Former Goldman Sachs executive Braulpal believes Bitcoin (BTC) is rarely at stake in the next phase of the uptrend.

PAL tells 1.1 million followers of social media platform X that Bitcoin tends to follow the global liquidity cycle, but is 10 weeks behind.

The macro guru shares a chart that suggests global M2s around the world, or total money around the world, have risen sharply after cutting the bottom in late 2024. PAL predicts that Bitcoin will soon finish its revision and start a fresh rally.

“The waiting game is a little more done… 10 week lead is my favorite.”

Source: Raoul Pal/X

PAL believes that BTC’s rally is imminent, but Julien Bittel, Head of Macro Research at Global Macro Investors (GMI), points out that Bitcoin is hoping to oust global M2 metrics for 12 weeks. According to Bittel, Bitcoin carves the local bottom this week, then moves “higher again” afterwards.

Earlier this month, PAL predicted that Bitcoin and crypto would witness “regular fixes” while Global M2 continues to rise.

“This will pass too…

Crypto still feels liquidity tightening from the stronger dollar in the fourth quarter of 2024. It’s almost complete, financial position eases quickly, and the M2 returns to its new high. ”

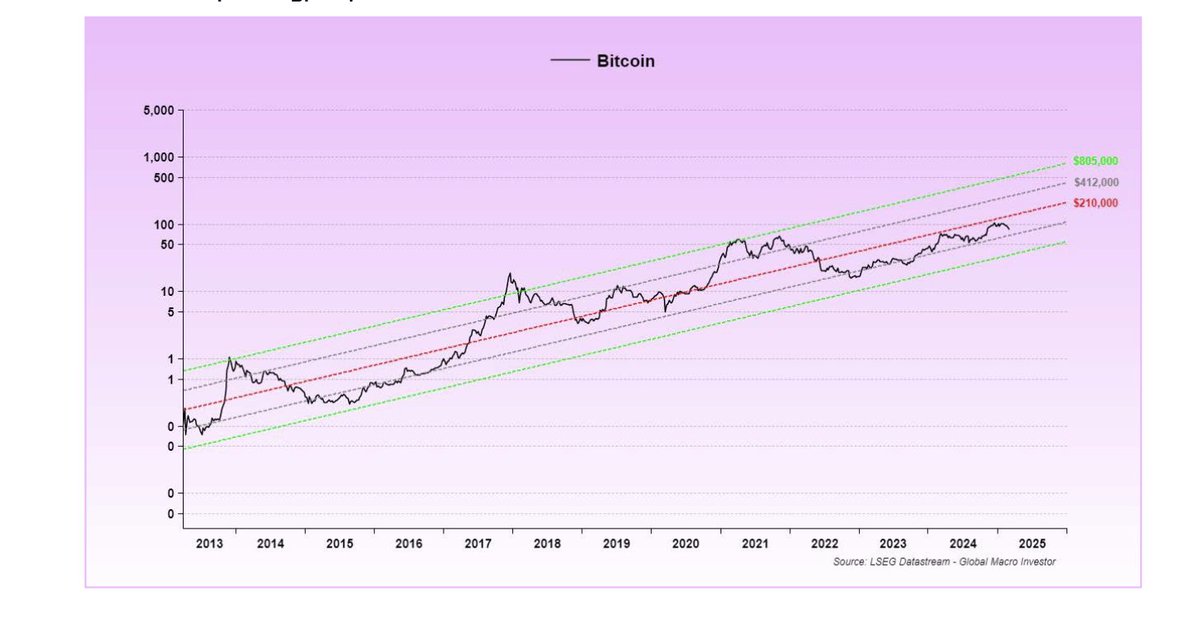

He also predicted that Bitcoin would reach the top of the market cycle of at least $210,000, but he also noted that BTC is within the realm of a possibility that it would rise to $412,000 or $805,000.

“As time goes by, we continue to climb onto the log regression channel. It remains to be seen whether we will stay in the male (red) or climb onto it by another standard deviation, or whether we will see two as the cycle occurs.”

Source: Raoul Pal/X

Logarithmic regression channels are technical tools that help traders visualize long-term price trends on a log scale.

At the time of writing, BTC is trading at $82,500, a 2.25% decrease in the past day.

Generated Image: Midjourney