SLNH has a pipeline of 1 GW or more, comparable to BITF, but has a market capitalization of just a fraction. With credit facilities up to $100 million for data center build-out, can Soluna be a baby Airen created?

The next guest post comes from bitcoinminingstock.io, A public market intelligence platform that provides data on companies exposed to Bitcoin mining and cryptocurrency strategies. Originally published by Cindy Feng on September 24, 2025.

I cover trades from some major HPC/AI pivots and public Bitcoin miners, but a considerable number of followers are increasingly pointed out by names of lesser known names: Soluna Holdings (NASDAQ: SLNH). Discussion? This is a microcap player that appears to be a $100 million credit facility to fund a large energy pipeline (>1GW), the construction of an HPC data center, and more recently, Project Kati.

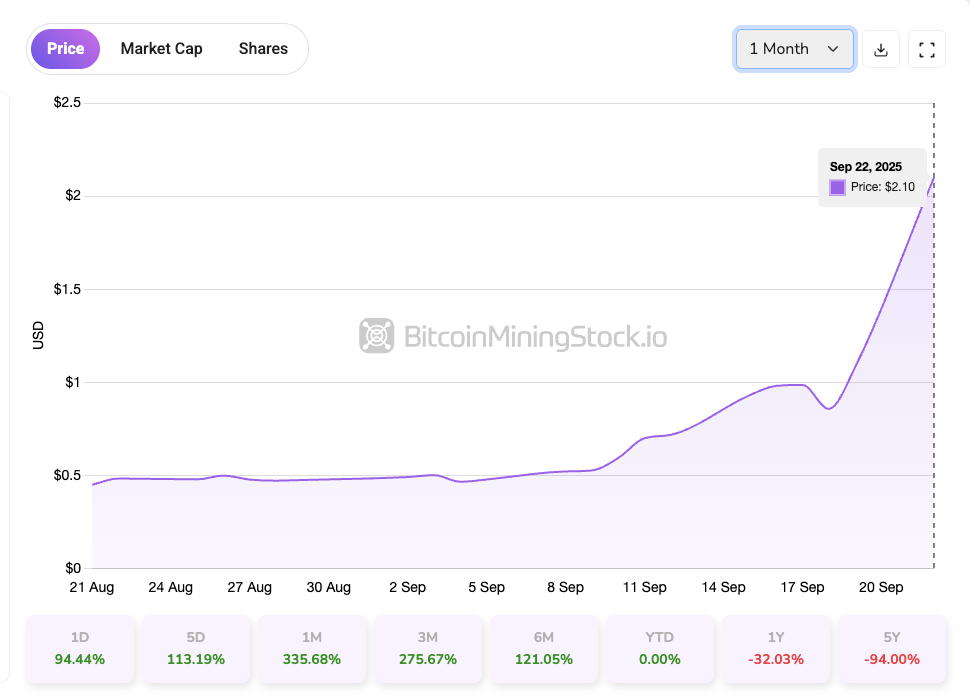

On September 22, 2025, $SLNH skyrocketed 94.44%.

Some believe that Soluna can follow a similar path to Iren or CIFR. Most will be shared at a low price until the market recognizes its enormous HPC/AI potential. But move beyond speculation. question Does hype hold up when stitching scattered facts together?

Let’s jump in!

Soluna Infrastructure Footprint: Play beyond 1 Golden Week

Soluna Holdings is a US-based developer of modular green data centers designed specifically for intensive computing applications such as Bitcoin mining and AI workloads. The company has established itself as a bridge between underutilized renewable energy assets and demand calculations.

