Sonic Labs has announced the end of its relationship with WinterMute. The platform is looking for new market makers that can reflect on on-chain activity and Defi’s growth.

Sonic Lab, a former phantom, has announced the end of its relationship with Winter Mute. The platform looks for new market makers that reflect Sonic’s chain activity on record beyond central exchange.

The announcement comes after the Native S-Token price slipped from $0.61 to $0.53 at sales pressure. The Sonic Labs team explained that the sale took place after WinterMute was notified that its five-year relationship with the project was over. One reason for WinterMute’s sale was to cover liquidity loans from Sonic Labs.

24 hours ago I told @wintermute_t that I wouldn’t renew my MM contract. We use WM exclusively for our five years of service.

We are involved with other MM companies that are willing to offer MM++, and they are involved in our Defi Ecosystem and involved in the application…

– Assistant.sonic (@sonicassistant) May 15, 2025

Sales were tracked in WinterMute wallets as the market maker sold the 3m S and moved its holdings to 10m tokens. WinterMute will keep it after sale $5.9 million S based on current prices.

The team’s explanation was met with some degree of skepticism as the exact terms of the token loan were unknown and the need for Wintermute to sell the token and crash the price was unknown.

The Sonic Community speculated that the partnership ended on bad terms, leading to sales pressure. There are also suggestions that WinterMute may need to repurchase the token in order for it to actually return the LOAN to the type. WinterMute does not provide any rationale for depositing tokens into exchange.

The termination of the WinterMute contract is expected to increase the volatility of Native S-Tokens. Assets are primarily traded in vinance and buybit, and market makers often help increase volume and generate demand for their assets.

Sonic cultivates a decentralized ecosystem

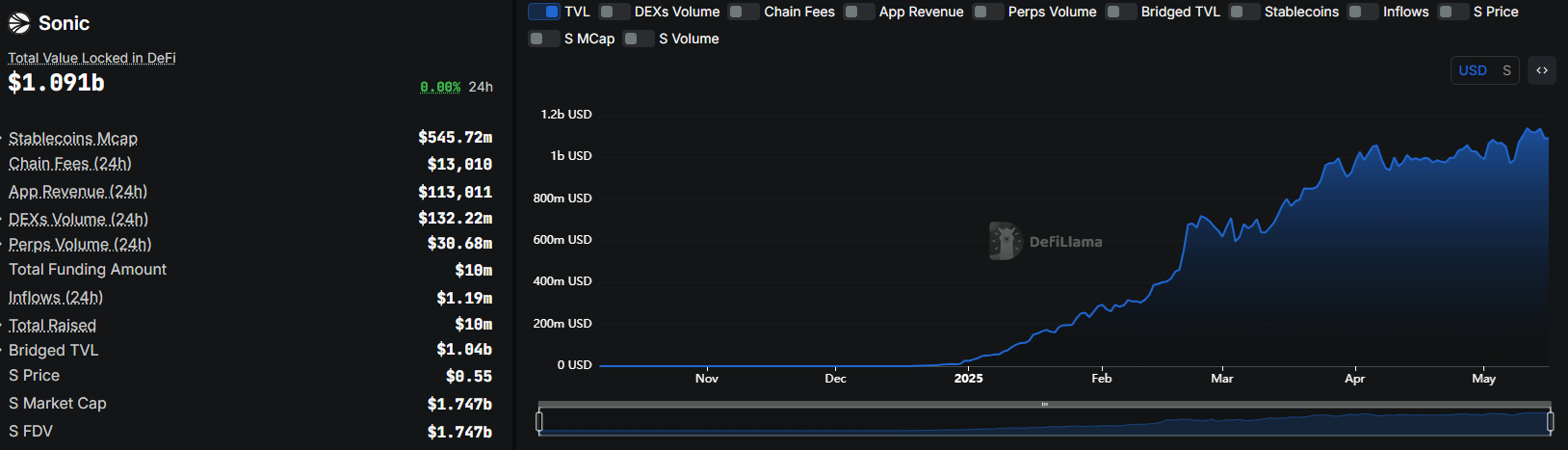

Sonic is recruiting market makers to grow their decentralized ecosystems and support teams, apps, and liquidity events. The chain recently posted a record of locked totals at over $1 billion, making it one of the fastest growing chains in 2025.

The Sonic Ecosystem includes the native version of Aave Lending, the Shadow Dex, and the Pendle Ildo Protocol version. Sonic was primarily sourced from the Ethereum ecosystem, with inflows of $2.3 billion and net inflows of $555 million. Sonic remains connected to the L1 ecosystem with constant bridging and active turnover. The chain also has a small influx from the base and Solana.

Sonic is looking for a market maker that can operate its total locked amounts above $1 million. |Source: Defi Llama

Over the past few months, Sonic has been constantly expanding transactions, active wallets and fees. However, Sonic is still produced for less than $15,000 Daily feeslags behind more established networks.

The chain has over $484 million at Bridged USDC and supports $100 million to $150 million DEX activities. Shadow Exchange carries over $55 million of daily DEX activities and trades some of the Sonic ecosystem’s most notable tokens.

The chain regularly features over 50,000 active users every day, comparable to similar networks. Sonic also holds a large social media community with the aim of building an ecosystem similar to Solana based on cheap transactions and available liquidity.