Ethereum’s derivatives market is growing in activity as open interest rises across the future and options.

With August over, Ethereum open interest and optional activities will hit new highs

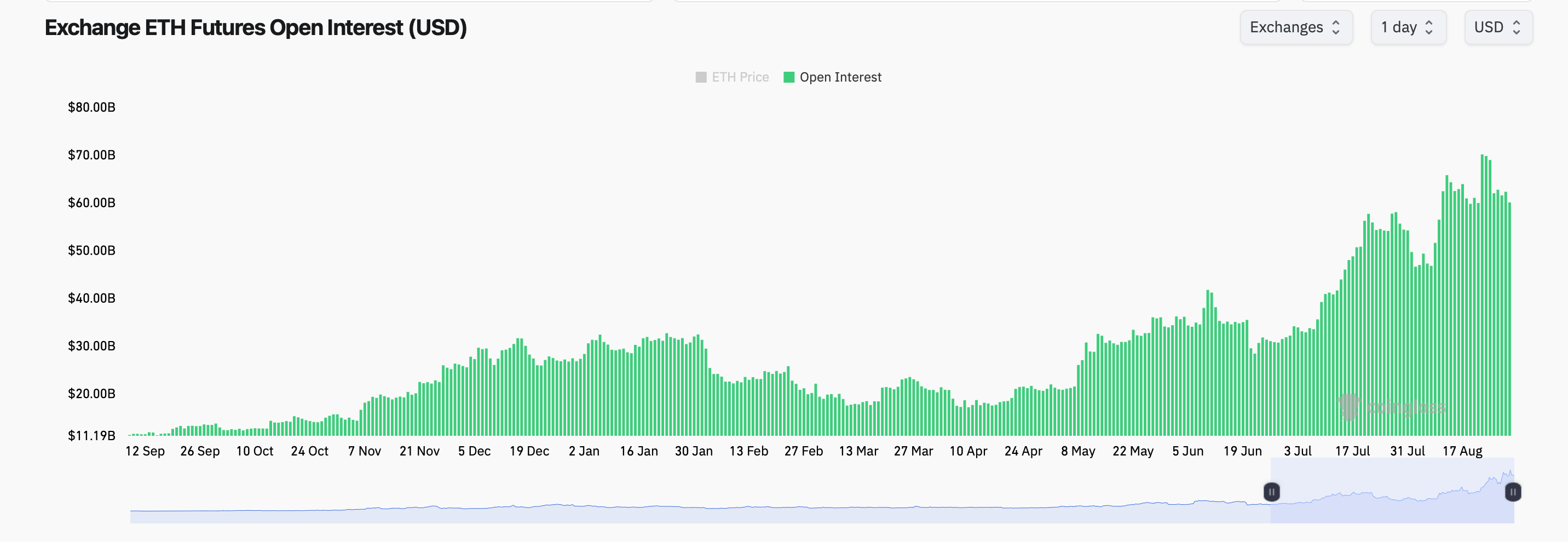

Ethereum Futures Open Interest has expanded sharply in recent weeks, rising to more than $60 billion across the exchange. This shows a sharp increase from the early summer level of nearly $30 billion, suggesting that traders have built a rapidly exploited position.

According to statistics from Coinglass.com, ETH futures are interested on August 29, 2025.

CME, Binance and Bybit remain dominant venues, with CME reporting 2.12 million ETH on open contracts and 272 million Ethereum leading Binance. Growth in futures positions indicates that traders are increasingly positioned for directional bets, while the distribution of the overall exchanges indicates fluctuations in emotion and exposure.

