Bitcoin continues to hover within the integration phase after a strong rebound from the $107,000 zone. Signs of bullish momentum are emerging, but the next move will depend heavily on whether prices can break through nearby liquidity levels or face rejection and renew and pull back accumulation.

Technical Analysis

By Shayan

Daily Charts

In the daily time frame, BTC trades within a well-defined range between $107,000 support and $123,000 resistance. The recent influx of buyers at the lower boundary has encouraged a sharp rebound, allowing assets to regain a 100-day moving average and move forward towards the high range.

This structure reflects emerging demand as participants advocate for key support. The decisive trigger is currently at the $123,000 limit. A breakout above this level not only marks a new all-time high, but also confirms bullish continuity for a wider trend.

4-hour chart

Zooming into the four-hour chart, Bitcoin approached the $117K Swing High, where the liquidity of the prominent buy-side is placed just above. The bullish structure remains intact, but it cannot rule out short pullbacks to the $110.7K-113.1K decision point demand zone.

The region has previously attracted strong shopping interests, and successful retests will strengthen bullish cases. Once the buyer defends this zone and regains momentum, the fluidity above the swing high can act as a magnet, facilitating continuous movement to a higher level.

On-Chain Analysis

By Shayan

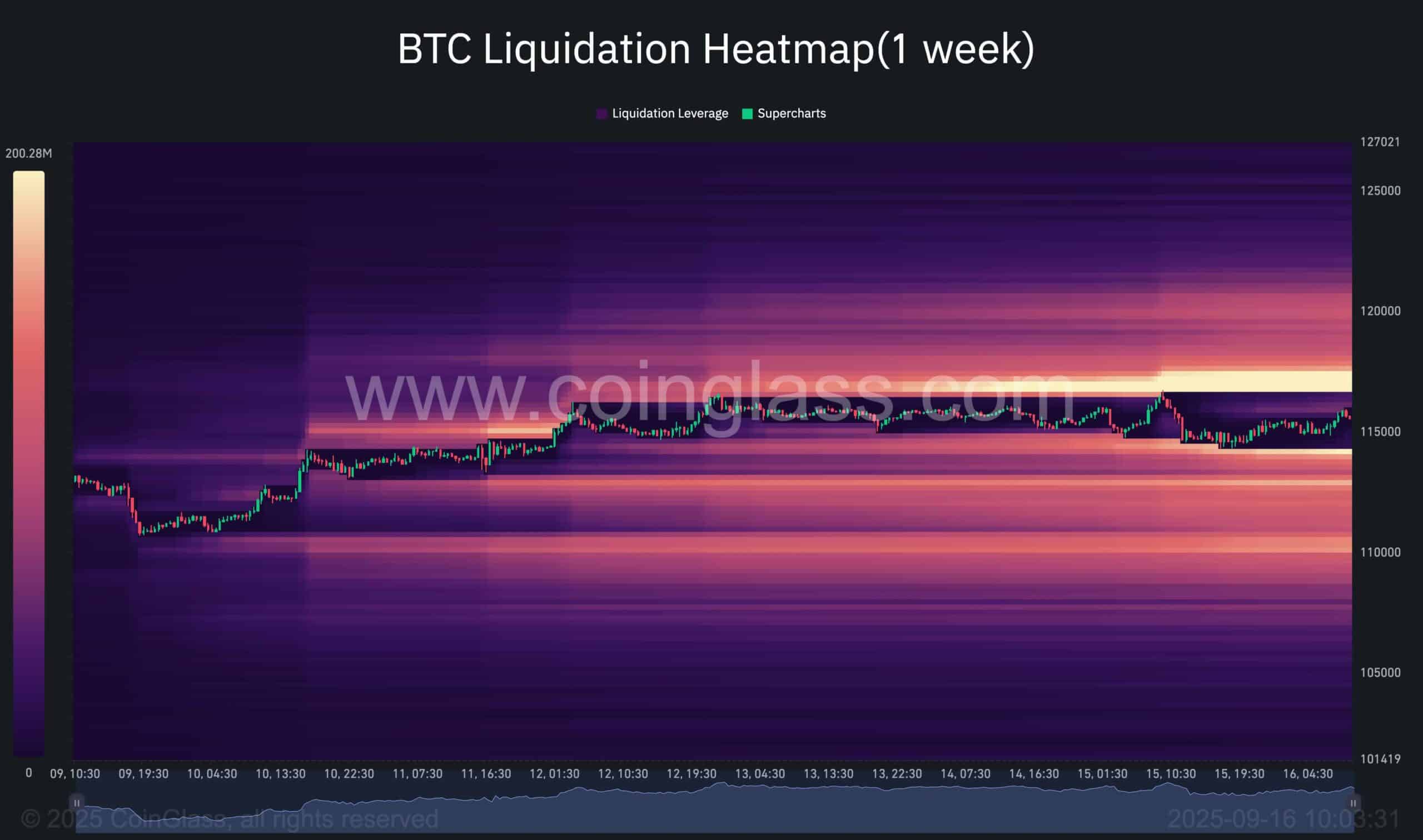

The One-Week Bitcoin Liquidation Heatmap highlights a dense cluster of liquidations just above the recent swing high, matching the liquidity described in the 4-hour chart.

Markets often accelerate to such zones, such as suspension orders and forced liquidation. A clean push on the swing high triggers this cascade, forcing the cover on the shorts and increasing the price.

This reinforces the outlined scenario. Short pullbacks to demand are still possible, but the path of minimal resistance is increasingly referring to fluidity absorption above swing highs.