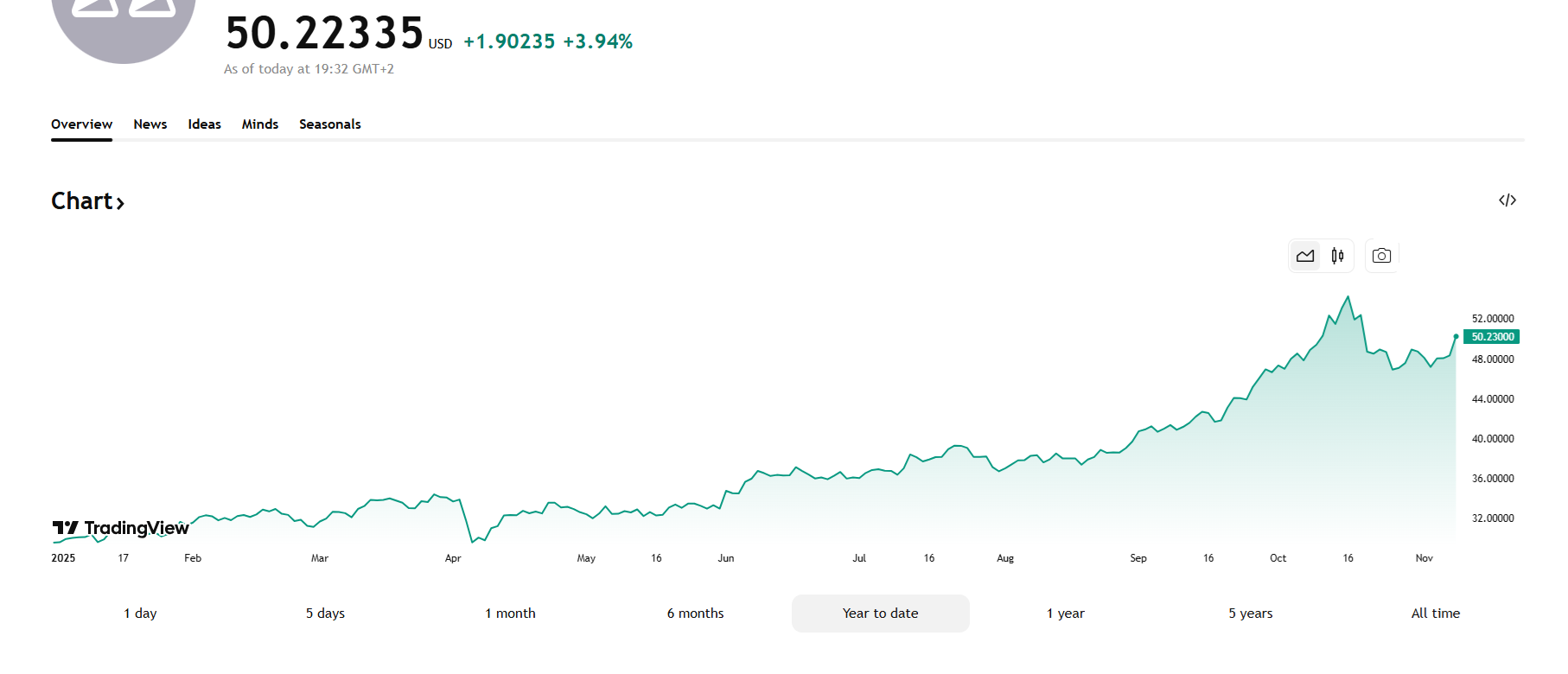

Silver has once again climbed above $50, taking the top spot as the fastest-growing trade of 2025. Precious metals once again outperformed gold and BTC, driven by speculative interest.

Silver is up over 58% year-to-date, outpacing the gains of both gold and BTC. spot silver trading price $50.23for the second time this year, BTC has been dethroned as the top asset.

An influx of bullion deposits into London vaults pushed silver above $50 for the first time in three weeks. Silver is considered a depreciating asset because of its longer-term growth potential. |Source: Tradingview

Historically, BTC has surpassed traditional asset classes. However, it is expected that precious metals will rise to the top in 2025. A speculative silver rally in the fourth quarter could change the balance of high earners in 2025.

BTC has shrunk its year-to-date net income by 30% and is trading above $105,000. The crypto industry has expressed hope that a slowdown in precious metals prices could lead to increased liquidity for digital assets. However, silver’s continued strength may delay the transition to crypto assets.

Silver stockpiles reach peak in 9 years

Demand for silver saw record inflows into London’s vaults. Reserves have increased to the highest level in nine years, and fears of a shortage have subsided for now. Silver deliveries have previously been tight, pushing the previous price further above $54 an ounce.

London vaults added 54 million troy ounces of silver in October based on increased demand. As bullion prices diverged, London deliveries piled up after global arbitrage opportunities. The inflow came as London’s silver stocks recently hit an all-time low.

In October, there was a wave of physical demand in India, and spot buying of silver ETFs was also noticeable. At the same time, traders were withdrawing silver from vaults in the United States and China and depositing it in warehouses in London. This accumulation shows that arbitrage is working and that there is sufficient supply left in the London market.

Despite increased availability, silver still showed potential for growth. The metal also reacted as gold prices climbed back above $4,100 an ounce.

Will precious metals cool down?

Silver is a special case, as this metal has been waiting to break out for years. Metals are considered subdued and run expectations are set in a higher range.

Despite this, the precious metal was trading amid a mix of hype and talk of a “downgrade trade.” Both gold and silver are expected to continue rising at a more sustainable pace, although the hyped rally is expected to subside.

Silver is rarely represented as a tokenized asset and has not generated any hype for creating new digital assets based on the metal. In the short term, traders are expecting extreme volatility due to the relatively low price of silver. This metal is accumulated in physical form and is a must-have for long-term investors, but traders can take on fairly high risks. As with any digital asset, long-term holders may be the winners.