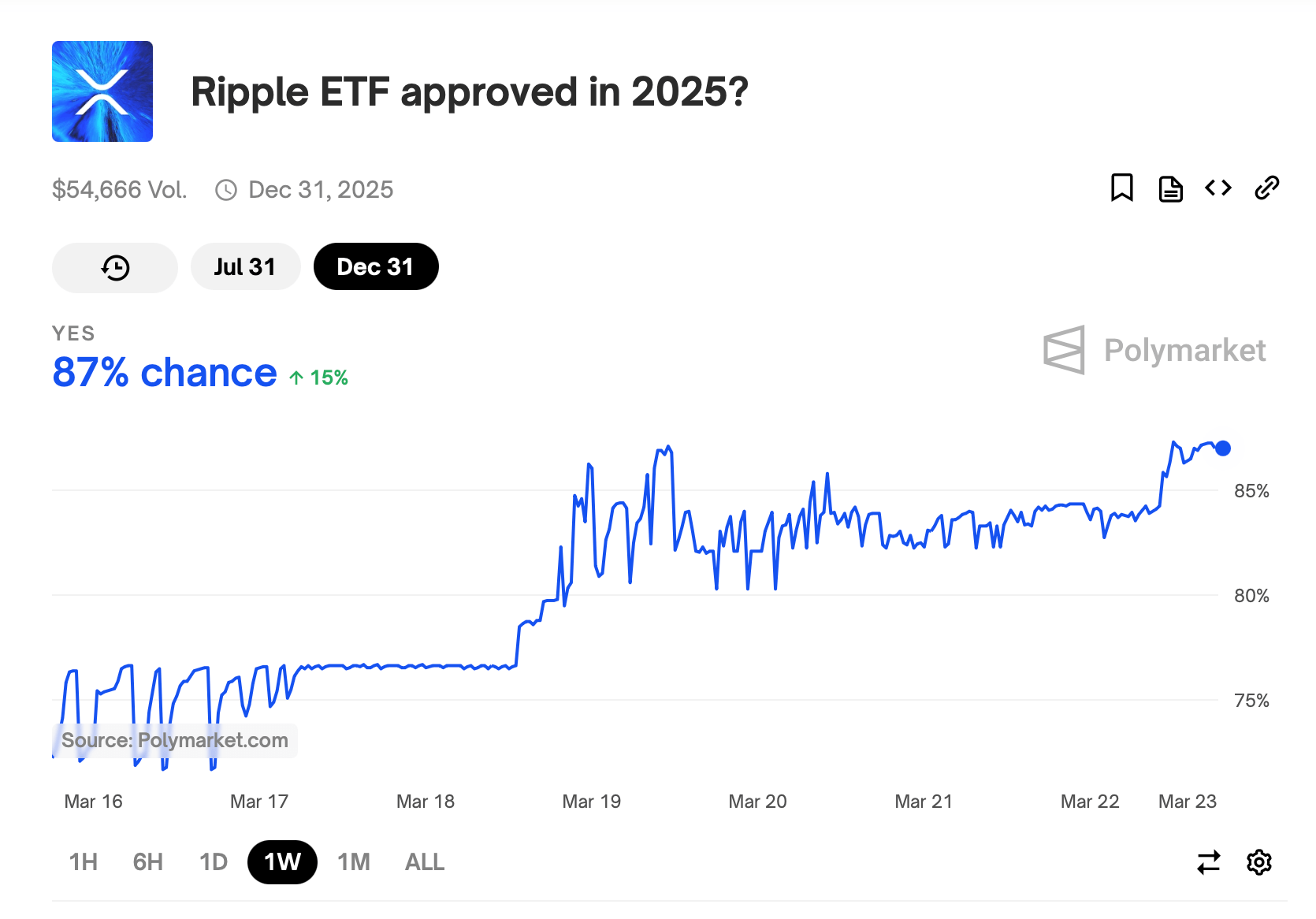

The multi-tier bet, which has accumulated a trading volume of $54,666, suggests that the Spot XRP Exchange-Traded Fund (ETF) is 87% likely to secure regulatory approval by 2025.

XRP ETF fanatics hit 87% confidence: Poly market trader bets big on approval in 2025

In January 2024, the Securities and Exchange Commission (SEC) cleared the path of multiple spot Bitcoin (BTC) exchange trading funds (ETFs), followed by the Ethereum (ETH) ETF in July. These approvals mark a key moment of accessibility for digital assets and are consistent with broader changes in regulatory scrutiny.

