Good morning, Asia. This is what makes news in the market:

Welcome to Asian morning briefings, daily summary of top stories throughout the US time, and an overview of market movements and analysis. For a detailed overview of the US market, see Coindesk’s Crypto Daybook Americas.

The first indication of how HyperLiquid is leaning towards the polls of the hotly contested Stablecoin is the early lead by the native market teams lined up in the stripes.

(https://www.usdhtracker.xyz/)

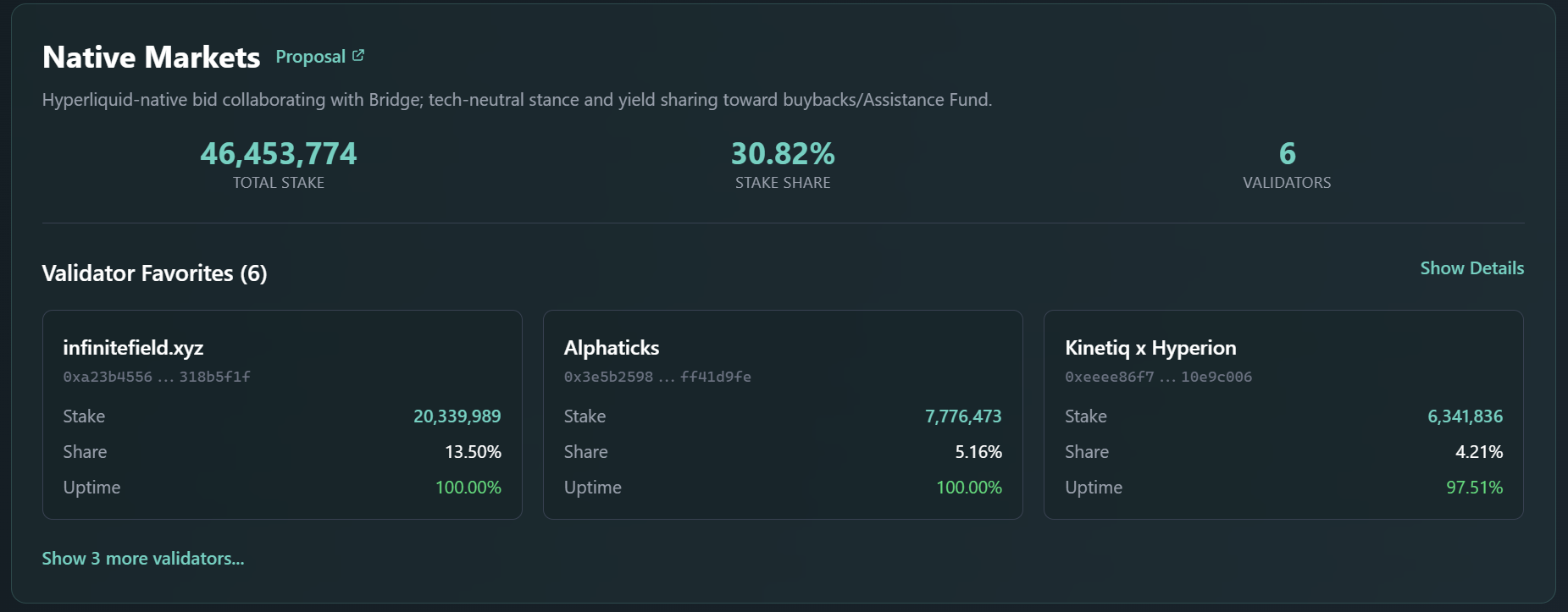

As of Thursday morning Hong Kong time, Native Market had secured 30.8% of its delegated stock, led by heavyweight validators Infinitefield.xyz (13.5%) and Alphaticks (5.2%).

Paxos Labs, the publisher of New York Regulations behind PayPal’s PYUSD, sits at 7.6% with support from B-Harvest and Hybridge. Ecena scored 4.5%, while Agora, Flux and Sky have yet to attract meaningful support despite their flashy proposals, but many of the most prominent validators have yet to vote virtually.

