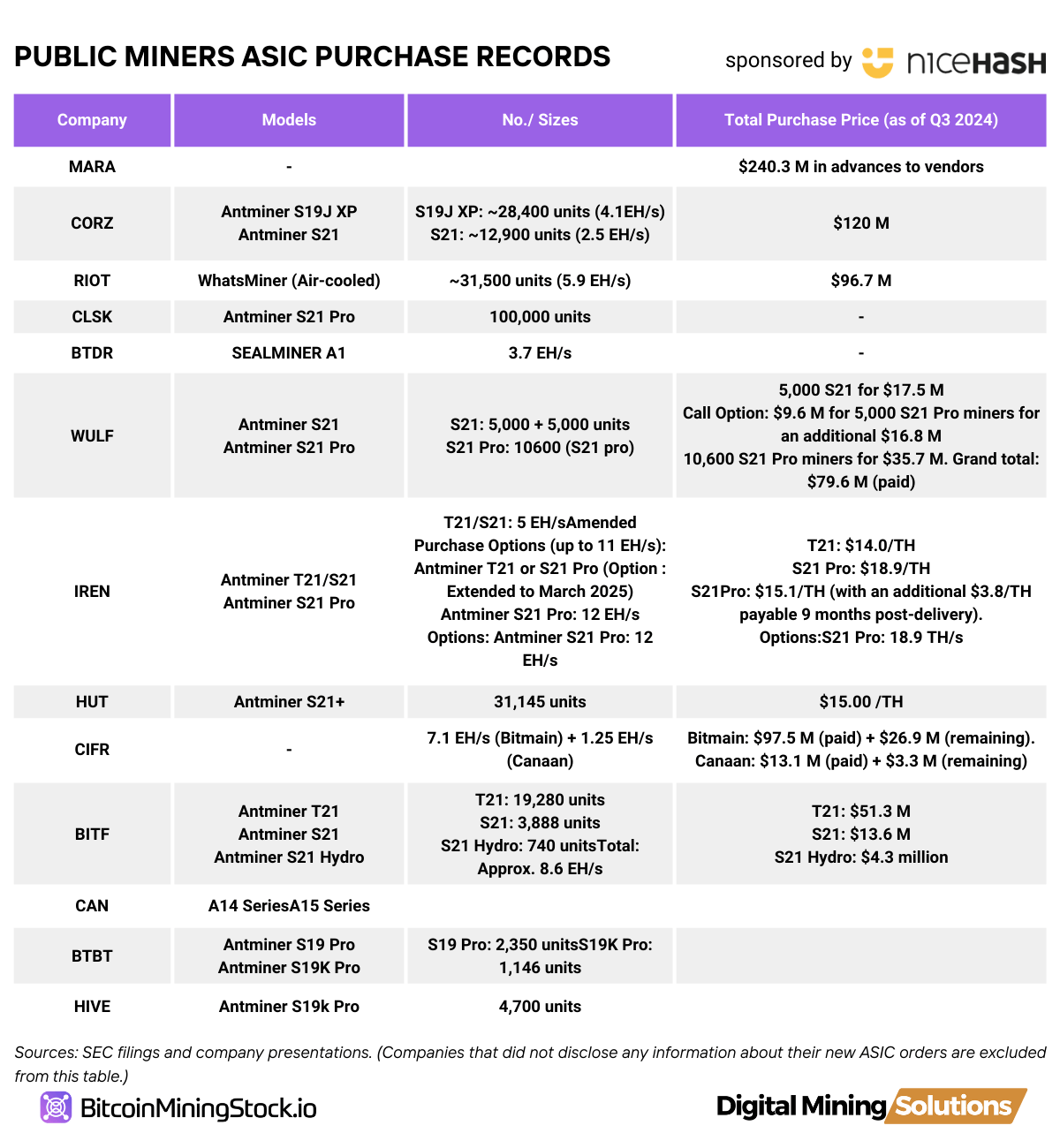

In contrast, top miners are already beginning to move S21 Series Hardwaresignificantly improves performance and energy efficiency.