Since Donald Trump envisioned the 47th presidency, a wave of alternative cryptocurrency ETF registrations have flooded the SEC pipeline, including XRP, LTC, HBAR, SOL, ADA, MOVE, APT, DOT and SUI. Currently, Polymet’s bets reflect the 87% chance that Spot XRP Exchange Sales Fund (ETF) will become greenlight by 2025, approaching the highest level of trust in bets since its inception.

This optimism spiked after it was revealed that the SEC was dismissing a lawsuit against Ripple Labs.

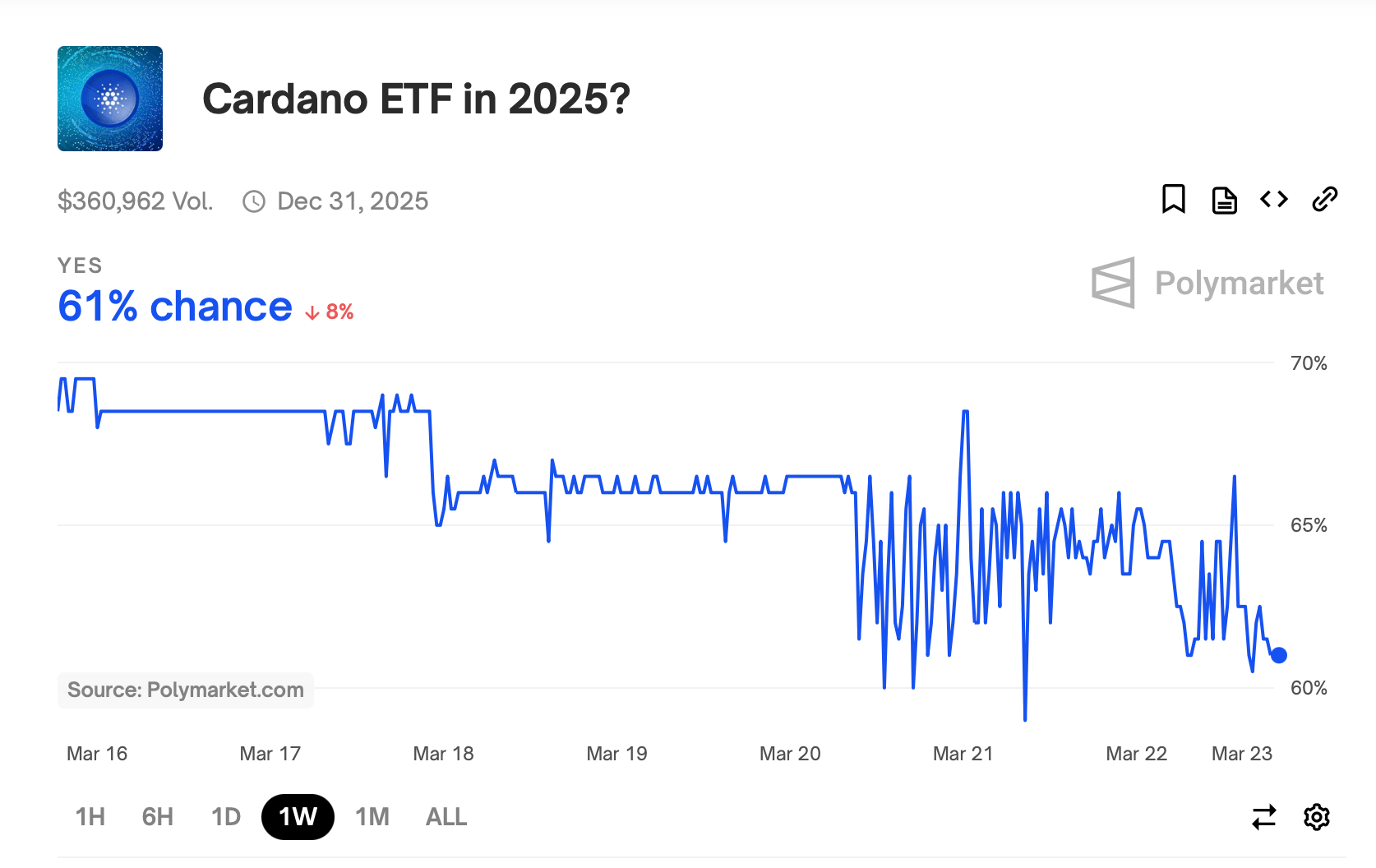

Apart from that, Polymate BET, which tracks potential Cardano (ADA) ETF approvals in 2025, shows a 61% chance as of March 23rd.