Soluna’s screenshot Investor presentation

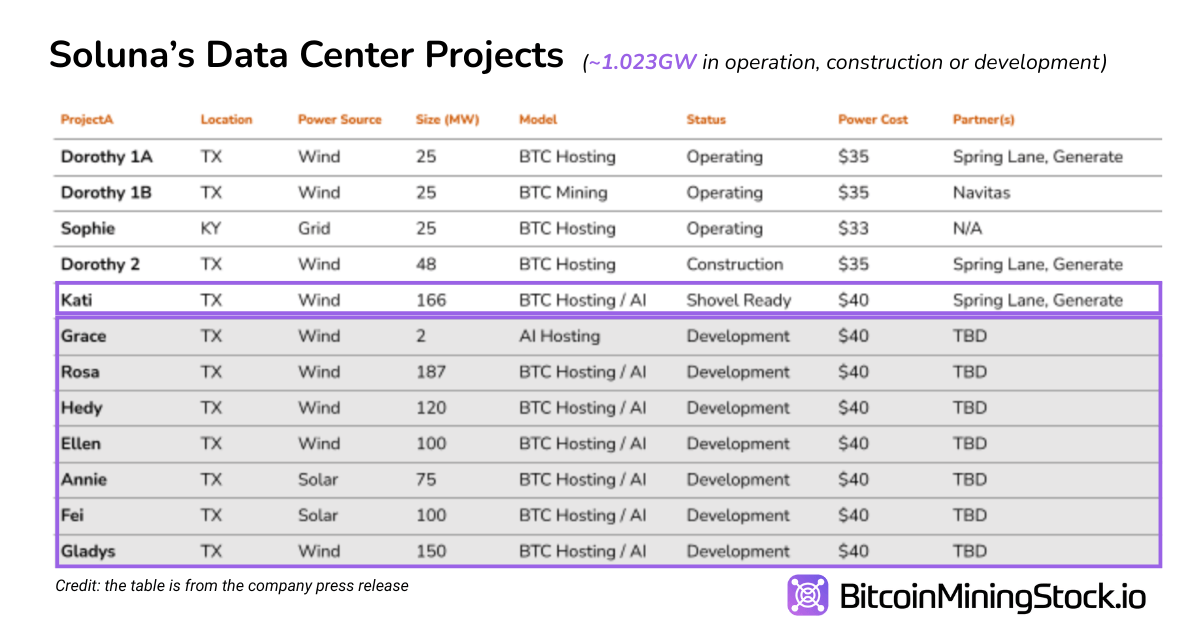

Currently, many modular sites are run or built throughout Texas and the United States, most of which are held in collaboration with renewable generations. As of the second quarter of 2025, Solna claimed a 2.8 GW Total Clean Energy Pipeline1.023 GW subset focuses on development near the mid-term. It places them in the same capacity league as BitFarms (1.2 GW)*, but in terms of market capitalization it was almost 1.5/100 of the latter until recently.

* Despite reporting energy capacity in a similar range, Soluna had an EH/s installation of 3.345 Hashrate As of August 2025 (0.526 EH/S for self-mining only), compared to BitFarms’ 19.5 EH/s.

Here is a breakdown of Soluna’s project portfolio based on public disclosures:

Project Kati is Solna’s biggest site to date It shows a clear move beyond Bitcoin mining and beyond AI and high performance computing (HPC) infrastructure. This site is configured as a two-phase, 166 MW buildout.

construction of For 1 (83 MW) is scheduled to begin in September 2025 and be operated in early 2026. 48 MW is already leased to Galaxy Digital Under the hosting agreement, the remaining 35 MW is reserved for Soluna’s own Bitcoin hosting client.

Project Kati broke the ground (Media Source))

Phase 2, Between 2additional 83 MW is dedicated to supporting AI and high performance computing (HPC) workloads. The expansion, along with other data center build-out plans, positions Soluna as the emerging infrastructure provider for the AI economy.

