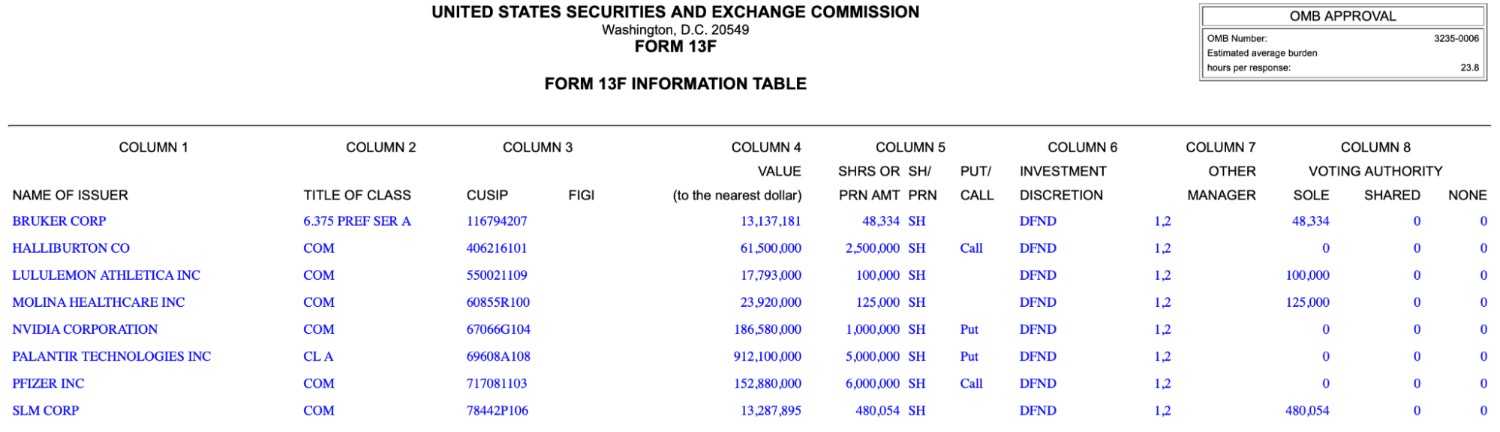

Scion Asset Management, the hedge fund founded by famed “Big Short” investor Michael Barry, published a new regulatory 13F filing on November 3, revealing several changes to its portfolio.

Most notably, Mr. Berry purchased 5 million put options on Palantir (NASDAQ: PLTR) and 1 million put options on Nvidia (NASDAQ: NVDA), valuing the former position at approximately $912 million and the latter position at approximately $186 million. In total, 80% of the manager’s $1.38 billion portfolio is allocated to the two positions.

Scion also made some notable long-side adjustments. Namely, it added 50,000 shares of Lululemon (NASDAQ: LULU) and initiated the acquisition of 125,000 shares of Molina Healthcare (NYSE: MOH), valued at $17.8 million and $23.9 million, respectively.

Similarly, the firm opened a 480,000-share position in SLM (NASDAQ: SLM) for $13.2 million, bought 2.5 million Halliburton (NYSE: HAL) call options worth approximately $61 million, and bought 6 million Pfizer (NYSE: PFE) call options for over $152 million.

Meanwhile, Barry Full exited positions in Estée Lauder (Nyse: El), Regener Pharmaceuticals (NASDAQ: Regn), Mercadribble (NASDAQ: Meli) and United Dies Group (Nyse: Unh).

Michael Barry attacks AI

In addition to this revelation, Burley appeared to criticize X for those passionate about the artificial intelligence (AI) market.

“These are not the charts you are looking for. You can continue doing your job.” the investor wrote.

These are not the graphs you are looking for.

You can work on your work. pic.twitter.com/ICldNUp2OI— Cassandra Unchained (@michaeljburry) November 3, 2025

The attached graph compares historical cloud growth from 2018 to 2022 with today’s environment for Alphabet (NASDAQ: GOOGL), Amazon (NASDAQ: AMZN), and Microsoft (NASDAQ: MSFT).

Other graphics highlight partnerships between Nvidia, OpenAI and other tech giants, while also suggesting that current capital spending in the sector reflects levels not seen since the dot-com bubble.

Collectively, the filings and cryptic social media posts suggest that Barry believes AI trading may be heating up.

This bearish stance is especially noteworthy as it coincides with Palantir’s strong third-quarter earnings announcement on November 3rd. At the time, software giant Palantir reported revenue of $1.18 billion, up 63% year over year.

Disclaimer: The featured image in this article is for illustrative purposes only and may not accurately reflect the actual appearance of the person depicted.