Michael Burry and Warren Buffett, who epitomize market caution, are flashing red lights in November. Mr. Barry is betting on Wall Street again, but Mr. Buffett’s favorite valuation metric has just reached an all-time high.

Together, their moves send a strong warning that financial markets may be entering dangerous territory, and cryptocurrencies are already feeling the pain.

Michael Barry’s “Wildest” 13F

The Short Bear, a pseudonymous trader and analyst, said Michael Barry’s latest 13F filing was the wildest yet. The filing, filed more than a week earlier than usual, shows Berry running aggressive short positions reminiscent of strategies before the 2008 financial crisis.

Michael Barry 13F

This is the wildest (and over a week early) 13th floor I’ve ever seen.

A pure bubble short, Berry is aiming for the next 2008.

I respect Burley, but keep in mind it took 2-3 years from the moment he started shortstop via CDS to 2005… pic.twitter.com/0PUa1mQJcl

— THE SHORT BEAR (@TheShortBear) November 3, 2025

Their analysis shows Berry’s trades include put contracts from 2026 to 2027, with tens of thousands of contracts in positions such as $50 and $30 puts. This is a bearish outlook in the long term, suggesting the possibility of a major market collapse within a few years.

Market analyst Kashyap Sriram noted that Berry shorted the market in the first quarter of 2025, just before the April flash crash that wiped out billions of dollars in stock value.

“On the eve of the final reckoning for the AI bubble, he’s short again,” Sriram wrote, likening the current hype to a fairy tale. emperor’s new clothes. “We all know AI is a bubble, but it’s easier to turn a blind eye than risk calling it out loud.”

Mr. Barry’s strategy suggests he believes the market is overextended by artificial intelligence enthusiasts, and reflects his contrarian stance before the subprime collapse nearly two decades ago.

Warren Buffett’s classic warning revisited

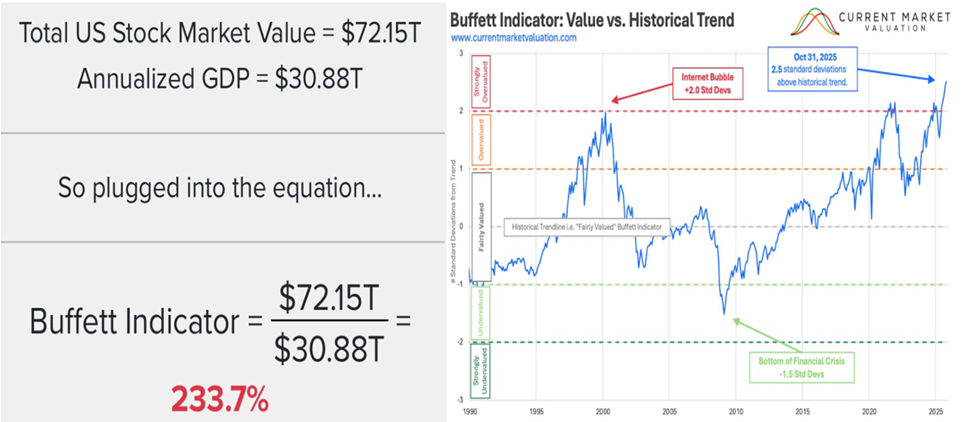

Meanwhile, Warren Buffett’s longtime valuation metric, the Buffett Indicator, is currently issuing its strongest warning since the dot-com era.

The ratio of US stock market capitalization to GDP reached 233.7%, a new record high.

Buffett indicator. Source: Giger Capital of X

Giger Capital quoted Buffett as saying, “When this ratio approaches 200%, as it did in 1999, you’re playing with fire.”

The 233.7% figure shows that US stocks are extremely overvalued relative to the real economy. Historically, such situations are associated with sharp corrections and multi-year bear markets.

Cryptocurrencies are already feeling the heat

The crypto market appears to be the first victim of this growing risk aversion. According to Coin Bureau, $790 billion in value has been wiped out since October, and the market capitalization of cryptocurrencies has fallen from $4.22 trillion to $3.43 trillion, wiping out all gains made since the beginning of 2025.

🚨The amount of virtual currency released is the highest since October, $790 billion!

Total market capitalization fell from $4.22 trillion to $3.43 trillion, a decline of ~18% in just four weeks.

We are back to where we started in 2025. 🔥 pic.twitter.com/IObVNCgy3P

— Coin Bureau (@coinbureau) November 4, 2025

Cryptocurrency analyst Ran Neuner warned that a slight decline in stocks could cause further losses for digital assets.

“The biggest risk for cryptocurrencies right now is a 5-10% correction in the stock market,” Neuner said.

The market faces mounting pressure heading into year-end as Berry doubles down on his shorts and Buffett’s indicators flash red.

Whether the tipping point is due to the unwinding of the AI bubble, a reset in earnings, or a liquidity crunch, both legendary investors appear to be preparing for their liquidation.

When some of the world’s greatest contrarians turn bearish, it may be useful to heed their warnings before the bubble bursts. Therefore, cryptocurrency traders and investors should always be vigilant and do their own research.

The post Michael Burley, Warren Buffett, November Flash Red Warning as Markets Overheat appeared first on BeInCrypto.