Open interest in major prediction markets exceeded $1 billion for the first time. Increased market liquidity has resulted in an increase in the number of users as well as new competitors competing with Polymarket and Kalshi.

Open interest across all prediction markets exceeded $1 billion for the first time. While Polymarket remained the leader based on several activity metrics, overall prediction market usage also shows the impact of the new platform.

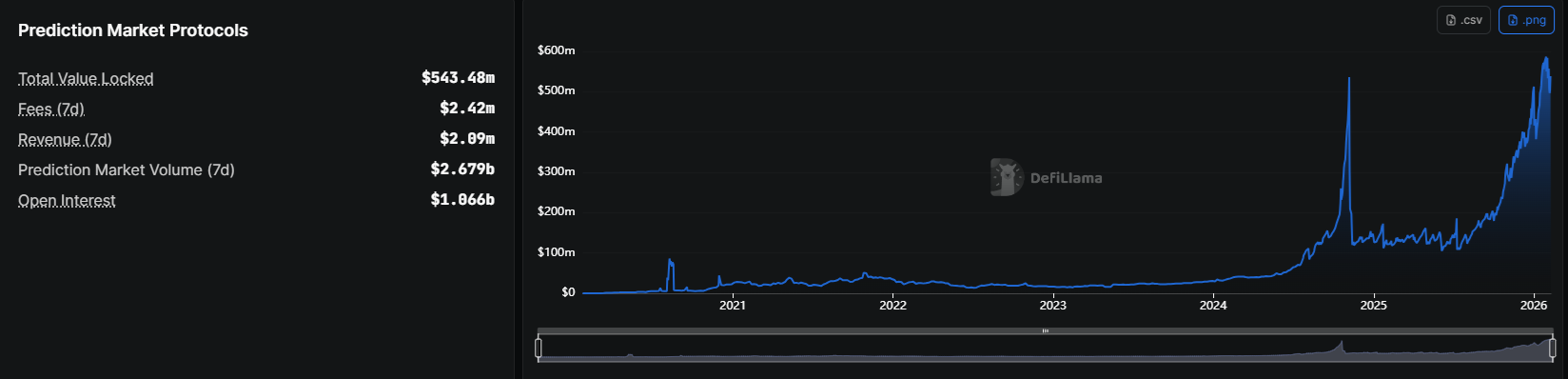

Open interest on the forecasting platform has topped $1 billion, indicating a high baseline of activity compared to the short-term peak in 2024. |Source: DeFi Llama

Based on DeFi Llama data, open interest has increased to $1.066 billion, with $564 million worth pegged in trading pairs. During the recent prediction market expansion, open interest has remained at a higher baseline compared to the temporary spike in 2024.

Prediction markets remain illiquid compared to exchanges. However, open interest is still growing exponentially, potentially putting the sector in competition with major decentralized exchanges.

Over the past three months, prediction market growth has accelerated with an influx of new wallets and a more diverse market.

Prediction markets prepare for Super Bowl season

In the short term, prediction markets are likely to be driven by an influx of bets on the outcome of the Super Bowl. Pairs are also produced in large numbers for the Winter Olympics, with up to $4 million being bet on medals.

Current events and politics remain major categories in the polymarket. Some of them are $BTC Trading has moved to 15 minute short-term forecast pairs $BTC price.

The mix of sports and current events still varies by platform. While Calci remains the leader in sports predictions, Polymarket relies on a variety of current events and niche bets.

Although almost all of Kalsi’s volume is focused on sports, and the market is starting to resemble a regular sports betting platform, Polymarket maintains a broader list of categories and is the only place to make predictions specifically related to Donald Trump and his statements.

Can predictions replace crypto trading?

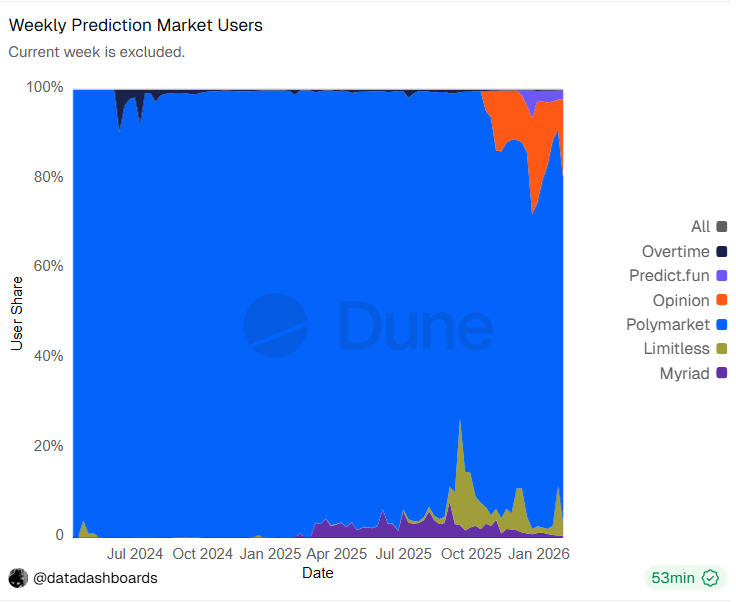

Prediction markets are not yet widely adopted as regulatory hurdles still exist. Markets also differ in their internal attractiveness. While Polymarket and Kalshi report high trading volumes, their competitor Opinion has much lower trading volumes.

In the case of Opinions, although nominal volumes are still high, transactions indicate fewer wallets are involved in the predictions. Although Kalshi and Opinion report high volumes or peak trading, most users still use Polymarket.

Despite reporting high volumes and open interest on competing platforms, most users are still focused on Polymarket. |Source: Dune Analytics

Prediction markets are still replacing some forms of cryptocurrency speculation, especially in short-term prediction pairs. The main attraction of prediction markets is that they are less likely to be manipulated.

Polymarket was launched as a crypto insider story, but all platforms are fighting for mainstream appeal. Most platforms are looking for fiat rails or using regulated stablecoins like USDC.