Bitcoin (BTC) has rebounded from a somewhat disappointing start this week as institutional inflows have started to pick up again, pushing the “digital gold” back to $93,000 on Thursday, December 4th.

Other bullish signals are also starting to emerge, such as long-term holders and whales moving BTC from exchanges to cold wallets, relieving selling pressure in the process.

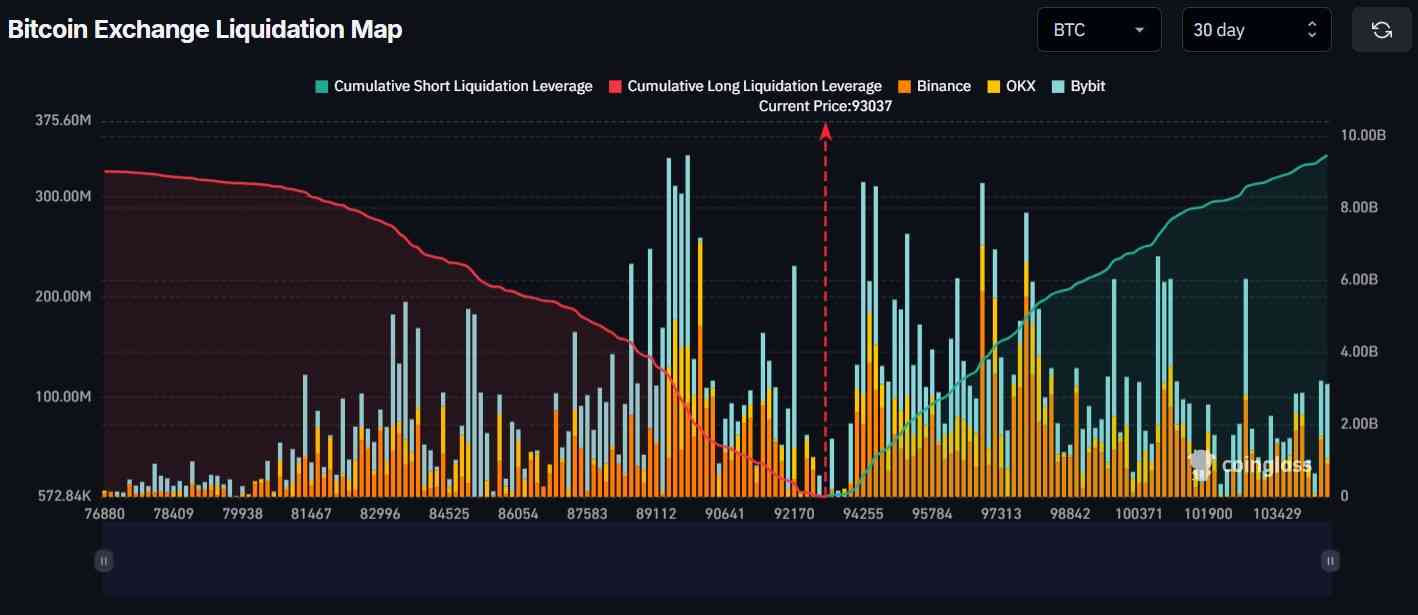

As BTC continues its resurgence, around $5 billion in short Bitcoin positions remain on the books and could be wiped out if the asset rebounds another 5% to $98,000, according to data reviewed by Finbold. coin glass December 4th.

Simply put, there are currently approximately $5 billion in positions against the cryptocurrency, with higher clearing concentrations extending into the $98,000 region.

This means that if the rally continues, these positions can turn into losses and trigger automatic liquidations on the exchange, which can occur in waves after a price rally.

These short-term liquidations can create significant buying pressure as traders scramble to cover their positions, further intensifying the bull market.

Bitcoin price fluctuation

As mentioned above, Bitcoin is above $93,000 at the time of writing, largely due to optimism that further interest rate cuts will be made at the next Federal Open Market Committee (FOMC) meeting. In fact, traders currently believe there is a 93% chance of that happening, according to the crypto-based prediction platform. Polymarket.

Institutional trends are also beginning to accelerate again. In fact, the US Spot Bitcoin ETF currently controls 1.36 million BTC, or about 7% of the total supply. Unsurprisingly, BlackRock dominates with around 3.9%.

At the 2025 Dealbook Summit held at the Jazz at Lincoln Center in New York City on December 3, BlackRock CEO Larry Fink described Bitcoin as a “fear asset” and pointed to its role as a hedge.

“Bitcoin is a fear asset. So you own Bitcoin because you’re scared for your physical security. You own Bitcoin because you’re scared for your financial security. The fundamental long-term reason you own Bitcoin is because you’re losing financial assets. Because you’re in the red.” Fink said.

Despite this, investors continued to buy the fund at the $120,000, $100,000 and $80,000 levels, which, like the net value, suggests deeper institutional investor involvement, Fink noted. Therefore, Bitcoin’s next big move this cycle will likely depend on institutional demand.

Featured image via Shutterstock