Polkadot’s financials became more aggressive and more conservative in the fourth quarter of 2025 (Q4), according to a new financial report.

Polkadot Treasury spent $7.4 million in the fourth quarter, the lowest level since OpenGov was introduced. Polkadot’s governance transitioned to the OpenGov model in June 2023.

After accounting for inflation and token burn, the Treasury posted a net profit of 1.6 million. $dotthe first positive results under the current system. At the end of the quarter, the Treasury held approximately $32 million. $dotworth approximately $58 million.

The report outlined that most spending went to core areas, with $2.5 million going to development, followed by $1.7 million to outreach and $1.3 million to operations. Meanwhile, records show that 68% of expenditures were handled through departments and incentives. Another 30% of the spending was done in stablecoins.

Treasury has also become more active across the Polkadot ecosystem, with approximately $3.8 million deployed in DeFi-related market operations. The report notes that the funds were managed across multiple parachains, including Hydration and Bifrost. The Treasury currently holds a variety of assets. $dotUSDT, USDC, HOLLAR.

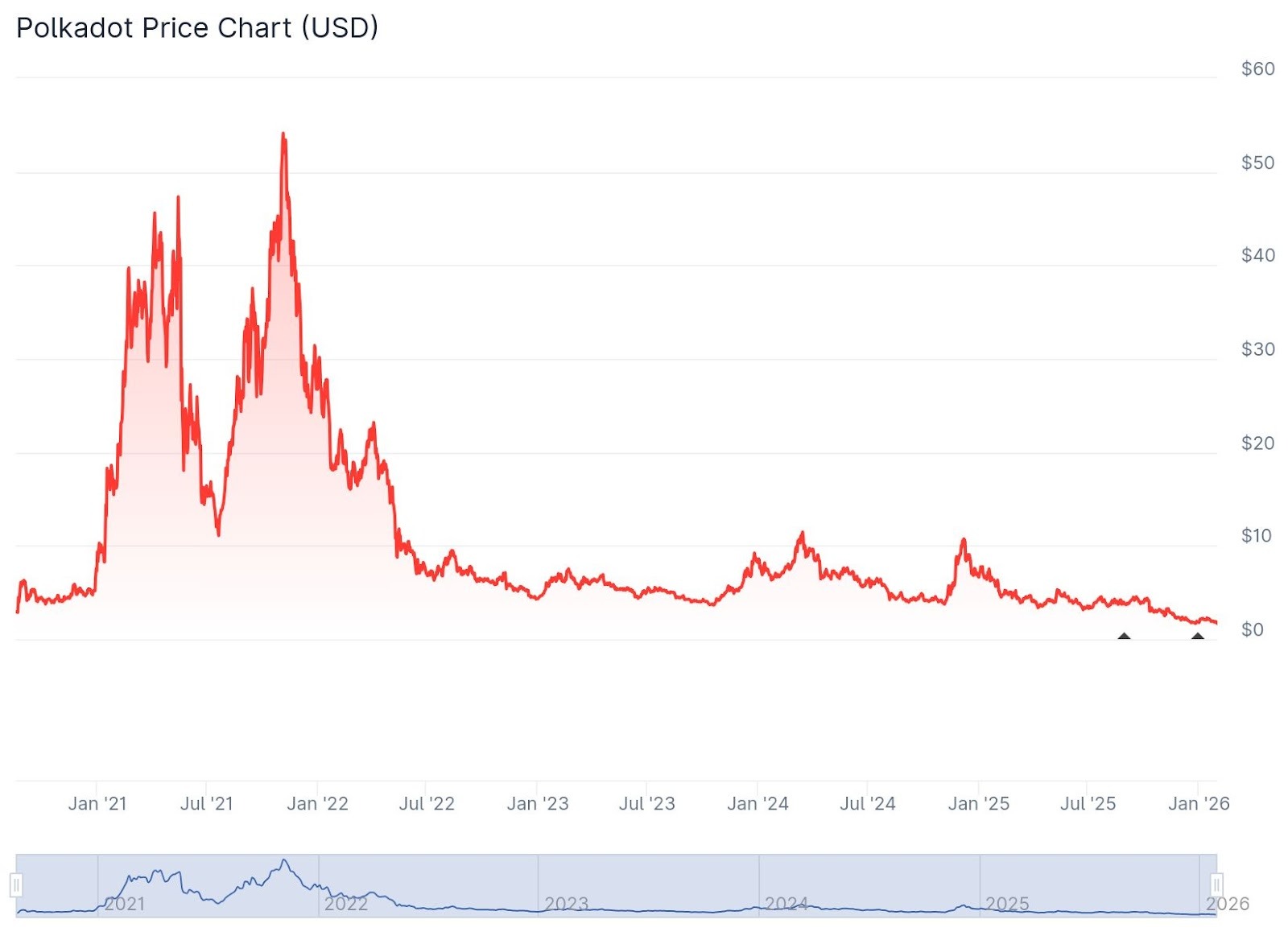

Despite all this, $dotprices remain near all-time lows. The token is currently trading at $1.69, down 72% over the past year, according to CoinGecko.

This finding is consistent with broader trends across blockchain for interoperability solutions. In a separate report published earlier today, Signum said that while tokens tied to these networks have struggled to record profits, interoperability activity continues to grow. It found that tokens related to Polkadot, Cosmos, and other interoperability projects were trading near multi-cycle lows.

For example, Cosmos’ native token ATOM is trading around $2.10, down about 66% over the past year, according to CoinGecko data. LayerZero’s native token ZRO is also trading around $2.01, down about 45% over the same period, despite new partnerships and an increase in cross-chain use cases.

Signum points to Chainlink as an exception among interoperability projects. This is primarily due to the expansion of Cross-Chain Interoperability Protocol (CCIP) across blockchains and service providers. For example, Coinbase recently selected CCIP as a bridging solution for approximately $8 billion worth of wrapped assets.