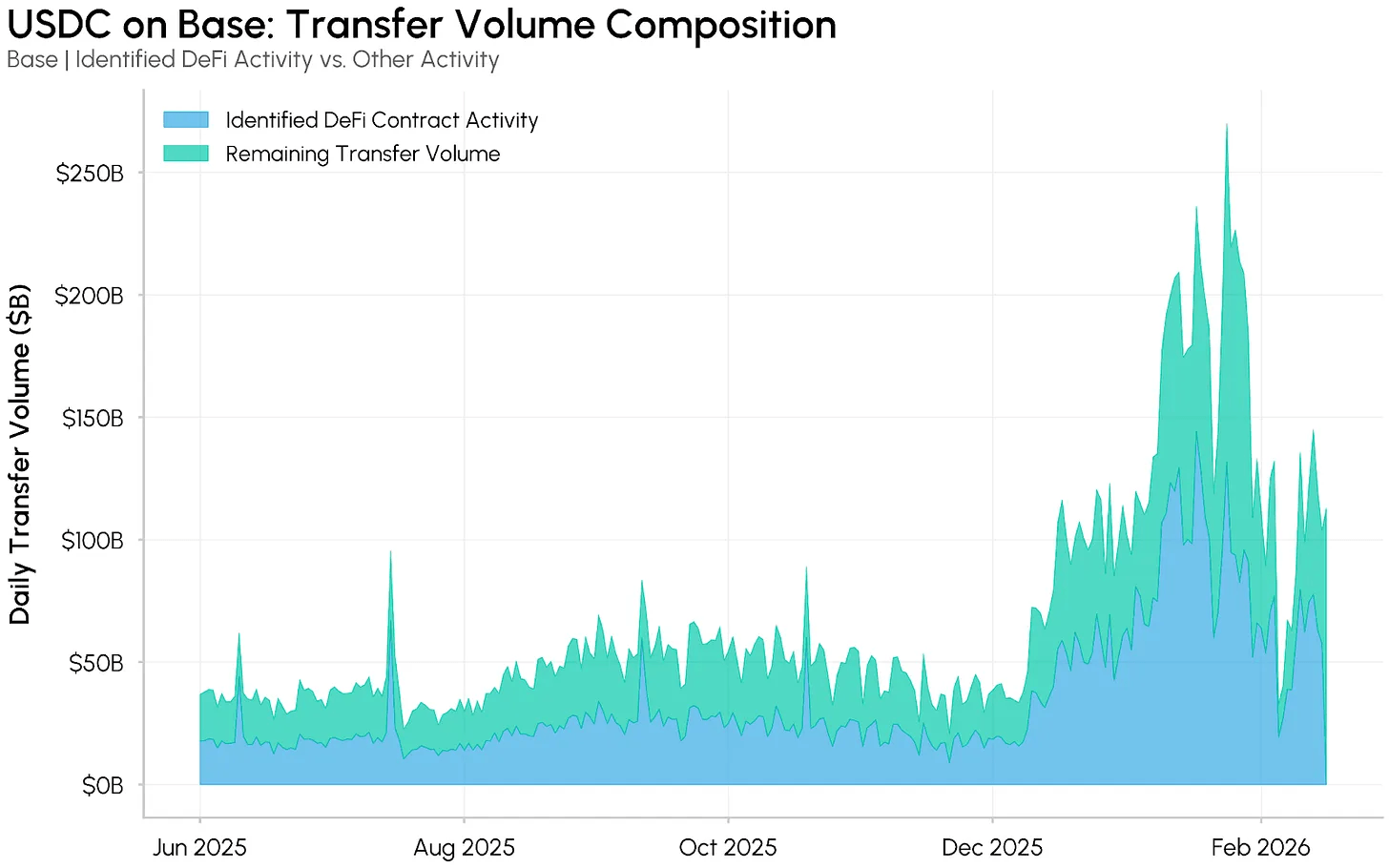

A new Coinmetrics analysis written by Senior Research Associate Tanai Ved finds that January’s record $8 trillion in adjusted stablecoin remittances was primarily due to: $USDC Base activity, and much of the surge is related to decentralized finance (DeFi) mechanics rather than payments.

