ETH Strategy, a Defi protocol that mimics Comporate Treasury Operations On-Chain, is currently deploying ETH in a yield position through a partnership with EtherFi, a non-biological liquid staking protocol.

According to a blog announcement on August 18th, assignments to partners like Etherfi “aimed at generating sectarian returns for sustainable ETH as part of the ETH strategic financial programme.” The user gets a chain receipt token for each position. This serves as a live verifiable “support proof,” the ETH strategy explained.

The ETH strategy, which has over 11,000 ETHs in the Treasury, states that the integration is “designed to sit alongside other defi venues when deploying additional partners, and is designed to diversify the source of yield while maintaining liquidity and management.”

In practice, this means that you can acquire returns through lending, staking or other yield mechanisms and assign ETH to multiple protocols without locking down user liquidity.

Staking yield

In an X post on August 18th, Ether.fi said the ETH strategy “will deploy a significant portion of its ETH holdings to Weeth.”

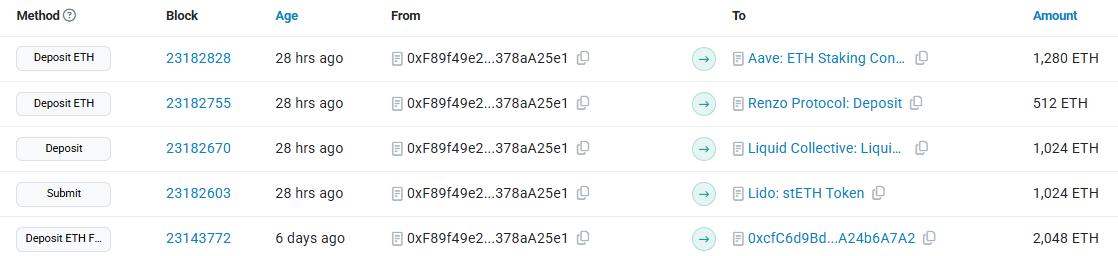

Although the exact amount has not been revealed, on-chain data shows that the ETH strategy has so far been allocated to Weeth at 2,048 ETH, with small deposits assigned to Lido, Liquid Collective, Renzo and Aave.

ETH Strategy is not a company with traditional off-chain balance sheets. This is a set of smart contracts run on Ethereum, which autonomously manages the Treasury’s location. ETH Strategy states in its official documentation that “two audits have been completed” but adds that it will be “published later” without naming the auditor or providing a timeline.

The ETH strategy did not respond to Defiant’s request for comment.

The protocol’s native token struts are designed to provide leveraged exposure to ETH without the typical liquidation risk of borrowing. Users will glue ETH or STABLECOINS to receive a convertible note consisting of Furnibble On Chain Debt Token (CDT) and NFT Call Options on STRAT.

The holder can sell CDTs for Stablecoins, keeping the NFTs converted to struts later.

The protocol gets its option premium and Strat is only minted when someone exercises an NFT option.

Strut Chart

However, its structure does not rule out market risk. Documents for the project specifically warn that a long-term ETH recession could “have inadequate value for the Treasury to repay debts on expiration date.”

As of press time, Strat has dropped by about 13.5% since its launch on August 13th, compared to about 9% of ETH per Coingecko data.