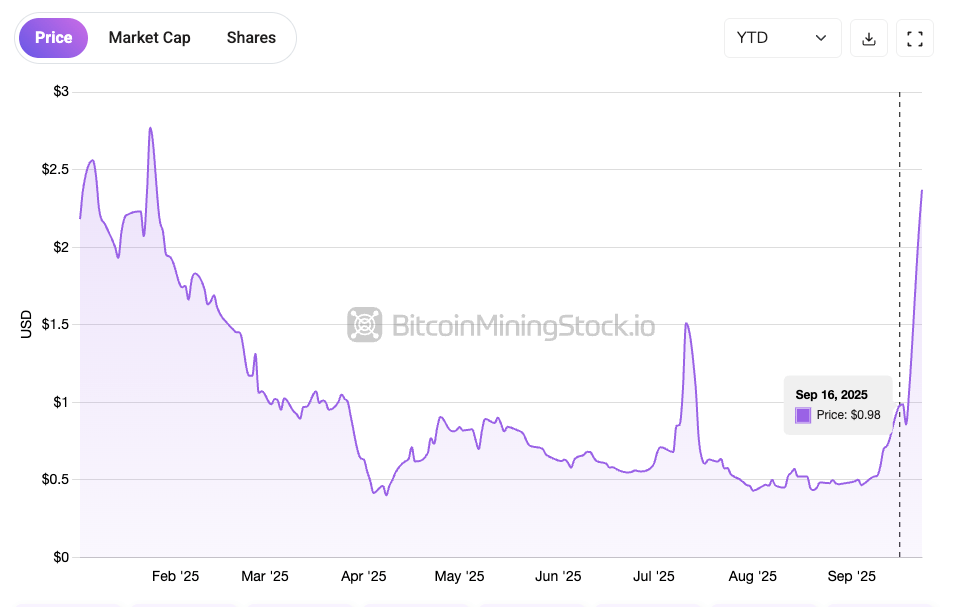

The market seems to be starting to set pricing Following the announcement of Soluna’s HPC/AI pivot, particularly Soluna’s $100 million credit facility.

$SLHN has risen since the $100 million credit facility announced on September 16, 2025

$100 million credit facility: capital costs

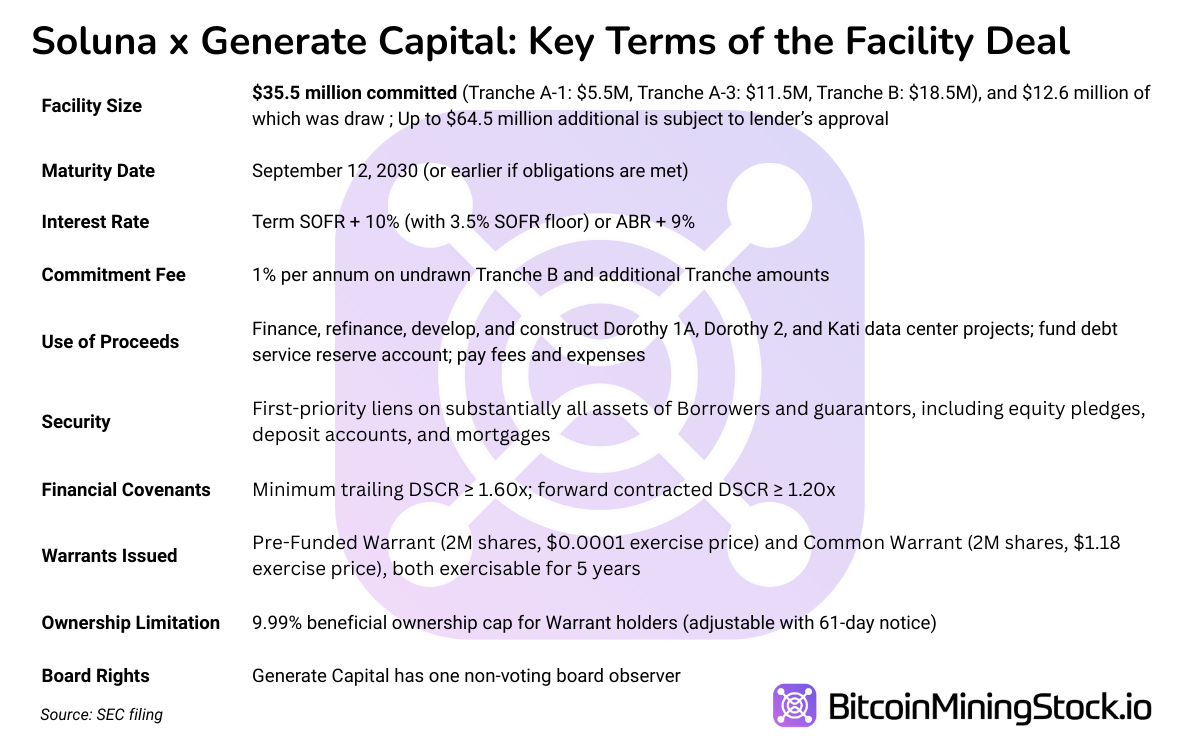

September 2025, on the left We have announced credit features of up to $100 million A lender known for his support of sustainable infrastructure from Generate Capital. For a company with quarterly revenue of $6.15 million and unlimited cash of $9.85 million, the transaction marks a major step in securing long-term project funding. But while the headline figures are substantial, the contract structure is layered with milestones and conditions that shape when and when capital will be available.

