Spot Ether Exchange-Traded Funds (ETFS) closed a week with a spill after nearly two weeks of significant influx.

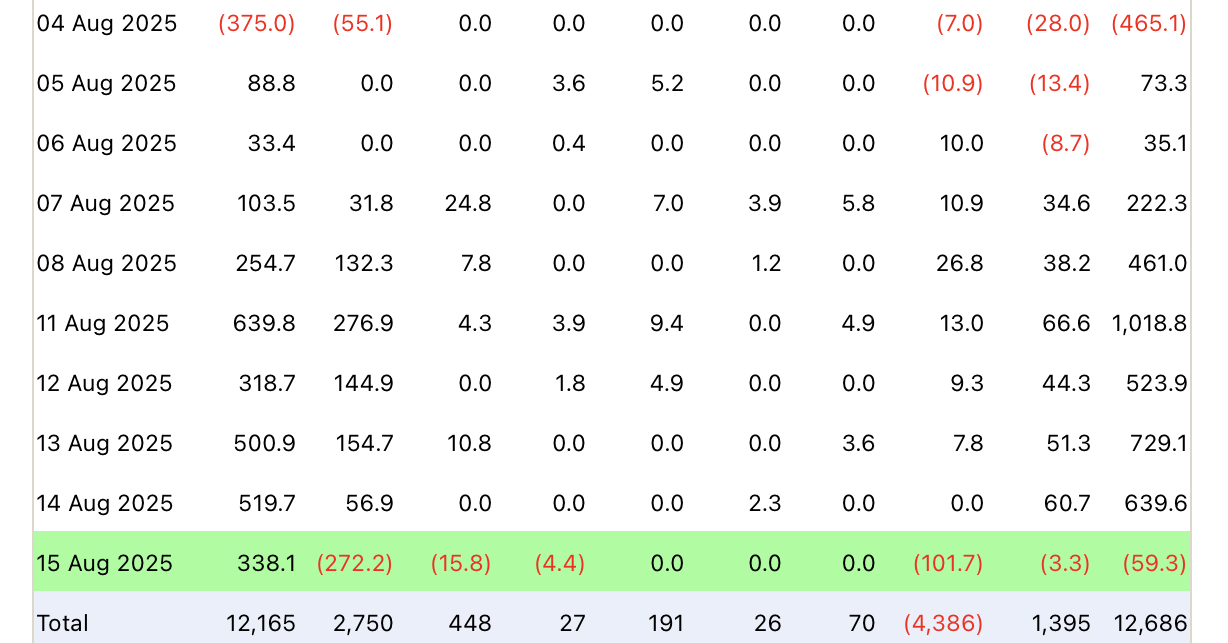

On Friday, US Spot Ether (ETH) ETF saw a $59.3 million spill, ending an eight-day inflow streak that added about $3.7 billion to its products, according to Farside data.

ETFs are key analyst signals for ether prices

According to CoinmarketCap, Ether was only 1.94% shortfall as it reduced it to $4,448 after recovering a record high of $4,878 in 2021 on Thursday.

The end of the eight-day inflow streak is a key indicator of ether traders, and along with the development of Ether Treasury companies, we could look to ETF flows in the coming weeks on whether ether can recover once again at its 2021 highest high.

Since its launch in July 2024, Spot Ether ETF has seen $12.688 billion in total net flow. source: father

Some analysts say sustained ETF influx is important for ether to regain its all-time high.

Nansen analyst Jake Kenneth recently said, “The rally will be held as long as the flow and the story remains strong.”

Crypto Trader Langerius has proposed an ether price tag of $10,000 if consistent weekly inflows continue.

Meanwhile, Crypto Trader Merlijin The Trader said on Thursday, “The ETF influx has just become vertical. This is what institutional FOMO looks like.”

Ether has increased by 29.63% over the past 30 days. sauce: coinmarketcap

However, sentiment platform Santiment said crypto traders have not shown “so much bullish” to the ether on social media like Bitcoin.

Related: Ether Unstaking Queue reaches $3.8 billion: What does ETH price mean?

Cointelegraph recently reported that the Ethereum staking ecosystem has reached a new high, with 877,106 ether currently in line for retreat.

This rise in unsed ETH could mean that massive profit acquisitions may be ongoing, but Defi analyst Ignas said the recent accumulation and purchase strength from the recent Ether Treasury Companies and Spot Ether ETFs have absorbed much of the sales pressure.

magazine: Scotty Pippen says Michael Saylor warned him about Satoshi’s chatter