Prices for Ethereum are approaching the much-anticipated $4,000 mark, but the rally appears to have reached a temporary halt.

The market shows signs of saturation, but Ethereum is far from the end with an upward movement. Recent integrations are probably short-term pauses before another leg goes up.

Ethereum shows signs of a meeting

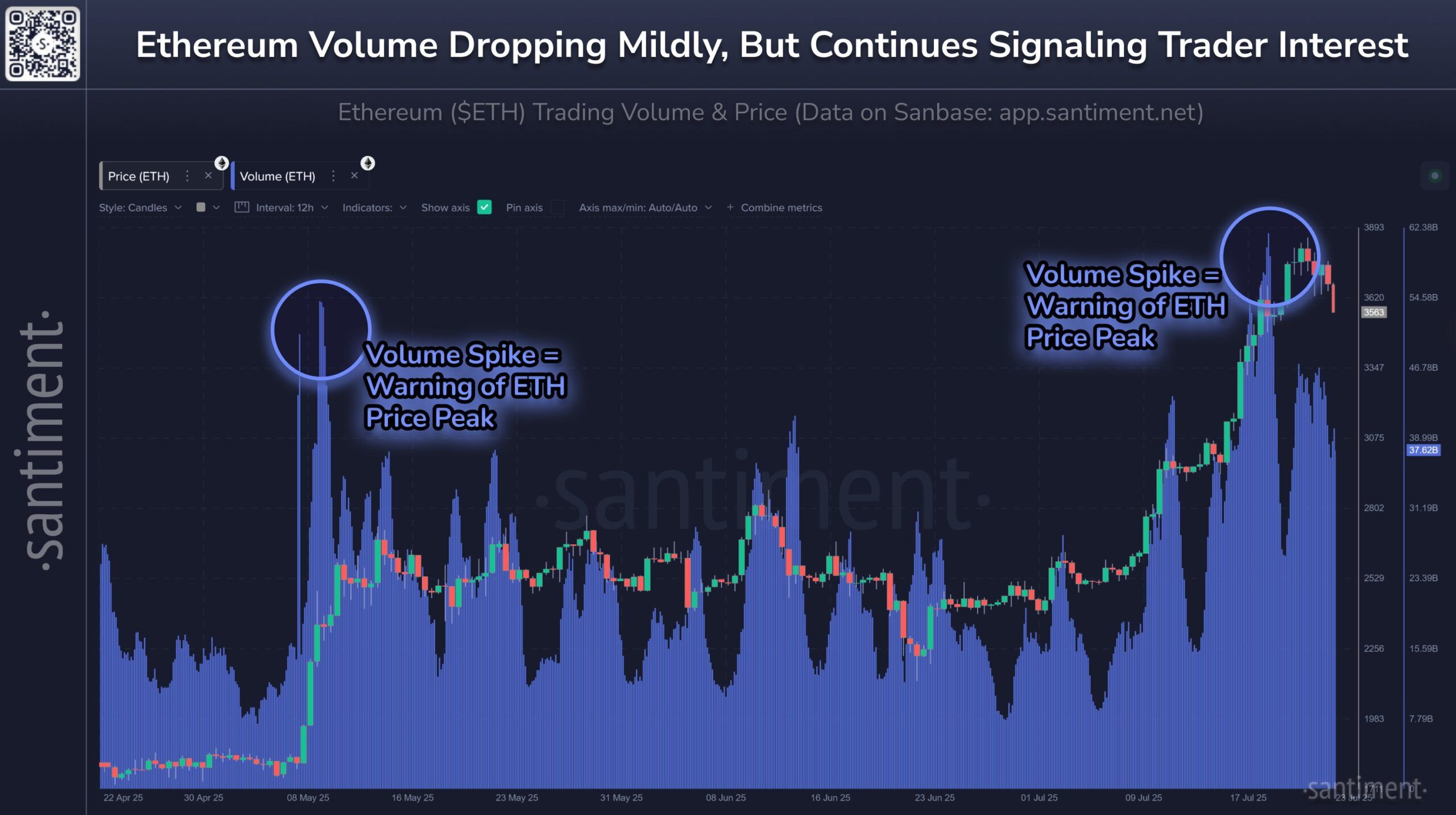

Ethereum’s trading volume has increased significantly, signaling that retail investors are showing renewed interest. Ethereum’s price ratio to Bitcoin fell nearly 6% this week, but the surge in trading volume reflects a pattern seen in May this year. Such spikes often preceded the local top, but this time it may be different.

