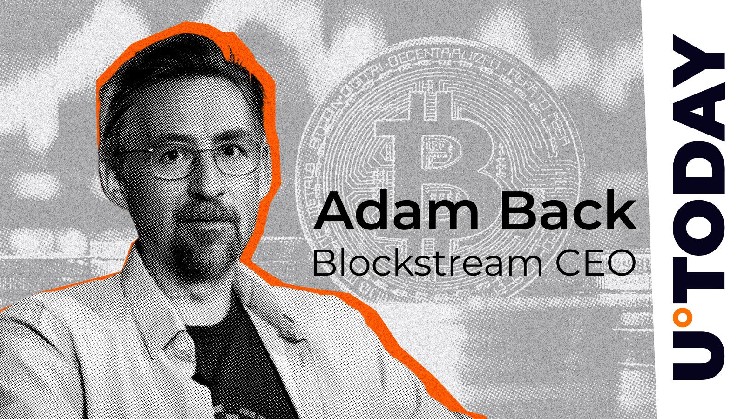

Blockstream CEO Adam Back, mentioned in Bitcoin Whitepaper, announced that it has taken steps to prevent Bitcoin from approaching zero.

He says he’ll buy all 21 million bitcoins at an incredibly low price, even if that happens.

The back location limits orders to buy all BTC for $0.02, here’s the catch

Commenting on a recent tweet published by Bitcoin Bull and Strategy Executive Chairman Michael Saylor, he said Bitcoin would be $1 million per unit, but Buck said he did his best to prevent deep BTC conflicts. What Buck did was issue a restriction order to Bitfinex Exchange to buy all the bitcoin they could reach if they crashed to 2 cents.

It’s $1 million Bitcoin because there’s a limit order at 21M BTC/BTC, so it won’t get zero. @Alistairmilne’s 1C with 2C/BTC 21mil BTC live orders at @bitfinex. https://t.co/lcybunomys

– Adam Back (@Adam3us) June 14, 2025

He apparently surpassed investor and venture capitalist Alistair Milne. But as Buck made clear in the comments, he and Milne placed those bids in 2020, cancelled them and “used liquidity to buy BTC.”

Well, after a while I got my FOMO, cancelled, and used liquidity to buy the BTC. But it was a live order for a while during 2020. https://t.co/nfl5wnog6t

– Adam Back (@Adam3us) June 14, 2025

Even if Bitcoin actually crashes, it’s just a joke to buy the entire BTC supply, as about 2 million BTC remains unlocked and the majority of the 19 million BTC already mined is held by the Bitcoin Treasury, such as the Saylor strategy above. The company currently owns 582,000 BTC, totaling over $61 billion.

Saylor says Bitcoin goes to a million

Bitcoin rose rapidly, adding 2.35% after BELLWETHER CRYPTOCURRENCY’s BTC plunged Friday, losing around 4.33% and fell above $108,000 to the $103,000 zone. Currently, Digital Gold has changed hands just over $105,000.

Thaler tweeted, “If it doesn’t go to zero, it’s going to be a million,” referring to Bitcoin and triggering a wave of positive comments from the crypto community, including Adam Buck above.

In one recent interview, Saylor said he hopes that after the large capital firm intervenes to accumulate BTC, no Bitcoin sellers will be left behind. This is not only due to strategy, but also thanks to the Spot Bitcoin ETFs (such as BlackRock, Fidelity, Bitise, Grayscale), which have accumulated BTC every week since its launch in January 2024.