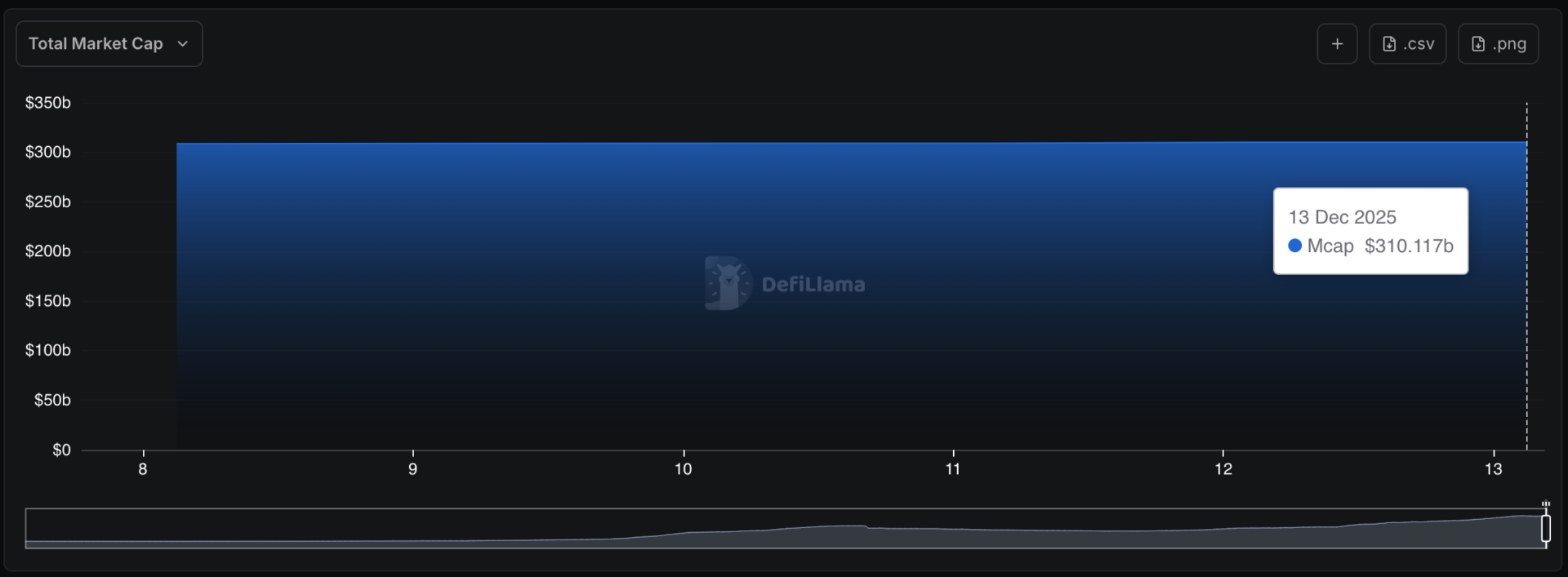

The stablecoin market hit a new record on Saturday, December 13th with a market capitalization of $310.117 billion.

Based on data obtained from DeFiLlama, the market capitalization of stable cryptocurrencies hovers around $309.911 billion at the time of writing.

Tether’s USDT remains the largest stablecoin with a market capitalization of $186.242 billion and 60.10% control. Circle’s USDC ranks second with a market capitalization of $78.315 billion, giving it approximately 25% control.

Stablecoin market capitalization. Source: Defilama.

Stablecoin market continues to grow rapidly

The stablecoin sector is growing significantly. Over the past 12 months, stablecoins have grown 52.1% from $203.728 billion to $309.911 billion.

During the October market crash, stablecoins maintained their growth trend. In November 2024, the stablecoin market capitalization fell to $302,837 million, but rebounded yesterday to hit a new high of $310,117 million.

Over the past seven days, Tether’s USDT has appreciated by 0.32%, adding $593.34 million to its circulation. The newly minted coin was added to multiple networks including Tron, Solana, Arbitrum, Aptos, and Polygon.

Circle USDC rose 0.71% and added $555.56 million worth of coins to Ethereum, Solana, HyperLiquid, Base, and BSC. Sky’s USDS, PayPal’s PYUSD, and World Liberty Financial’s USD1 minted new coins within the same period.

Outside of the top 10 coins, Tron’s USDD rose by 23.46% and crvUSD by 28.92%. Overall, the stablecoin sector rose 0.57% for a total increase of $1.79 billion.

But not all stablecoins were green. BlackRock BUIDL fell 13.24% with a market cap of $1.321 billion.

Stablecoins with high yields continue to fall

Ethena’s stablecoin remained in the red. USDe fell by 2.98% this week, while USDtb recorded a hefty decline of 18.99%. USDe has a market capitalization of $6.525 billion, while USDtb has a market capitalization of approximately $850.8 million.

Most stablecoins with yields, like Ethena’s USDe, have become less attractive to investors, especially after the October crypto crash. As reported by Cryptopolitan, this negative trend for coins started after USDe lost its peg to the US dollar.

According to data obtained from StableWatch, the market capitalization of high-yielding stablecoins has declined by 1.9% over the past 30 days. The amount of redemptions exceeded the amount of new coins minted. Over the past week, alUSD is down 80.5%, smsUSD is down 68.1%, and sBOLD is down 13.6%.

At the time of writing, there is approximately $19.86 billion in the high-yield stablecoin sector across 64 coins. The growth of the stablecoin market sector is primarily driven by payment stablecoins, i.e. non-yielding stablecoins.

According to an exclusive report published by Fortune, YouTube has started allowing content creators to receive payments in PayPal USD (PYUSD).

Mae Zabane, head of cryptocurrencies at PayPal, confirmed the news to Fortune magazine. He added that the feature is currently live, but only available to US-based content creators. A Google spokesperson also confirmed the addition of this feature.

Google has experimented with stablecoins in the past. An executive at the tech giant said Google received payments in PYUSD from two customers.

PayPal is leveraging its status as a fintech giant to popularize PYUSD and drive further adoption. A few months ago, PayPal introduced an option that allows recipients to receive payments in PYUSD.

PayPal USD has gained 13.33% in the past 30 days and has a market cap of $3.863 billion. The stablecoin is the sixth largest coin among other stablecoins specialized in payments.