of cryptocurrency market entered a volatile “deleveraging” phase in early 2026. After a tumultuous January, $Ethereum coin The company’s valuation plummeted after a massive liquidation cascade wiped out more than $1.9 billion. $ETH Long positions across major derivatives exchanges.

As of February 7, 2026, ethereum price The stock is hovering around $1,950, trying to stabilize after falling rapidly from its year-to-date high of $3,300. This analysis examines Ethereum’s technical “trapdoors” and recovery zones as the market weathers this 2026 crypto crash.

Can Ethereum recover in 2026?

Yes, recovery is technically possible, but the path is currently blocked by significant overhead resistance. Technical data suggests that Ethereum is entering the next phase. Short to medium term integration phase. As a long-term goal, ethereum coin We remain bullish due to inflows from institutional ETFs, but the immediate outlook remains neutral to bearish until the $2,300 resistance level turns into support.

liquidation cascade

in the current situation Virtual currency crash 2026a “liquidation cascade” occurs when the price drops to a level that forces leveraged traders to automatically sell their positions. This creates a feedback loop of selling pressure. This is exactly what we observed. $ETH Chart between $2,150 and $1,820.

Ethereum price chart analysis: $1,800 floor

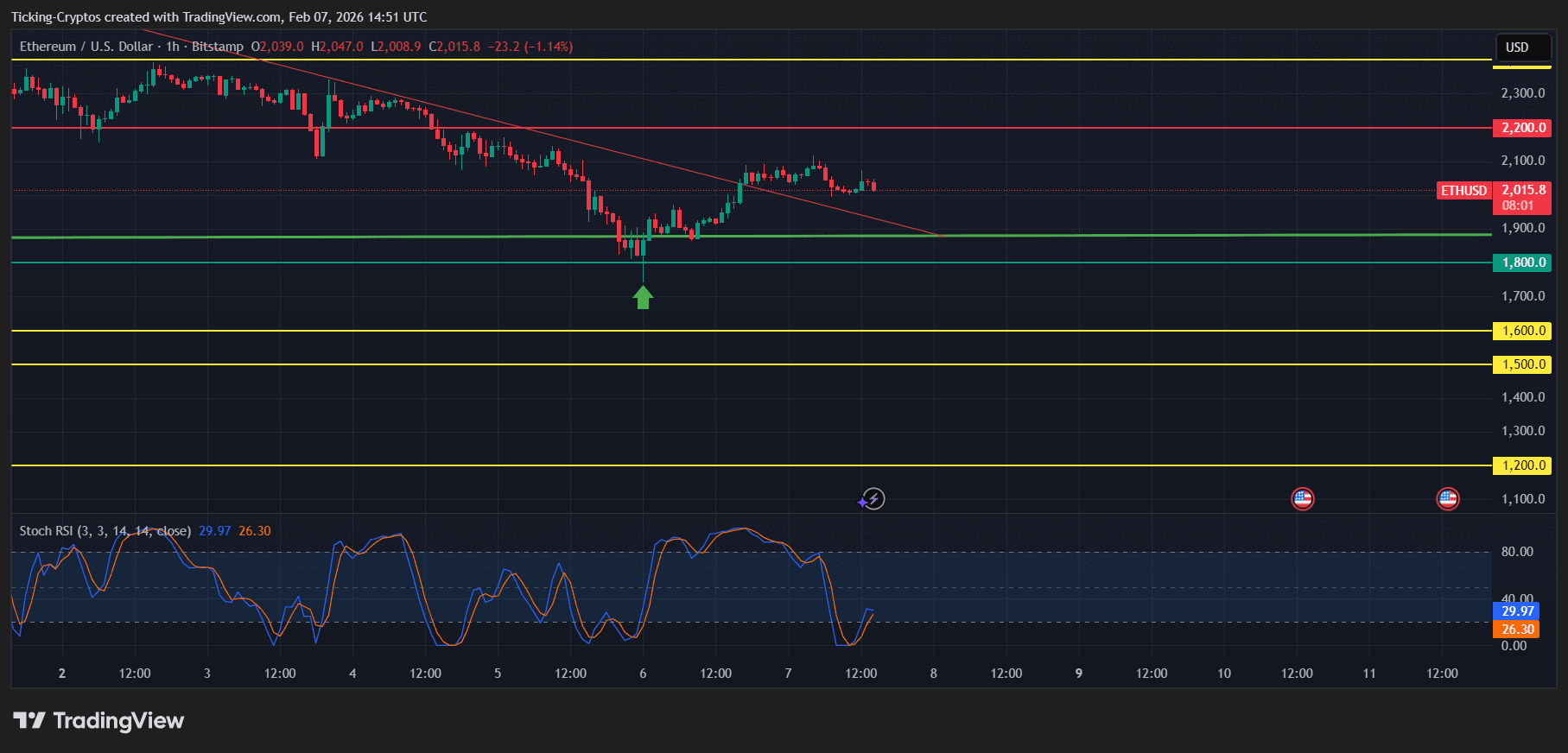

The chart provided shows a sharp “V-shaped” attempt at $1,823. This level is very important as it coincides with the mid-2025 accumulation zone and the 0.618 Fibonacci retracement level.

$ETH/USD 1H – TradingView

Main technical findings:

- Liquidation gap: The rapid fall from $2,400 to $1,800 created a “liquidity vacuum.” Price movements tend to “fill in” these gaps with sideways movements before the definitive trend resumes.

- RSI oversold bounce: The 14-day Relative Strength Index (RSI) reached 28 on February 5th, indicating oversold conditions that typically precede a relief rally.

- Volume profile: High sales volumes during a selloff signal a “climax” event and often mark the bottom for the area.

Ethereum Price Prediction 2026: Lower Target and Bearish Case

If the $1,800 support fails to hold on a weekly closing price basis; ethereum coin Move on to deeper modifications. Macroeconomic headwinds continue to weigh on risk assets around the world.

Future sub-goals:

- $1,600 (Primary Support): This represents the bottom of a long-term uptrend channel. Touching here will correct it by 50% from the recent peak.

- $1,450 (macro demand): A historic turning point in early 2024 that served as the starting point for the last bull market.

- $1,200 (surrender target): A “worst case” scenario if broader market contagion continues.

The future of Ethereum: the “boring” middle ground

our main Ethereum price prediction For the next 4-8 weeks, $1,850 and $2,250.

- resistance: The $2,400-$2,600 zone is currently saturated with “trapped” buyers who may sell in response to the bailout, creating a ceiling.

- support: The bulk buy orders are between $1,750 and $1,850, forming a temporary bottom.

According to external analysis from major financial institutions such as Reuters, institutional interest in Ethereum remains strong despite the price drop, which could provide the liquidity needed to end the selloff.

conclusion

Ethereum is currently at a crossroads. on the other hand, Cryptocurrency crash in 2026 Although it was painful, technical defense at the $1,800 level provides a foundation for stability. Investors should watch for a breakout above $2,300 to confirm a trend reversal.

can be tracked live $ETH price here Check whether the support levels mentioned in this analysis are tested in real time.