Today, on April 8, 2025, Sandbox (Sand) recorded a price increase of 8.8%. Despite the jump, the altcoins appear bearish, and you could potentially see drops as the whale sand tokens are thrown away.

Hashed (@hashed_official) may deposit and sell $4.1 million worth of 17.03mm $SAND on #Binance.

Hashed led the $2.5 million investment on May 22, 2019 with $SAND. They still hold 25.55m $sand, worth $6.15 million.

Address: 0xf1db561ef1452c7e88c24ed438e546d3019e1b06

data @nansen_ai pic.twitter.com/1odqnrhkf9

– Onchain Lens (@onchainlens) April 8, 2025

Whale throws away 17.03 million sand

Today, Crypto analyst Onchain Lens posted on X that a major whale, commonly hashed, hashed, is likely to deposit 1,703 million dollars of sand in Binance, worth $4.1 million, and sell these tokens.

This substantial influx suggests that whales are transferring sand tokens from their cold wallets to exchange. This is considered a bearish sign. Furthermore, this indicates potential sales intent and suggests potential downward movements over the next few days.

According to data, the investor began investing in sandboxes in 2019, when he accumulated $2.5 million worth of tokens on May 22nd.

Sand Price Update

Today, Sandbox recorded an impressive recovery following the long-term price declines that have been attracting attention in recent weeks. The asset price is currently at $0.2382, an 8.9% increase over the past 24 hours. That trading volume also recorded a 35.80% increase over the period, indicating that investors and traders are beginning to show a growing interest in sand. This means future breakouts and potential uptrends.

The current price for the Sandbox is $0.2382 USD.

Despite today’s price hike, the asset has been on a downtrend for several weeks. That price has dropped by 13.6% and 19.1% over the past week and a month ago, respectively. So in this case it’s interesting to see if the sandbox can do a breakout or continue the ongoing downtrend.

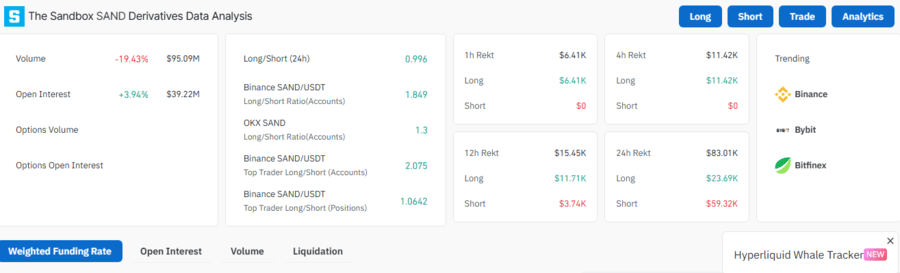

Sand’s open interest (OI) skyrocketed 5.64% yesterday, according to Coinglass metrics. This increase in OI shows that traders are building new positions in the sand market. This increased interest and demand could serve as a catalyst for potential upward movements.

Today, open interest in sand rose 5.64%.

Technical indicators show that sand has broken from a wedge pattern that falls in the weekly time frame. Currently, the token is sitting at the upper limit of this pattern setup as support. This means that the token is experiencing an expansion in purchasing activity. This means that it is likely to quickly strengthen its value for the $0.266 and $0.292 range of resistance.