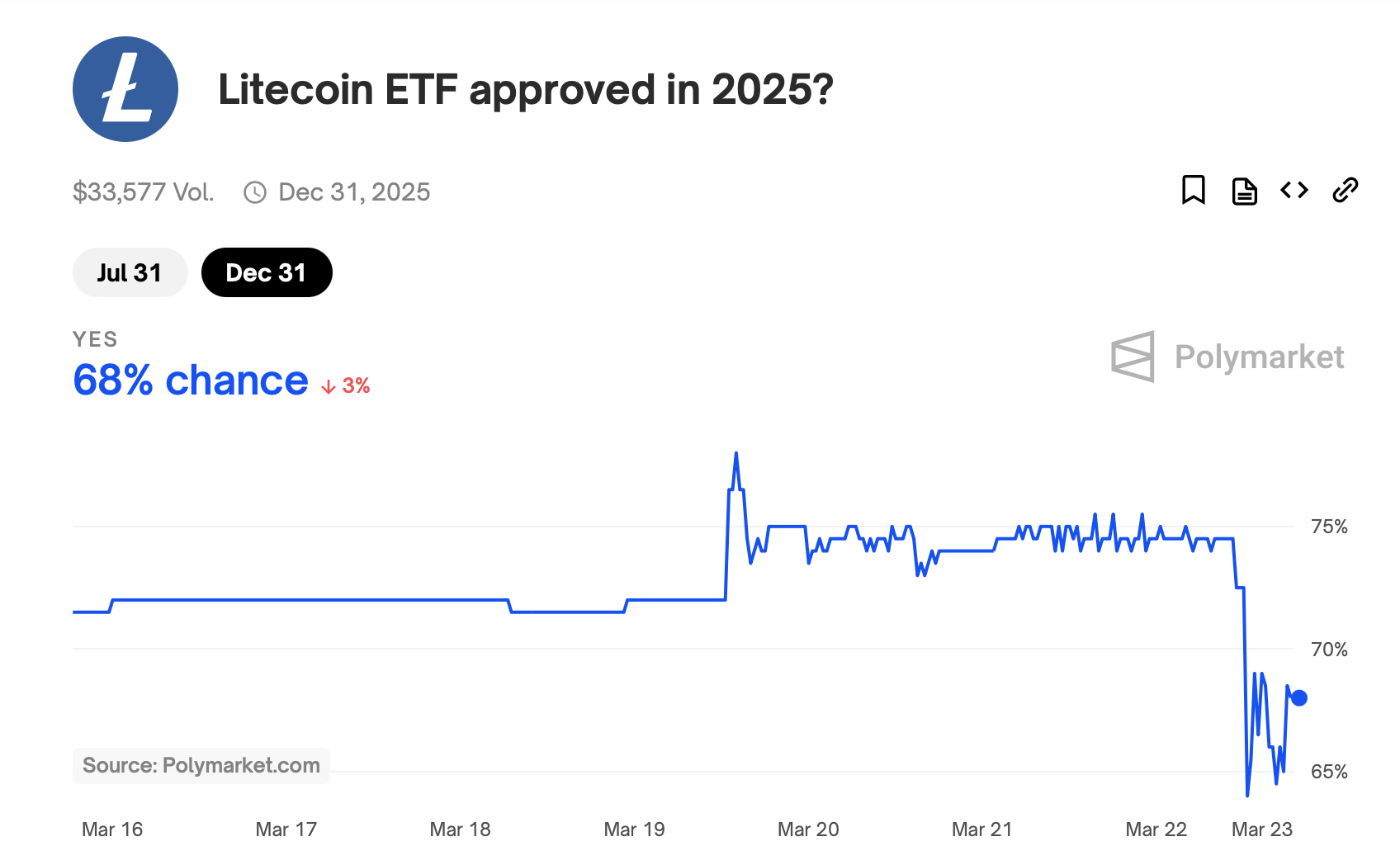

Litecoin (LTC) is also on the platform, with 33,577 trade bets reflecting the 68% chance of the LTC ETF approval on March 23rd. Companies such as Coinshare, Canary Capital and Grayscale are competing to ensure regulatory clearance for LTC products.

