Cryptocurrency exchange OKX, traditionally known for its centralized trading services, is expanding into decentralized finance with a new feature that allows US users to trade tokens directly on a decentralized market.

DEX trading options available through the OKX app allow users to buy and sell tokens while maintaining control of their digital assets. Transactions are performed via self-custodial wallets. This means users keep their own private keys rather than storing their funds on an exchange.

According to OKX, this feature provides access to millions of tokens across Solana, Base, and X Layer, OKX’s proprietary Ethereum layer 2 networks built using Polygon’s Chain Development Kit (CDK).

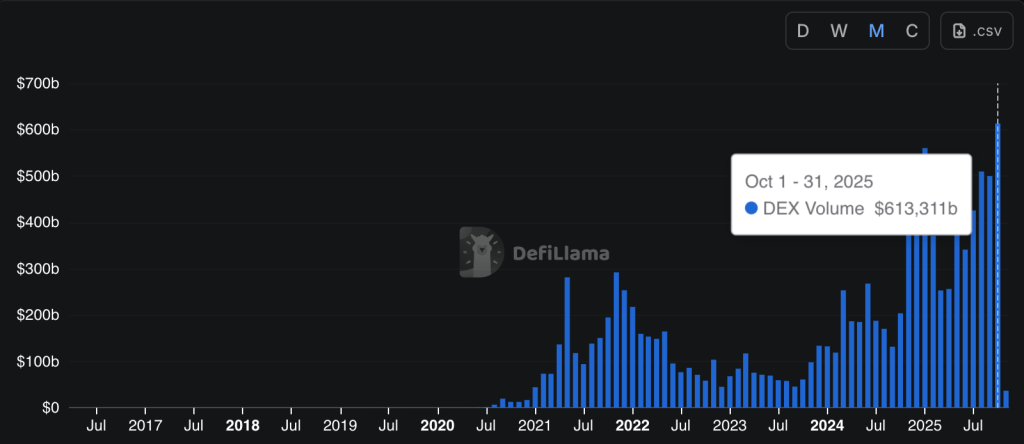

The move comes amid a surge in decentralized exchange activity. DEX trading volume hit an all-time high of $613 billion in October, accounting for about 20% of total trading volume on crypto exchanges, according to ForkLog data.

DEX volume will skyrocket in 2025. source: folk log

By integrating DEX access directly into the app, OKX aims to address long-standing barriers for traders using decentralized platforms, such as managing multiple wallets, bridging assets across blockchains, and paying gas fees.

The announcement follows OKX’s announcement earlier this year of plans to re-enter the U.S. market after reaching a $505 million settlement with the Department of Justice.

Related: VC Roundup: Capital Selection and Retrenchment Rounds Highlight a Cautious Reset in Crypto

The continued appeal of decentralized exchanges

OKX enters a decentralized exchange market that is already crowded with established players such as Uniswap, PancakeSwap, and Hyperliquid. DEXs have long been considered a cornerstone of the broader decentralized finance (DeFi) ecosystem, but they continue to expand rapidly across multiple sectors, particularly in the derivatives space.

DEX-based perpetual futures trading reached an all-time high of $70 billion in September, highlighting traders’ growing demand for on-chain liquidity and decentralized derivatives markets.

Although DEXs can pose challenges with accessibility and usability, they are often preferred by experienced traders because of their low fees and adherence to the self-custody principles that underpin the cryptocurrency ecosystem.

Related: How Hyperliquid achieved $330 billion in monthly trading volume with just 11 employees