My annual mining report shows that the majority of large public miners ordered the S21 series within the first nine months of 2024.

If Cango wants to stay competitive, you may need to do so Replace the old machineAnd consider it Migrating from third-party hosting to self-operation infrastructuremay improve margins over time by reducing hosting fees and energy costs. Without this improvement, the production costs will be higher $67,769 per BTC– In tightening markets, profitability could be eroding.

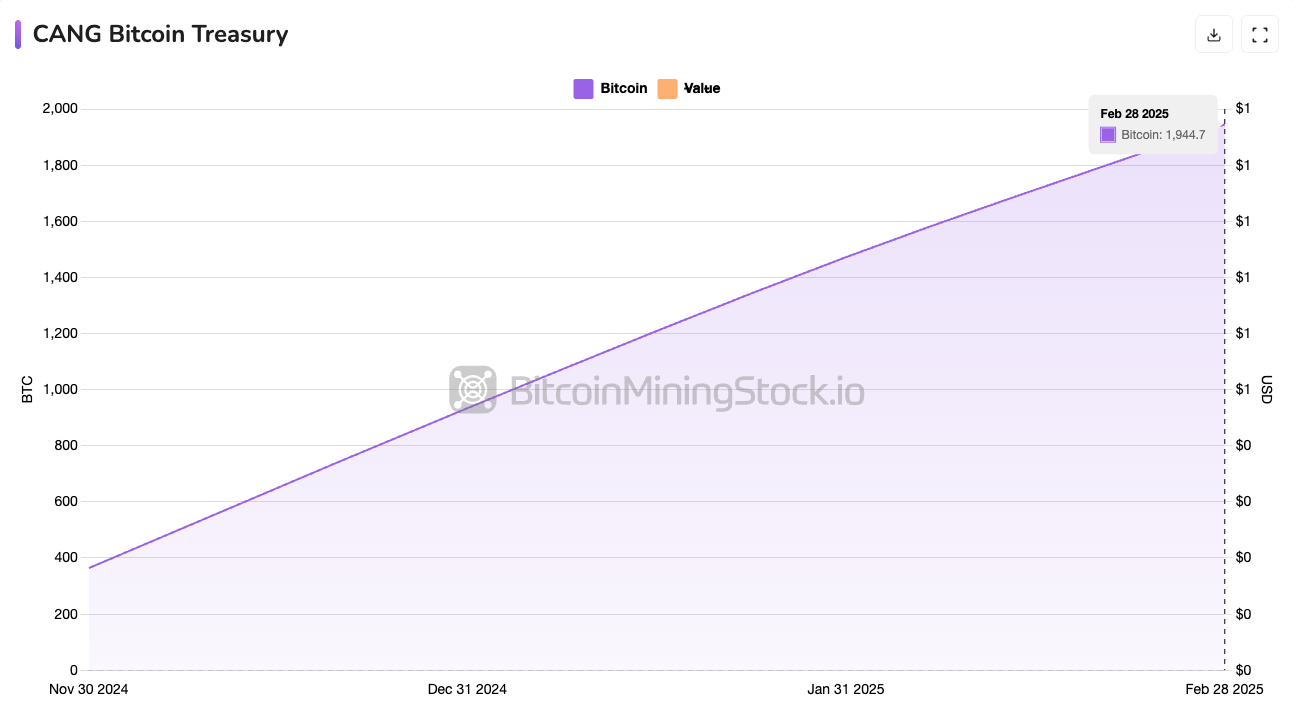

Bitcoin Treasures

Cango clearly adopts “My & Hold” The strategy chooses to hold Bitcoin instead of liquidating for short-term cash. As of December 2024, the company owns 933.8 BTC ($85 million at year-end price). By February 2025, that figure had more than doubled to 1,944.7 BTC, confirming an aggressive accumulation.

Historical performance data for miners is now available with the Premium feature.

