Bitcoin was soaked at $115,363 earlier than today. This was a 2.6% drop in just 24 hours, which was surprising. The price chart went red and a wave of normal concerns hit social media, but on-chain data provided a more realistic explanation. Another major sale from Galaxy Digital.

The company, led by Mike Novogratz, reportedly moved 11,000 btc and withdraws more than $11.5 billion in USDT from the exchange. This is not the first time Bitcoin has recently left Galaxy. The data show a consistent pattern of BTC distribution dating back to mid-July, even though everyone is still positive. And Novograts was also quite vocal about Bitcoin’s high.

The galaxy leaves and then returns

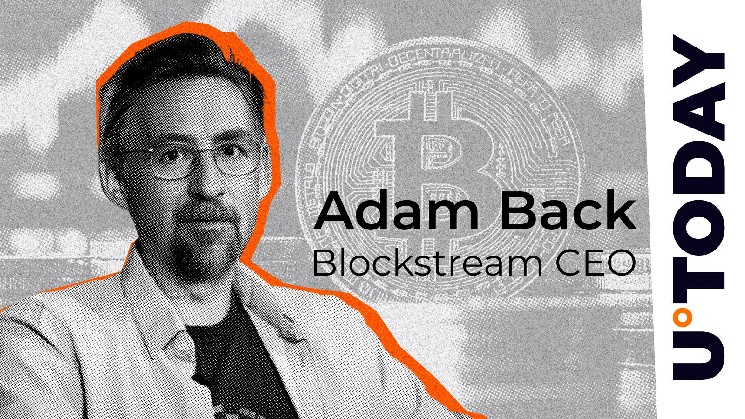

Amidst fear, uncertainty and doubt, Adambak posted a brief but clear statement online, confirming that he intervened to make purchases from his account, not on behalf of the fund or the Treasury Department. It happened to confirm that he took advantage of the price decline, not institutional movements or adjusted announcements.

His comments were not only distinguished by his position in the Bitcoin community, but also because rumors recently linked him to a much larger BTC transfer.

Novo was on sale – it appears that it doesn’t use TWAP. Personally, I woke up this morning. Thank you for cheap sats @novogratz

– Adam Back (@Adam3us) July 25, 2025

Earlier this year, Blockchain activity suggested that 80,000 BTC linked to dormant wallets was quietly offloaded through the Galaxy. This later led to reports of stock transactions involving US-related investment companies, with Buck’s name being frequently mentioned in the mix.

This may have helped to promote the disruption surrounding today’s sale, but he quickly set the record straight. According to Buck, he was not behind the sale – he bought it.

Once Bitcoin falls below critical levels again, the contrast between institutional movements and individual signals continues to widen. For now, at least, Adambak is still accumulating Bitcoin.