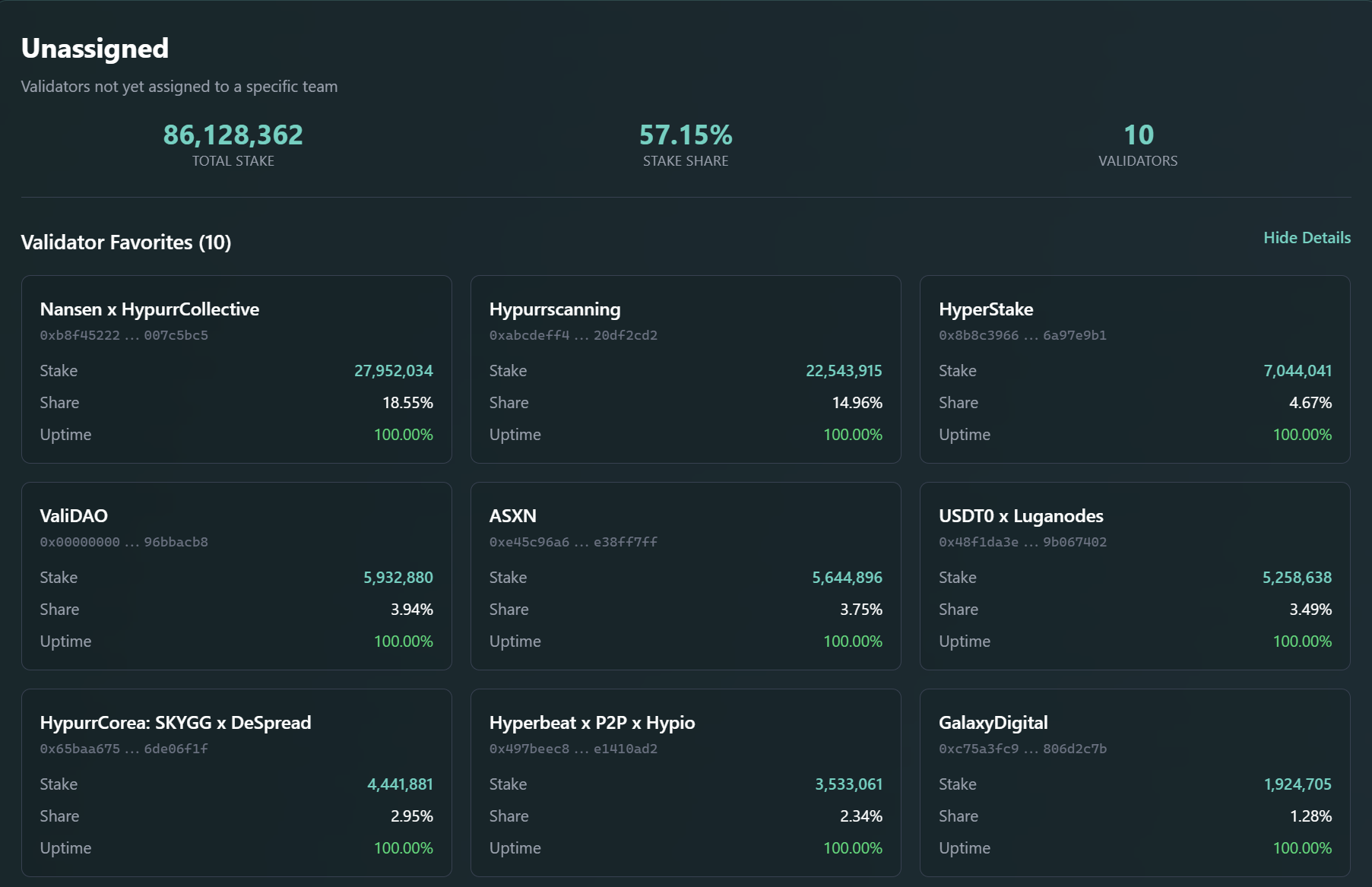

Overall: Over half of the stock, 57%, remains unallocated.

That block includes some of the most influential and high lipid validation devices, such as the Nansen X Hypurrcollective (the single largest validator over 18%) and the Galaxy Digital. The location where they will ultimately land the land will determine whether the early momentum of the native market will last until the September 14th deadline.

Native Markets pitched high liquid native Stablecoin issued via Stripe’s bridge infrastructure, pledging yields on support funds and hype buybacks.

However, prominent voices, including Agora CEO Nick Van Eck, pushed alongside Stripe to launch the Tempo blockchain, warning that control of wallet provider Privy could cause conflict.

Despite these criticisms, some effective people seem to see Stripe’s global payment rail as a compelling advantage.

It’s more than just another token launch that is at risk. High lipids currently hold USDC deposits of $5.5 billion, and hold about 7.5% of Stablecoin’s supply.

If you replace it with USDH, you will redirect hundreds of millions of dollars with annual Treasury yields. Paxos pledged 95% of the reserve revenue from the hype buyback, Frax promised users 100% of the yield directly, Agora gives 100% of the net yield along with the facility’s management person, Sky (Ex-Makerdao) proposed a $25 million “Hyperliquid Star” project to Boottrap Defi on the chain, in addition to a 4.85% return.

High lipids have already commanded almost 80% of the decentralized permanent trade. No matter which issuer wins the USDH contract, it not only mints Stablecoin, but also wires itself to the financial backbone of one of Crypto’s fastest growing exchanges.

Market movements:

BTC: It currently trades at $114,053, an increase of 2.6% over the past 24 hours and a 2.1% increase over the past week, but a 3.9% decline for the month. The move reflects the short-term rebounds driven by positive risk sentiment and stable demand despite continued long-term integration.

ETH: ETH is up 2% at $4,373.99 as investors messed up a massive slave event in which more than 30 baritators were punished.

gold: It was held close to one ounce after the $3,674 peak on Tuesday as investors await US inflation data that could shape FRED cuts.

Nikkei 225: Asia-Pacific markets were mixed on Thursday, with Japan’s Nikko 225 rising 0.23% and topics falling 0.18%.

S&P 500: The S&P 500 rose 0.3% to a record 6,532.04 on Wednesday after an unexpected decline in wholesale prices strengthened hopes for a Fed rate cut next week.

Other locations in the code:

- Trump’s CFTC hopeful Quintenz will controversy with Tyler Winklevoss (very) public (Coindesk)

- Polygons deploy hard forks to address finality bugs that cause transaction delays (block)

- Activist Investor Elliott Management says that after “proximity to the White House” inflated bubbles, the code is facing an “inevitable collapse”