Coin index Tanay Ved collapses $USDC$5.3 trillion on a monthly basis

Coin Metrics reported that adjusted stablecoin transfer volume reached a record $8 trillion in January 2026, with the majority of that increase concentrated in the following areas: $USDC on the base. The report isstrange case of $USDC on the baseThe paper, written by Tanay Ved, Senior Research Associate at Coin Metrics, attributes much of the expansion to a combination of single assets and network activity.

According to Coin Metrics Network Data Pro: $USDC on Base has a supply of approximately $4.1 billion and generated approximately $5.3 trillion in trading volume in January alone. Senior researchers at the company note that this leads to unusually high speeds compared to other chains, prompting a closer look at the underlying dynamics.

According to Coinmetrics data, the increase was dominated by large-scale transfers. every day $USDC Transactions over $100,000 on Base rose from less than 50,000 in mid-2025 to more than 450,000 at its peak in January 2026. According to the report, remittances between $100,000 and $10 million accounted for about 90% of total remittances, while the largest band above $10 million saw intermittent spikes.

To determine the cause of this activity, Coin Metrics analysts analyzed it using ATLAS data. $USDC We will focus on updating the Base balance during 10 days in January. The top five addresses were related to DeFi infrastructure, specifically liquidity provision on Aerodrome and lending and flash loan activity on Morpho.

Coin Metrics ATLAS data is available for airfield WETH/$USDC Centralized liquidity pools alone account for an estimated 32% of the total, or $6.4 trillion. $USDC Adjusted transfer amount in Base for the past year. Combine with Aerodrome’s cbBTC/$USDC In pool and Morpho activity, these contracts accounted for a significant portion of flows related to DeFi mechanisms rather than traditional payments.

This analysis explains how centralized liquidity models or providers encourage frequent rebalancing. Liquidity providers (LPs) exit and redeploy as price ranges change. $USDClarge inflows and outflows occur with limited net changes to the pool balance. At its peak level in January, WETH/$USDC Pool recorded more than $100 billion daily $USDC Remittance volumes typically stayed within $20 million, while net daily flows typically stayed within $20 million.

Coin Metrics also identifies flash loan activity on Morpho as one of the key factors. Single flash loan transaction involving $114 million $USDC shows how a bot borrows and repays large amounts within a single atomic transaction, generating large volumes of transfer without representing any pure economic movement.

Source: Coin Metrics ATLAS & Network Data Pro Latest report from Coin Metrics.

Coin Metrics estimates that it will break down about 50% of January’s $5.3 trillion. $USDCThe adjusted transfer volume at Base is likely due to the top three DeFi contracts. The remaining activity still shows growth, but not at the scale suggested by the daily peak of over $200 billion.

The researchers conclude that while stablecoin adoption continues to grow, transfer volume metrics can confuse fundamentally different types of activity. Coin Metrics highlights the need for more granular classification to distinguish between liquidity management, arbitrage, and genuine payment or settlement flows. It can be misleading to lump everything together into one specific type of classification.

Frequently asked questions ❓

- What did Coin Metrics report on stablecoin volume in January 2026?

According to Coin Metrics, adjusted stablecoin transfer volume reached a record high of $8 trillion in January 2026. $USDC on the base. - how much $USDC Did you experience any transfer volume on Base in January?

coin metrics data show $USDC on Base generated approximately $5.3 trillion in adjusted transfer volume during the month. - What drove the increase? $USDC What are your base activities?

According to Tanay Ved and Coin Metrics, much of the growth is due to DeFi activity at Aerodrome and Morpho, such as liquidity rebalancing and flash loans. - Why does Coin Metrics say that transfer amounts can be misleading?

Coin Metrics points out that headline volumes can confuse DeFi mechanics and payment activity, and detailed classification is essential for accurate interpretation.