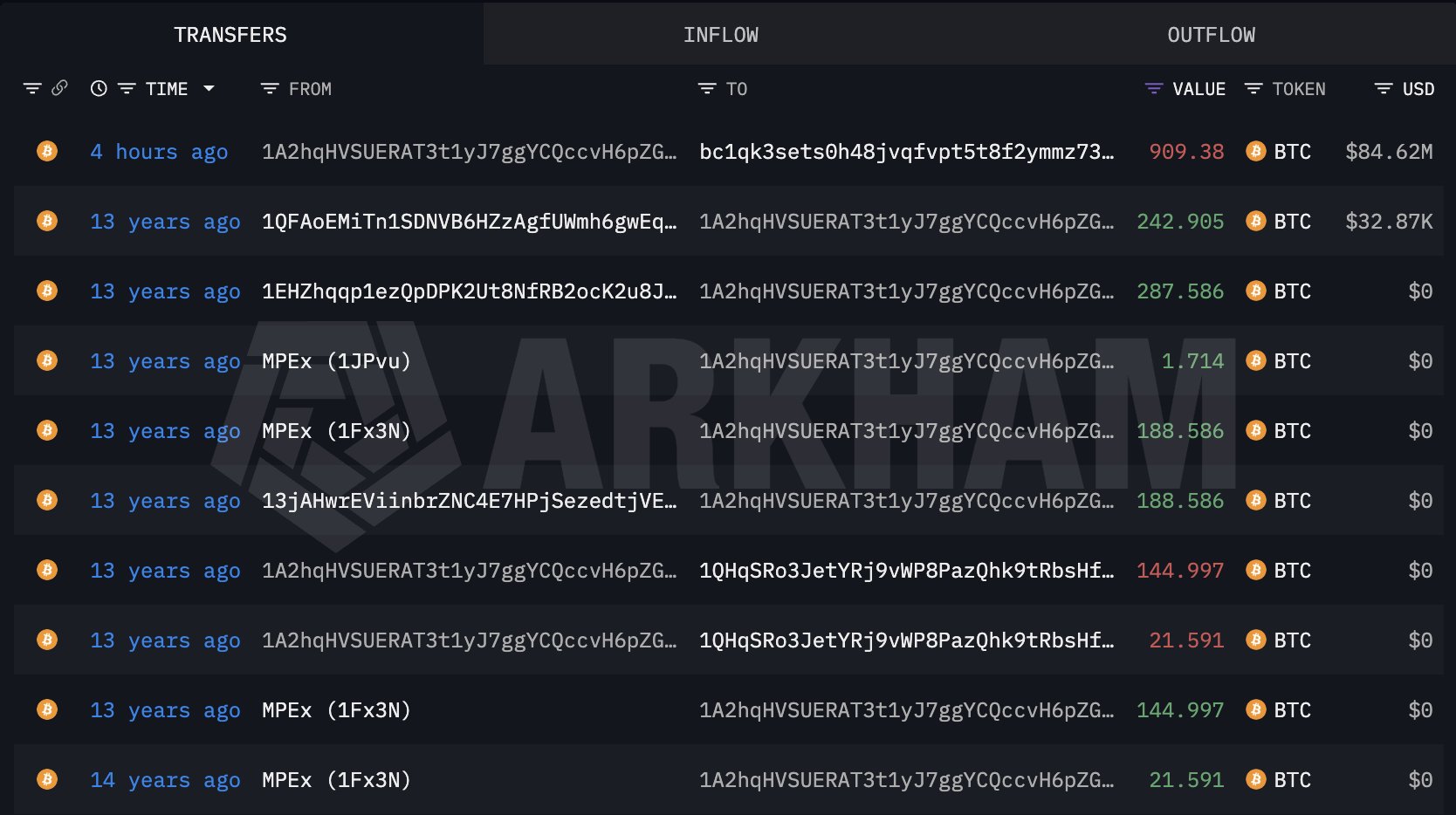

An unchanged Bitcoin address just moved through the stack — 909.38 BTCAs revealed by Lookonchain, it has now been converted into a new wallet format worth $84.62 million. Everyone who knew what a wallet like this could cause immediately asked three questions. It’s about the who, why, and what happens next.

The address received its first inflow sometime between 2011 and 2012 via MPEx and a series of now-defunct legacy platforms, establishing itself in the sub-$7 landscape long before halvings, ordinals, ETFs, and stablecoin pairs existed.

This entire stack has lasted through Mt. Gox, the China ban, the 2013 double top, the 2017 crash, the 2020 pandemic crash, and two US presidential cycles, only to be moved by a single trade just four hours ago.

The new destination wallet is a modern, SegWit compatible and efficient bech32 address. This is a strong signal that the original owner or successor is technically competent, alive, and aware of wallet hygiene best practices.

Why now?

There is no evidence of exchange deposits yet, but the nearness of the transition to the present BTC Technical pressure zones are hard to ignore.

Bitcoin is trading at $91,111, well below the local high of $124,743, but chart signals point to a possible death cross of the 23/50-day moving average. Deeper flushes to $74,000 or even $69,000 remain in play, and early cycle holders on a zero-cost basis have little incentive to wait for liquidity if the macro environment changes.

This is not a bullish or bearish move per se, but rather a relapse. What matters now is whether or not it can be done. BTC They touch public CEX or disappear into wrapped tokens, mixers, or institutional vaults through OTC trading.