The Bitcoin (BTC) Treasury is facing a rather important situation as it erodes the market premium of underlying BTC holdings amid a decline in volatility and a sharp slowdown in new purchases.

In particular, monthly BTC purchases by these companies have crashed 97% since November 2024, reflecting a very careful market approach in recent months. However, recent data from Cryptoquant suggests the need for immediate changes in strategies.

A decline in Bitcoin volatility threatens the market value of Bitcoin’s Ministry of Finance

Generally, Bitcoin Treasury is traded at premium. That is, the market value exceeds the actual value of BTC as investors believe these companies can grow their holdings, monetize volatility and act as a secure exposure to the best cryptocurrency. Therefore, the market net asset value (MNAV) that compares the stock price of these companies with the NAVs owned by Bitcoin is always above 1.

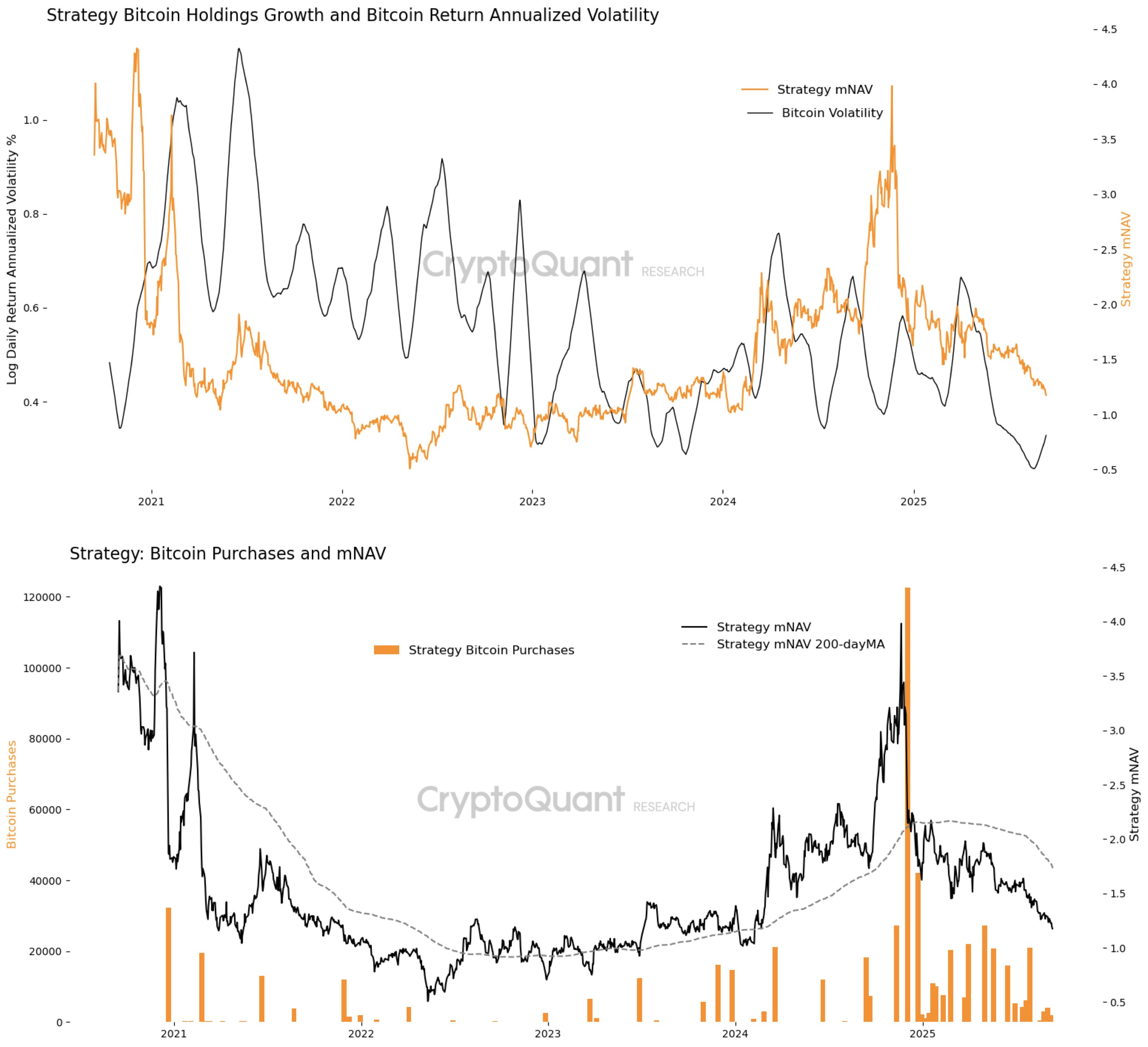

However, Julio Moreno, head of Cryptoquant Research, shares that annual Bitcoin volatility has dropped to a multi-year low, removing its premium key drivers, and there is less opportunity for the Treasury to take advantage of price fluctuations and justify valuations beyond underlying BTC stocks.

When analyzing market data for Strategies, the biggest company BTC holder, we can observe that certain volatile surges rose above 2.0, especially in early 2021 and mid-2024. During these windows, the finance company was able to monetize volatility, increase fairness or liability with premiums, and deploy those revenues to rapid BTC purchases.

However, volatility is now well below the annual return of 0.4 logs per year, reaching its lowest level since 2020. The planarization volatility curve coincided with a steady decrease in MNAV, returning to 1.25. This narrow premium suggests that investors no longer see treasury companies as providing meaningful leverage in directly holding Bitcoin.

Weakening the Ministry of Finance’s problems with demand compounds

Without the “fuel” of price fluctuations, Bitcoin finance companies are struggling to expand their holdings in a way that justifies their premium valuation. There was an isolated burst of purchases between late 2024 and early 2025, but overall activity remains stifled.

In response, despite BTC itself trading at a relatively high price range compared to recent years, the strategy’s MNAV has been on a downward trend since the turn of 2025. The data suggests that when the Treasury purchases aggressively, investor enthusiasm will push MNAV high and strengthen the cycle of premium issuance and BTC accumulation.

Julio Moreno explains that for MNAV Premium to last, new demand from BTC volatility rebound and large-scale purchases will soon be needed. Until then, it could become increasingly difficult for treasury companies to justify valuations beyond Bitcoin’s net asset value, forcing investors to consider direct exposure to Bitcoin for returns rather than corporate strategies.

At the press conference, Bitcoin traded at $115,810, reflecting a 4.72% increase last week.

Pexels featured images, TradingView charts

Editing process Bitconists focus on delivering thorough research, accurate and unbiased content. We support strict sourcing standards, and each page receives a hard-working review by a team of top technology experts and veteran editors. This process ensures the integrity, relevance and value of your readers’ content.