Neobank Revolut introduced a 1:1 exchange between USD and stablecoins, allowing its 65 million users to exchange up to $578,630 every 30 rolling days without incurring fees or spreads.

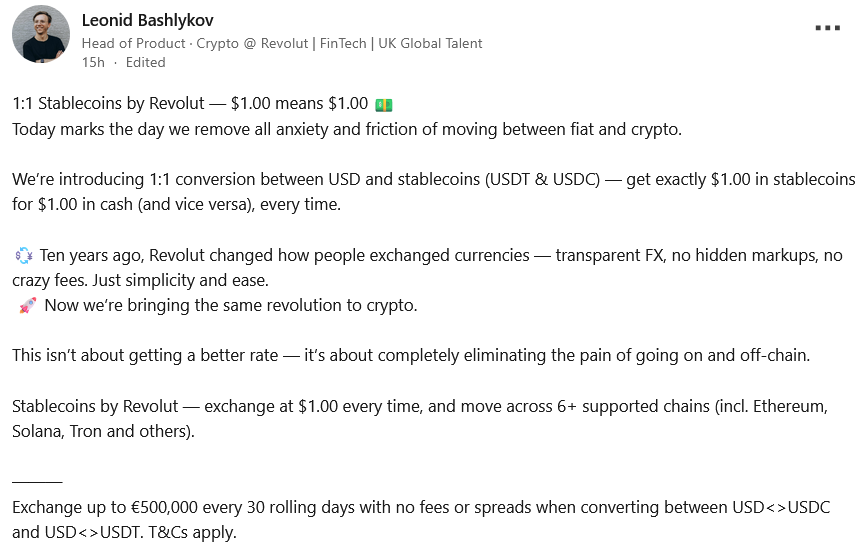

“Today is the day to remove all the anxiety and friction when moving between fiat and cryptocurrencies,” Leonid Vasilikov, head of crypto products at Revolut, posted on LinkedIn on Thursday.

“Revolut’s 1:1 stablecoin — $1 means $1.”

Revolut reported holding $35 billion worth of assets on behalf of its customers in 2024, an increase of 66% from 2023, with monthly transactions on the platform also increasing significantly.

Revolut’s services will apply to Circle’s USDC (USDC) and Tether (USDT) across six blockchains, including Ethereum, Solana, and Tron, Vasilikov said.

This comes about a week after Revolut received a crypto asset market regulation license from the Cyprus Securities and Exchange Commission, allowing it to offer regulated cryptocurrency services in 30 countries that are part of the European Economic Area.

Vasilikov said that one-to-one conversions are not meant to improve rates, but to “completely remove the pain of moving on-chain and off-chain.”

sauce: Leonid Vasilikov

In response to Vasilikov’s post, Elbruz Yilmaz, managing partner at venture capital firm Outran, said a one-to-one conversion would have a major impact on small and medium-sized enterprises in countries facing economic challenges, such as Turkey.

He noted that small and medium-sized businesses lose significant value when they have to convert currencies such as the Turkish lira into US dollars, and losses are compounded by SWIFT fees and slippage when transferring funds across borders.

“Clean 1:1 ramps transform stablecoins from speculative assets to working capital infrastructure. Faster cycles. Less exchange hemorrhage. Better financial management.”

Vasilikov said that as long as the stablecoin remains pegged, Revolut will cover the spread internally to ensure customers receive a 1:1 rate.

The UK-based bank has been offering cryptocurrency trading since 2017 and currently supports over 200 tokens, as well as the option to pay with cryptocurrencies for everyday purchases.

Western Union announced its own stablecoin plans this week

Earlier this week, money transfer platform Western Union announced that it will introduce a stablecoin payment system on the Solana blockchain sometime in the first half of 2026.

Related: Ondo tokenizes over 100 US stocks and ETFs on BNB Chain

The solution consists of the US Dollar Payment Token (USDPT), which Western Union plans to issue on partner cryptocurrency exchanges, and a digital asset network.

Zelle and MoneyGram are also making similar moves.

Last Friday, the parent company of payments platform Zelle announced it would introduce stablecoins to facilitate faster cross-border payments, while MoneyGram announced in mid-September that it would integrate its crypto app in Colombia and offer a USDC wallet for local residents.

SWIFT (Society for World Interbank Financial Telecommunication) is also building a blockchain payments platform to support the transfer of stablecoins and tokenized assets.

magazine: Bitcoin OG Kyle Chasse is one shot away from being permanently banned from YouTube