All facilities, $35.5 million is currently committed. This includes the initial $12.6 million draw used to refinance Dorothy 1A and Dorothy 2, and an additional $22.9 million to support the ongoing development of Dorothy 2 and the first phase of Project Katy. The remaining $64.5 million has not been committed. This may be made available at Generate’s discretion, depending on future milestones and performance. in short, Heading numbers are ceilings and not guaranteed.

Unlocking the capital is not cheap. For loans interest rate SOFR + 10%, with a minimum SOFR floor of 3.50%, creating a starting interest rate of at least 13.5%. Alternatively, Soluna may choose to rent at an ABR + 9% rate. That rate alone is considered aggressive. In addition, Solna pays a Annual fee of 1% of unused funds for a given trancheIn other words, the clock will begin to record whether the money is unfolding or not. It will be costly to keep it available even if Soluna does not touch the rest of the facility.

Next, there are restrictions. Funds are surrounded by ring fences It can only be used on three specific assets: Dorothy 1A, Dorothy 2 and Project Katy. Similarly, collateral is at the project level. Generate Capital is the first to request initial claims on the stock, assets, cash accounts and real estate of the borrowing entity. However, guarantees are excluded, particularly from Soluna’s parent entities. This setup limits the company’s liability beyond the project and generates a clear execution path related to project performance.

Also included in trading Financial Contracts It is designed to monitor continuous viability. Soluna must maintain coverage rates for subsequent debt services (dscr) at least 1.60x, forward I signed a DSCR at least 1.20 times. These coverage tests are standard for project financing and are intended to ensure that project-level cash flow is sufficient to cover scheduled debts.

In addition to the loan, we also receive generated productions Equity-related incentives In the form of two warrants, a warrant of up to 2 million shares at a strike price of near zero, and a common warrant of an additional 2 million shares of $1.18. Both can be exercised immediately over a five-year period, with ownership rising 9.99% to avoid triggering disclosure thresholds. Such a structure gives the generation Long-term interests In the future of Soluna, dilution risk will also be introduced.

This is a classic case of stock-related infrastructure finance designed for High-risk, high-upside scenario. This structure gives Soluna a key runway to refinance existing assets and fund the construction of flagship buildouts. Meanwhile, we introduce a new layer of cost, monitoring and milestone-based conditions. For companies with limited traditional financing options, transactions are High Leverage Growth Enabler. But it also places the soluna on a tight rope. Execution cannot be negotiated. If Soluna stumbles, the lender will hold both the capital and the control lever.

Final Thoughts

Soluna bull papers are simple. Once management delivers on Kati 1 and successfully moves to High-Margin AI hosting using Kati 2, the company can unleash predictable repeat revenues on a scale not previously seen in history.

Assuming an annual revenue of $1.5 million per MW for AI/HPC workloads, a rough benchmark based on peer disclosures shows that Kati 2 can ultimately generate $124 million at full capacity (83 MW x $1.5M). That’s mostly 20x Soluna’s current quarterly execution rate. For a company with a market capitalization of $100 million, advantage It’s clearly converted.

but The risk of drawbacks It’s equally important. There is little room for error generating capital loan terms. Whether you missed a DSCR contract, construction delays, or poorly performed, it could lead to warrants, loss of assets, or dilutions through warrant exercise or emergency funding.

In effect, Solna was found guilty of her ability to perform.

Best case: Scaling to legitimate HPC infrastructure players with diverse revenue and strategic relevance, following the Iren or Corz path.

The worst case scenario: Tough contracts and high debt costs suffocate the company before the project matures.

Speculations about potential JVs or M&As It can raise investor interest. A recent tweet from the CEO suggested interest from hyperscale miners, power plant owners and infrastructure funds.

At @solunaholdings we are ripe for picking…

Like ripe apples at harvest.

We are selected as the top minor in Hyperscale.

He has been chosen as the owner of the top power plant.

It has been selected as a top infrastructure fund.

A clean computing project that exceeds 1GW…pic.twitter.com/ARN4GYYBPJ

-John Belizaire (@jbelizaitraceo) September 22, 2025

There are no public confirmations of transactions from “Top Hyperscale Miner,” but the foundation is set up for future partnerships with Galaxy Digital generating capital on board as anchor tenant and lender.

Either way, Solna has entered the high stakes phase. Credit facilities buy time, not certainty.

For now, 94% of the spikes reflect investor enthusiasm. What comes next depends on the execution.