This financial approach has gained even more visibility Cango has been added to the Bitise Bitcoin Standard Corporations ETF On March 18, 2025, an ETF tracks public companies with over 1,000 BTC. Inclusion can show awareness of the institution and increase visibility among encrypted investors.

Following previous assumptions, Cango was able to mine around 8,500 BTC in 2025. Coupled with its existing holdings, its Treasury could reach around 9,500 BTC by the end of the year. By then, if BTC reaches $100,000, Bitcoin Holdings could reach nearly $1 billion. Among the largest public BTC holders Worldwide, it could rival established mining companies and reconstruct the narrative of its assessment.

This strategy is consistent with the long-term bullish view on Bitcoin, but I’ll introduce it to you Liquidity and balance sheet risks. Cango may be forced if the price of Bitcoin drops significantly Sell BTC at a disadvantage or Relying on external funding This is especially true because the company’s mining operations are still margin-sensitive and capital-intensive, thus funding operations.

Non-binding buyout offer: Hidden bit main play?

On March 14, 2025, Cango received a non-binding acquisition offer from permanent Wealth Capital Ltd. (EWCL). Little is known about this investment management company, founded in the UK’s Virgin Islands. Key individuals in EWCL have a link to BitmainThe world’s largest ASIC manufacturer.

This raises some Speculation:

- Is this an attempt? Separating Cango’s Bitcoin Mining Business from the origins of Chinese companies? Given China’s ban on mining in 2021, structural separation could reduce the risk of regulation and allow Cango to operate more freely.

- Effectively it will be cango Bitmain Support Mining Proxy? The company has purchased the entire fleet from Bitmain’s existing business, and Bitmain affiliates continue to operate and maintain these machines after their acquisition. Currently, Bitmain linked personnel are behind the acquisition attempt.

If a transaction occurs, Cango will have direct access to Bitmain’s ASIC supply, reducing hardware costs and increasing Cango’s competitiveness, but it could also be seen changes in ownership structure that will affect existing shareholders. Investors need to closely monitor whether the transaction is realising and the terminology it contains, as it could fundamentally change the company structure of Cango.

Final Thoughts

Cango’s aggressive pivot towards Bitcoin mining essentially restructured its corporate identity. It is no longer an auto platform company with medium growth prospects – now Ranked one of the biggest bitcoin miners in hashrate. There is a stack of BTC sitting on the balance sheet, which coincides with the new “Bitcoin Treasury” trend.

That said, the story is still under development. There are still core questions about operational efficiency stability of Bitcoin Priceand how Cango can deploy its liquidity Optimize the cost structure. As companies like Mara have done, for example, the transition from third-party hosting to self-mining infrastructure could significantly improve long-term margins. Recent non-binding acquisition offers from entities linked to Bitmain also add to the plot. If deeper integration with Bitmain is achieved, it could allow access to discounted ASIC hardware and accelerate fleet upgrades.

However, the challenge continues. Despite holding $345.3 million in cash and short-term investment, it could be roughly covered 1. Operations for 13 years At the current rate of combustion, Aging fleet, It mainly consists of second-hand S19 XP HYDs. The model is heading towards faster depreciation. As peers move to S21 series machines, Cango may find an efficient disadvantage if they don’t maintain their pace. Fleet depreciation could further erode the already thin gross profits, particularly given that the Q4 report did not take into account these costs.

In particular, Cango’s leadership team brings an A A strong financial backgroundand its shareholder base includes Tencent as the top 11 holder. This is a fact that is often overlooked by Western investors. However, China’s headquarters continue to pos Regulatory and geopolitical risksespecially as mining bans are in effect in China.

Anyone interested in Cang should Monitor the following important factors:

- Bitcoin production costs for peers

- Depreciation and sales of old mining fleets

- Liquidity and volatility of BTC holdings under the “HODL” strategy

- The impact of China-based operations on future strategic flexibility

- Potential connections with Bitmain from the outcome of the acquisition offer

Only time can tell whether Cango can establish himself as a key player in the sector.