Pacifica, Solana’s fastest growing perpetual futures DEX, took the top spot for most active trading volume. Pacifica has expanded its activities over the past few months in preparation for broader deployment.

Pacifica took the lead as the most active Solana perpetual futures DEX. The platform has taken the number one spot in daily, weekly, and monthly volumes after breaking out over the past few months. Pacifica was launched around the time Aster started the Perp DEX wars, but still serves a closed user base.

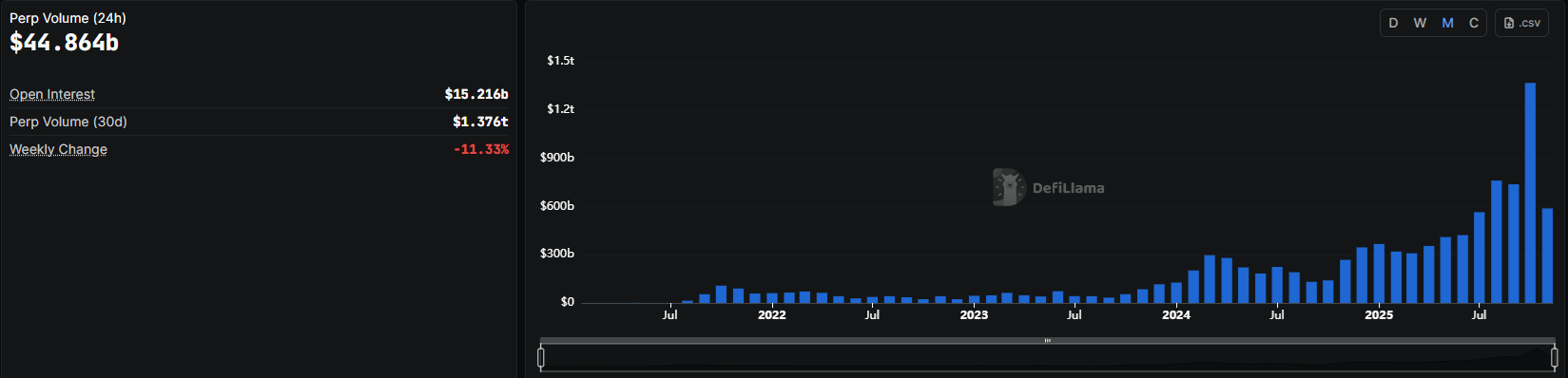

Pacifica surpassed Jupiter to become Solana’s largest DEX market. |Source: DeFi Llama

Pacifica is currently growing, with new listings added regularly and weekly updates on activity. Pacifica’s trading volume even surpassed Jupiter’s, leading to more DEX activity and briefly joining the ranks of Solana’s leaders.

Pacifica weekly updates 🌊

New milestones, innovative order types, and new security features. If there’s one thing we know for sure, Pacifica will never stop shipping. ⛴️

Please join us: https://t.co/mL0onjhCYJ

Update 🧵👇 pic.twitter.com/5Uh2GurBvP

— Pacifica (@pacifica_fi) November 13, 2025

Pacifica has become part of a larger trend in Solana, with perpetual futures volume increasing over the past few months. In total, the platform achieves $1.49 billion in daily trading volume across the PERP DEX market.

Solana has nearly doubled its Perp DEX activity over the past three months, hitting a monthly record in October. Perp DEX volume rose to $65.3 billion In the past month.

Pacifica gradually expands liquidity

Pacifica grew from a zero-volume startup to a Solana leader in less than six months. Perp DEX is expanding step by step, inviting more users and increasing deposits. Market operators participate in high-risk markets that also include technical deficiencies. Pacifica has begun initial closed beta testing.

Constance Wang, founder of Pacifica and former COO of FTX. announced The platform has increased the deposit threshold to $100,000.

Part of Pacifica’s growth is due to its points farming program, which hands out 10,000 points every Thursday. Pacifica has promised to conduct further agricultural rounds in the coming months.

Perp DEX has launched a mobile version and plans to expand to multiple chains. The market operator also plans to add spot markets and DeFi lending.

Perp DEX Posts Record Volume

Perp DEX activity peaked in October, reaching total volume. 1.36 trillion dollars. HyperLiquid stood out for managing multiple on-chain liquidations on October 11th. In the past few weeks, Aster has outperformed HyperLiquid in reported trading volume.

Perp DEX activity reached a record in October, causing a stress test in major markets with record on-chain liquidations. |Source: DeFi Llama

Although Reiter was the best leader in history, the accuracy of the reported trading volumes was questioned. Lighter offers zero-commission trading, which results in high trading volumes. However, Lighter has the lowest of the major locks. PERP DEXnot commensurate with the large amount of transactions.

Currently active Perp DEXs are no longer just competing, but innovating to build their own organic user base. Although Pacifica has managed to enter the top 10 exchanges in terms of trading volume, it has not actively expanded its activities and has avoided bot infiltration.