Although Polymarket was founded in 2020, it didn’t really make its name known until November 2024, after the US presidential election. However, 2025 brought unprecedented growth to crypto-native apps as the decentralized prediction market evolved into an international information resource frequently cited by the world’s top media outlets.

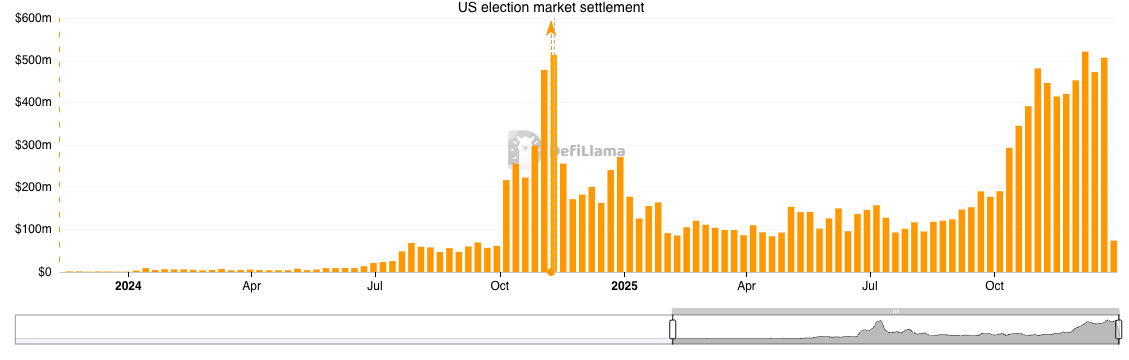

Just 18 months ago, Polymarket was in its fourth year of existence and was processing volumes between $10 million and $30 million per week. However, in November 2024, the platform shattered expectations, processing more volume in five days than in all of 2023.

By the way, the prediction market’s volume for 2023 was negligible, with some days trading less than $1 million.

Polymarket Volume – DeFiLlama

Fast forward to today, Polymarket routinely processes $500 million a day, major news outlets regularly cite its potential, and its founder, Shane Coplan, has been called the world’s youngest self-made billionaire.

Regulatory benefits

The Trump administration in the United States has embraced prediction markets, with the president’s son Donald Trump Jr. investing in Polymarket and serving as a strategic advisor to regulated competitor Calci.

Furthermore, President Trump himself has humorously referred to polymarket odds, or as he calls them, “poly polls,” in public speeches.

In addition to the presidential family’s vested interest in the success of the prediction market field, new regulatory changes scheduled for 2026 also bode well for prediction markets compared to traditional gambling venues such as online sports betting.

According to the United States’ One Big Beautiful Bill, passed in July, gamblers’ loss deductions are capped at 90%, but prediction market traders are subject to 100% of their losses being deductible in capital gains tax.

Although not explicitly discussed, this change could be a factor in traditional betting services like DraftKings entering the prediction market space as they seek to retain power users, where that extra 10% is important.

In October, DraftKings announced the acquisition of Railbird Prediction Markets and announced that Polymarket Clearing will be the official clearing house for the upcoming DraftKings Prediction Markets division.

Outlook for 2026

Last year’s prediction market competition was primarily characterized by an ongoing, and often unpleasant, competition between Calci and Polymarket.

Competition intensified after the Federal Bureau of Investigation (FBI) searched the home of Polymarket founder Shane Coplan in 2024. Days after the incident, it was revealed that members of Carsi’s team had paid influencers, including former NFL Pro Bowler Antonio Brown, to slander Coplan on social media.

Throughout 2025, Calci and Polymarket will take turns revealing new VC funding and new partnerships, with their counterparts announcing strikingly similar developments within 48 to 72 hours.

But 2026 could be the year Calci and Polymarket move away from their fledgling rivalry and lean more into their own user acquisition processes.

Polymarket is expected to officially launch in the US in 2026 after receiving operational approval from the Commodity Futures Trading Commission (CFTC) in November, and the Polymarket US app is gradually rolling out limited access to US users as of today.

There is also growing speculation regarding Polymarket’s future crypto activations, namely a native $POLY token and potentially its own Ethereum Layer 2 network.

Meanwhile, Carsi is facing legal trouble in the United States after the state of Nevada, home to the gambling capital of Las Vegas, filed a cease-and-desist order against him.

The decision came after a U.S. district judge revoked an earlier seven-month injunction that had allowed Kalsi to operate in the state. However, it is worth noting that there is no publicly available information on whether the state plans to impose similar restrictions on polymarkets.

Kalsi’s cryptocurrency integration plans remain unclear. The company is sponsoring a series of crypto-native influencers on X and is focusing on integrating stablecoins for on- and off-ramping. However, prediction market data, order books, and user base remain completely off-chain and gated by know-your-customer (KYC) restrictions.

Information presented by the company and its affiliates suggests that Kalsi may continue to lean further into the cryptocurrency space beyond just user acquisition, but there are currently no official statements confirming that.