According to the on -chain data, the Etherrium supply of the exchange has plummeted to the newest lows as investors continue to withdraw ETH.

Ether Leeum supply to the exchange has recently continued to decline.

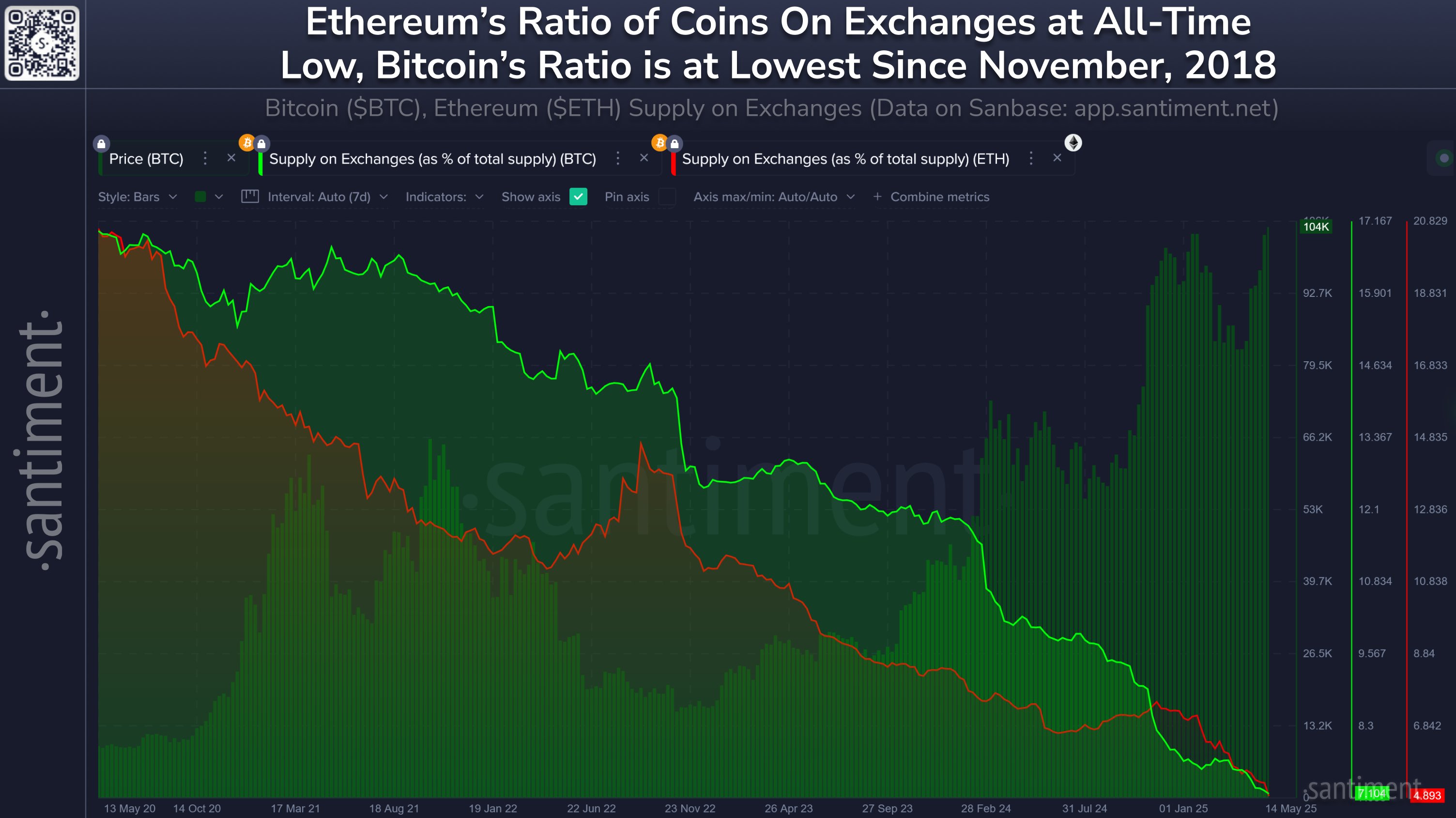

Santiment, a chain analysis company from X’s new post, discussed the latest trends in Ethereum exchange. As the name suggests, “Exchange Supply” indicates the image indicator of the total ETH supply sitting on a wallet attached to the centralized exchange.

If the value of this metric increases, it means that the investor deposits a pure number of tokens to this platform. One of the main reasons why the holder can transfer coins to the exchange is that this kind of trend for the purpose of sales can be weak in the price of coins.

On the other hand, when the indicator goes down, the supply means that the supply is leaving. In general, investors withdraw their coins into their early wallets when they try to keep coins in the long run, so this trend can be optimistic for cryptocurrency.

Now, the chart shared by the analysts has a chart that shows the Etherum exchange supply trend over the last few years.

The value of the metric appears to have been following a downward trajectory for a while now | Source: Santiment on X

As shown in the graph above, the supply of Etherrium on the exchange has been in a long -term decline, but there was a temporary deviation period.

One of these steps came at the end of the bull at the end of 2024.

But for months after the peak, the indicator returns to the downward trajectory and suggests that the holder resumed the accumulation. Today, this metric is the lowest value recorded at 4.9%.

On the same chart, Santiments also attached data to supply to Bitcoin exchange. The biggest cryptocurrency has been a net leak trend for the last few years, and unlike ETH, there has been no remarkable deviation.

In the last five years, investors have withdrew 1.7 million BTC from the exchange. This reduction has increased the value of the lowest meter method to 7.1%since November 2018. During the same period, ETH holders pulled out 15.3 million tokens from their assets from this platform.

It is important to keep in mind that the exchange played a central role in the market a few years ago, but it is no longer true. The emergence of the EXCHANGE-Traded Funds (ETF) means that there is another major gateway to this sector, so exchange leakage may no longer affect the previous.

ETH price

At the time of writing, Ether Leeum is about $ 2,500 more than 2% last week.

Looks like the price of the coin hasn't moved much recently | Source: ETHUSDT on TradingView

DALL-E, Santiment.net’s main image, TradingView.com chart

Editorial process focuses on providing thorough research, accurate and prejudice content. We support the strict sourcing standard and each page is diligent in the top technology experts and the seasoned editor’s team. This process ensures the integrity, relevance and value of the reader’s content.