In October, one of the historically strongest months for Bitcoin (BTC) has already pop up in flyers for many labels in the Crypto industry, Uptober.

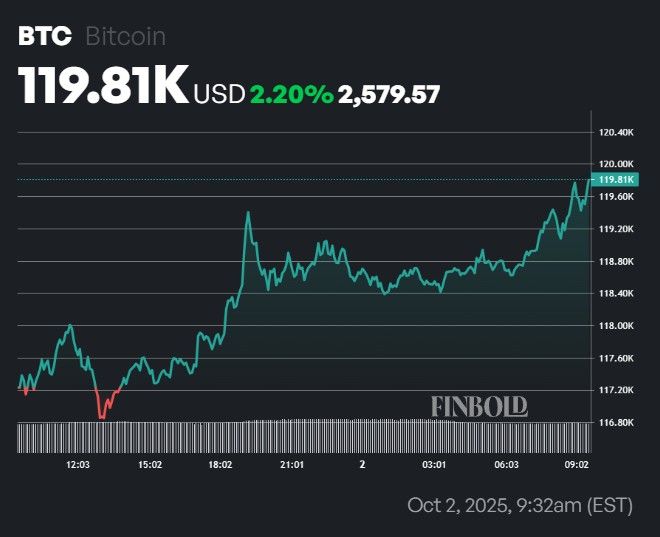

The world’s largest cryptocurrency, trading at around $119,810 at press, is up over 2% each day and over 7% on the weekly chart.

Daily trading volumes are also rising, sitting at around $67.866 billion after a 2.2% increase, but after an increase of 1.83% over the past 24 hours, the total market capitalization is back to $2.38 trillion.

In other words, the flagship digital assets have risen to their highest level in over two months, just as the US government officially shut down earlier this week.

Bitcoin price forecast October 2025

Given the reputation of the month as one of the most powerful trading months, as assets are already heading towards a psychological threshold of $120,000, Finbold consulted an AI signal machine learning tool that integrates large-scale language models (LLMS) with momentum-driven market technology indicators.

Based on the forecast, the cryptocurrency achieved a price of $127,734 by the end of October 2025, meaning upside of 6.78% from its current level.

The Claude Sonnet 4 is the most bullish LLM, keeping in mind that it has a slightly lower potential target for the $135,000 (+12.85%), GPT-4o and Grok 3, and is projected to have prices of $123,200 (2.99%) and $125,001 (4.49%), respectively.

The predictions are really optimistic, but we can guarantee them. For example, Bitcoin ETF is once again gaining traction, attracting a net inflow of $676 million on Wednesday, October 1st.

Plus, even longtime skeptics have changed their minds about assets. One of them is nothing but Warren Buffett, who promoted the virtues of gold and silver, not just Bitcoin.

Technical indicators are also in the spotlight. In fact, Bitcoin’s monthly Bollinger Bandwidth (BBW), an important volatility measure, is compressed to a historic low, flashing setups that previously preceded explosive gatherings of up to 200%.

Featured Images via ShutterStock