Japan becomes the 11th country to launch government-backed Bitcoin mining using renewable energy sources.

The 4.5 MW project will use a water-cooled rig and is expected to be operational by late 2025.

Analysts predict that Bitcoin could reach $160,000 to $200,000 by the end of 2025 due to rising demand.

The global race to accumulate Bitcoin is intensifying, with countries competing to secure every new coin in circulation. Once wary of cryptocurrencies, he now embraces Bitcoin as part of his energy and digital strategy.

The move marks a major turning point for Japan, Asia’s second-largest economy, along with countries such as the UAE, Bhutan and El Salvador.

Japan’s 4.5 MW Bitcoin Mining Initiative

With this announcement, Japan becomes the 11th country to officially recognize Bitcoin as a strategic asset. The country has launched a government-backed 4.5 megawatt Bitcoin mining project in collaboration with Canaan Inc. and the national power company.

The project will use a water-cooled Avalon A1566HA rig and is expected to be operational by late 2025 using surplus renewable energy from solar and wind sources.

The government’s pilot mining initiative, led by Japan’s Ministry of Economy, Trade and Industry (METI), focuses on harnessing surplus renewable energy from regional power companies. This approach aims to balance energy efficiency and the country’s cryptocurrency adoption goals while mitigating the carbon footprint often associated with Bitcoin.

Scheduled to launch by late 2025, the project will act as a digital load balancer, coordinating mining operations based on power source.

The government is currently mining Bitcoin.

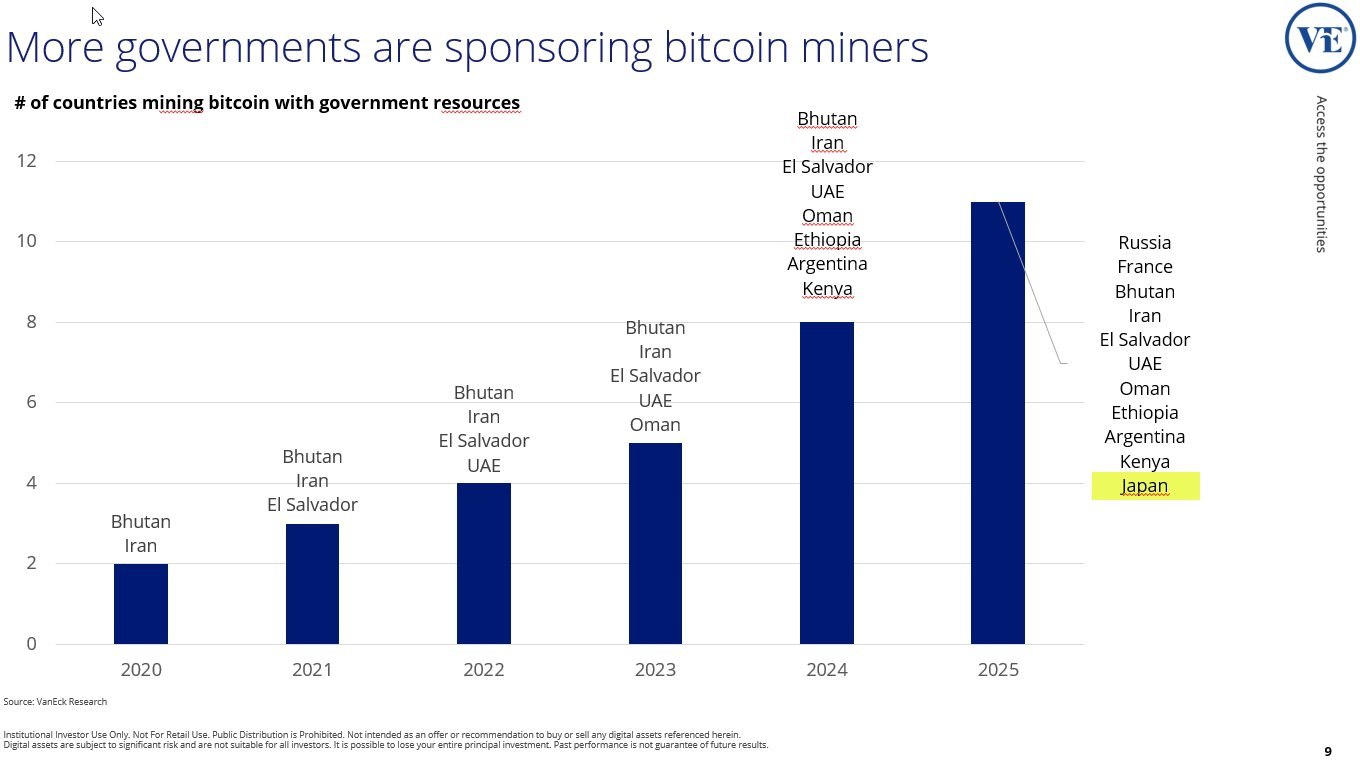

For years, governments have considered Bitcoin subject to regulation and taxation. Now they are starting to mine it themselves. According to VanEck Research, the number of countries participating in government-backed Bitcoin mining has jumped from just two countries in 2020 to 11 countries by 2025.

Countries such as Russia, France, Bhutan, Iran, El Salvador, UAE, Oman, Ethiopia, Argentina, and Kenya actively sponsor Bitcoin mining through direct government participation or state-owned enterprises.

Impact on Bitcoin price

Rising demand for ETFs from institutional investors and expansion of government-backed mining could push Bitcoin into a new demand cycle where limited supply meets massive accumulation.

New supply has already been halved by April 2024, and this rapid increase in sovereign mining could make distribution even tighter. Analysts now expect Bitcoin to reach between $160,000 and $200,000 by the end of 2025, supported by steady institutional inflows and national adoption.

Bitcoin is currently trading at around $103,163, marking an increase of 2% in the past 24 hours.