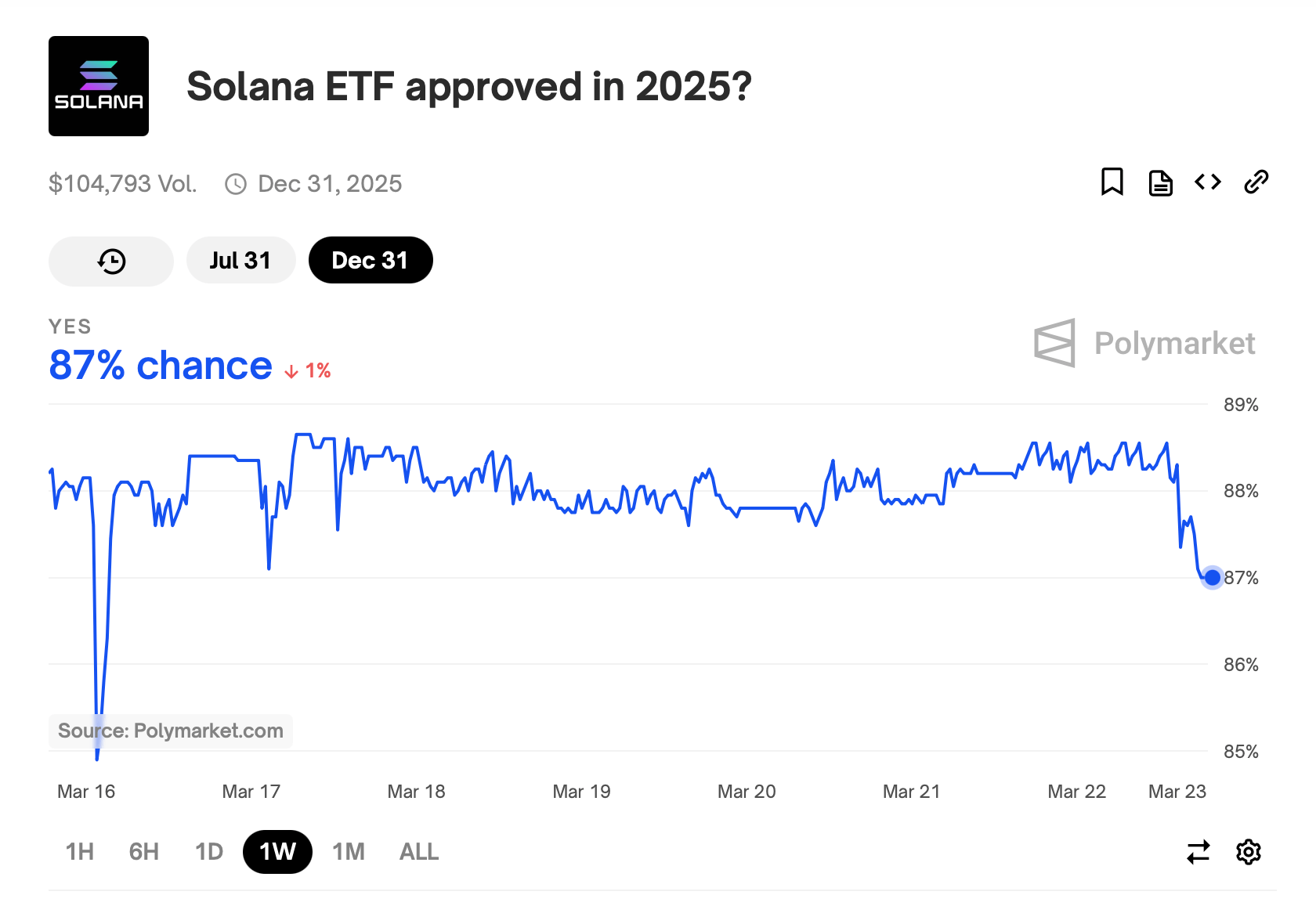

Meanwhile, the Solana (Sol) ETF proposal, backed by a $104,793 polymer stake, holds an 87% chance of approval, according to bettors. The roster of financial companies such as Vaneck, Grayscale, 21Shares, Bitise, Franklin Templeton and Canary are about to debut Sol Etf.

In particular, the forecast market does not host active bets for DOT, HBAR, MOVE, APT, or SUI ETFs. The growing interest in Crypto ETFs highlights a pivotal shift towards mainstream adoption due to regulatory clarity and institutional support.