Bitcoin is struggling to get out of its narrow range, showing chains and market data showing momentum.

Cryptoquant data highlighted by Axel Adler in his weekly commentary points to a decline in demand from buyers and a weak follow-through after attempts to exceed $115,000 have failed.

Cryptocurrency indecisive comes as September is drawn to the end of a month, which is associated with historically negative returns.

Bitcoin prices and volumes across the exchange. Source: Cryptoquant

Analysts watch support and resistance levels

Bitcoin has traded between local maximums of $115,400 and minimums of $108,600 over the past week, before setting off in tight bands ranging from $108,800 to $109,800. Attempts to regain the highlands have come across the most consistent sales of descent.

Cryptoquant data suggests that the immediate resistance level is located between $111,000 and $112,000.

A critical return on this band could restore bullish momentum and allow a retest between $114,000 and $115,400. In contrast, a break below $108,600 could accelerate losses to a stronger support zone of between $106,000 and $105,000.

“The best downward structure remains unbroken.” Adler pointed outpointing out that a base above $108,600 is important to maintain neutrality. If that base doesn’t recover quickly and gives way, the fix could deepen.

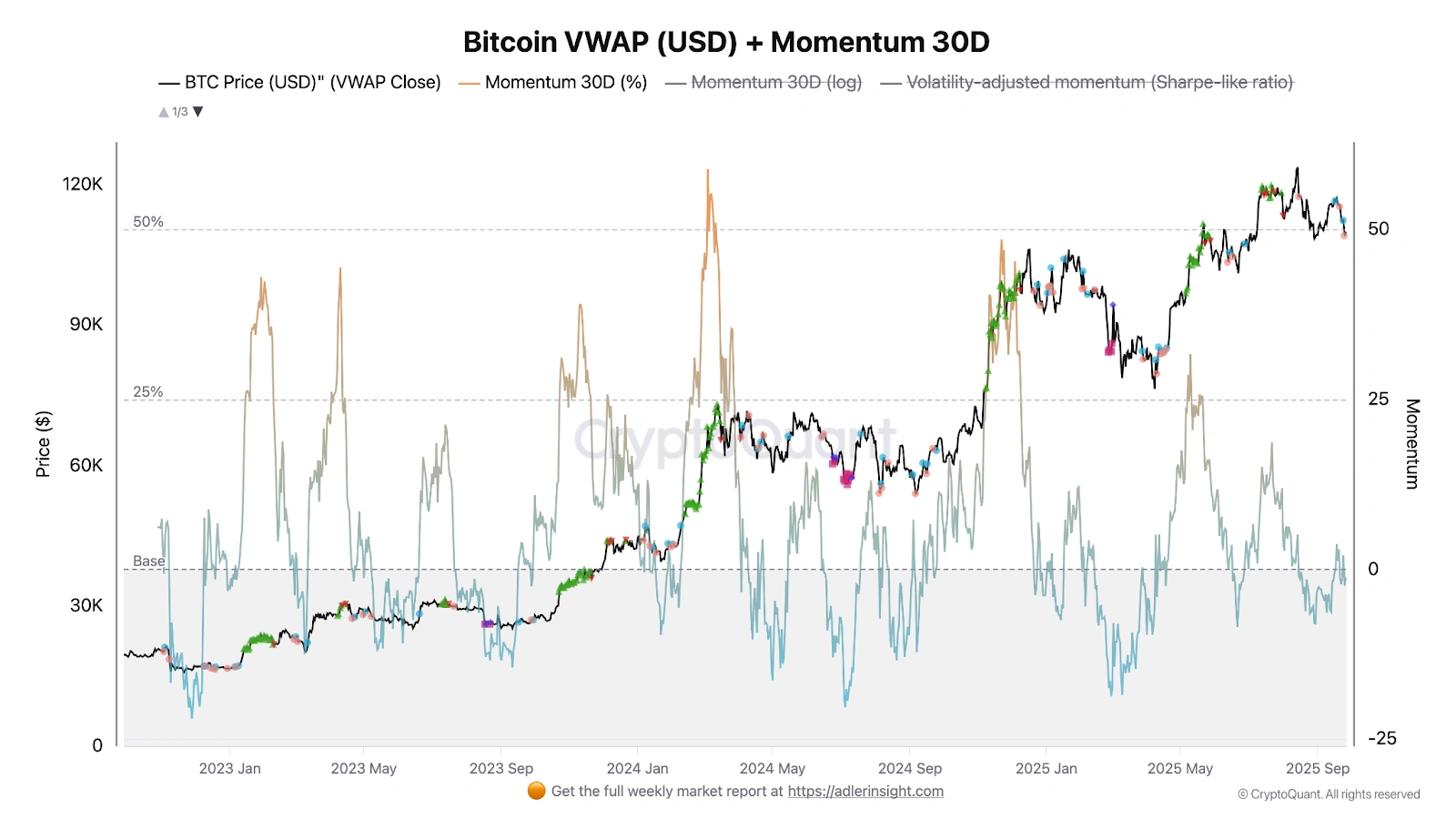

Bitcoin’s momentum is decreasing. Source: Cryptoquant

Momentum measurements change to negative

Cryptoquant’s 30-day momentum index marked a 3% point swing, down approximately 2% from +1% at the start of the period.

Exercise ranged from -6% to +1% over the week, with only two of the 7 sessions above zero, which itself was too little to confirm sustained trend intensity.

The loss of support between $114,000 and $115,000 coincided with this recession, reinforcing the signal that cooling and unloading control market behavior.

“For a bullish reversal, you need a return of over $112K while holding a few days >0,” Adler writes. Without that, neutral bear scenarios that include another test under $108,600 will remain in the base case.

What should I see next week in the quarter?

Bitcoin’s recent price trajectory reveals a market that is not crucially bullish but not collapsed. That momentum remains neutral to slightly bearish, with the next direction likely to be to buyers and sellers.

If the base holds and demand metrics recover, BTC could make new advances. But otherwise you could drag it into a more extended integration or deeper pullback.

In his forecast next week, Adler suggested that market conditions remain neutral and that participants should retain, rather than financial advice.