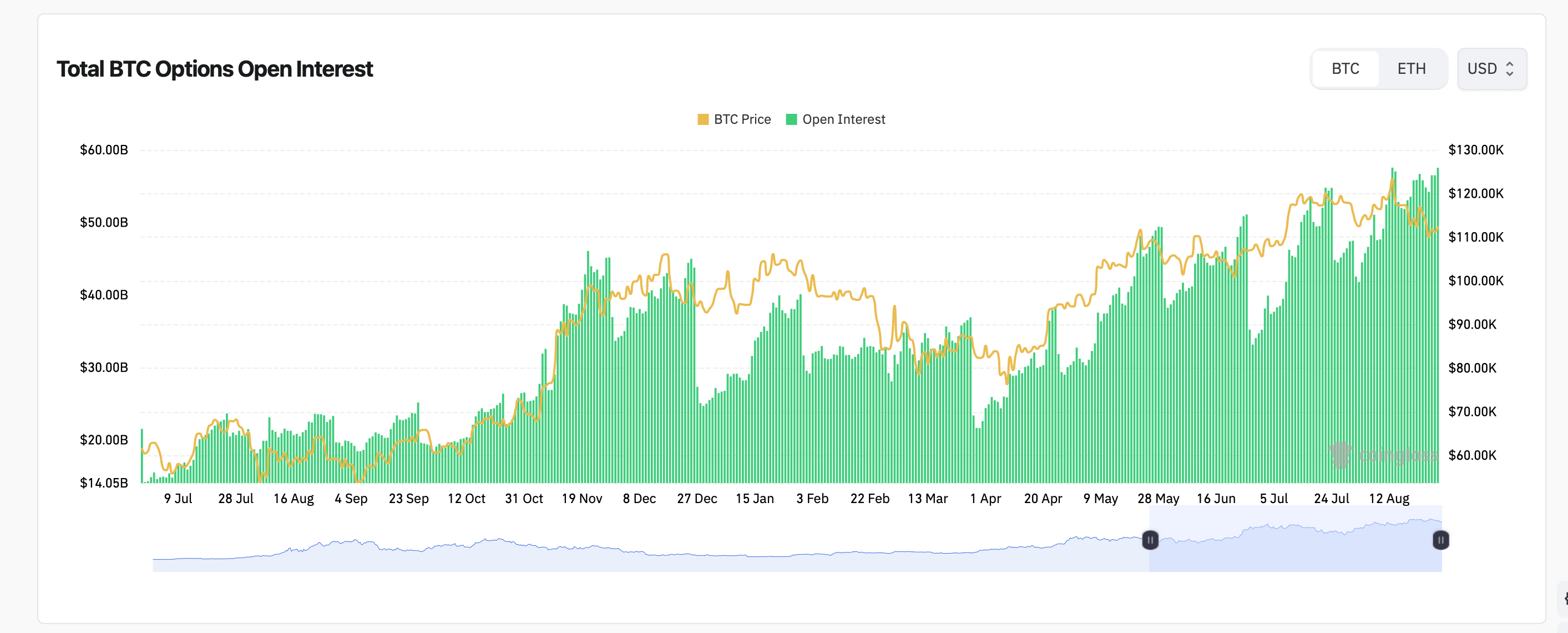

Option activities are also hot, with Delibit dominating the market. The December 2025 call has the largest open interest, with the $6,000 strike holding 86,431 ETH on the contract. An additional focus cluster of $4,000, $5,000 and $7,000 strikes of around $4,000 and $7,000.

ETH Options According to Coinglass.com Statss, there is an interest on August 29th, 2025.

The broader options market shows remarkable skew. The call represents 66.06% of open interest with 2.29 million ETH compared to Puts’ 1.17 million ETH. This positioning reflects bullish slopes, but recent volumes show a more complicated story. Over the past 24 hours, call accounted for 51.32% of the deal, while Puts took 48.68%.

Over the past week, Skews has shifted quickly, reflecting a shift in trader sentiment as Ethereum spot prices tested at a $4,288 level from the $4,900 range. It is important to note that options dealers are actively hedging with puts while short-term traders maintain long exposure over long periods of calls.

Ethereum also leads the market in liquidation. Over $190 million in ETH positions have been liquidated in the last 24 hours, the highest of all cryptocurrencies. Longs controlled these liquidation at $169 million, compared to $21.8 million from shorts across the ether market.

This wave of forced rewinding highlights the rapid changes in terms of the derivatives market. Combined with the sharp movements of ETH, high leverage combined has led many exposed traders to get caught up in the wrong side of volatility. Traders like these are shipwrecked.

At Exchange Front, CME open interest accounts for around 15% of the ETH futures market, while Binance leads by almost 20%. Other notable venues include BYBIT, which has 1.19 million ETHs, and OKX of 854,890 ETHs. This distribution highlights the growing role of both regulatory and offshore venues in ETH derivative trading.

Ethereum’s derivatives market is running hot, with the future and options expanding to levels and liquidation indicating the risks associated with level-level positioning. With options skew spinning and heavy calls stacked up in late 2025, the market appears poised for the uptick in volatility in the future.