If both trading and social volume decline for the rest of the week, this could indicate that the market is preparing for another bullish surge. Irritability and profitable behavior from retail investors may set the stage for the next upward wave.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s daily crypto newsletter.

Ethereum volume and price. Source: Santiment

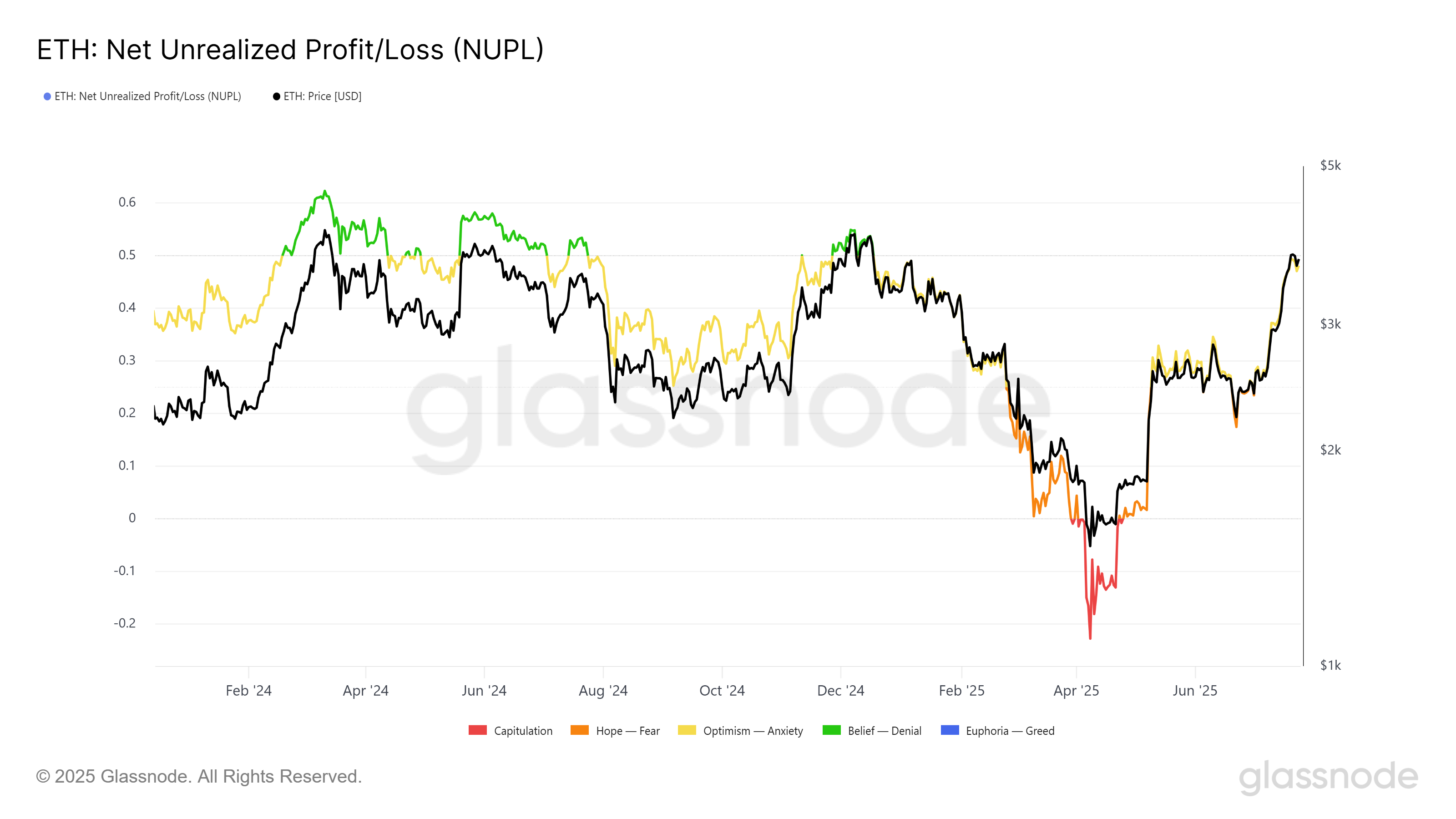

Looking at the broader technical indicators, NUPL (Net Unrealized Profits/Losses) suggests that Ethereum is ready for a critical gathering. The NUPL indicator was a historically paused with an uptrend when the threshold of 0.5 was reached, followed by a sharp rally.

Ethereum is currently approaching this threshold, marking the beginning of a strong upward price action in the past. As NUPL indicators continue to rise, they provide a strong historical precedent for Ethereum’s next price rally.

Ethereum Nupl. Source: GlassNode

ETH prices are on the waters

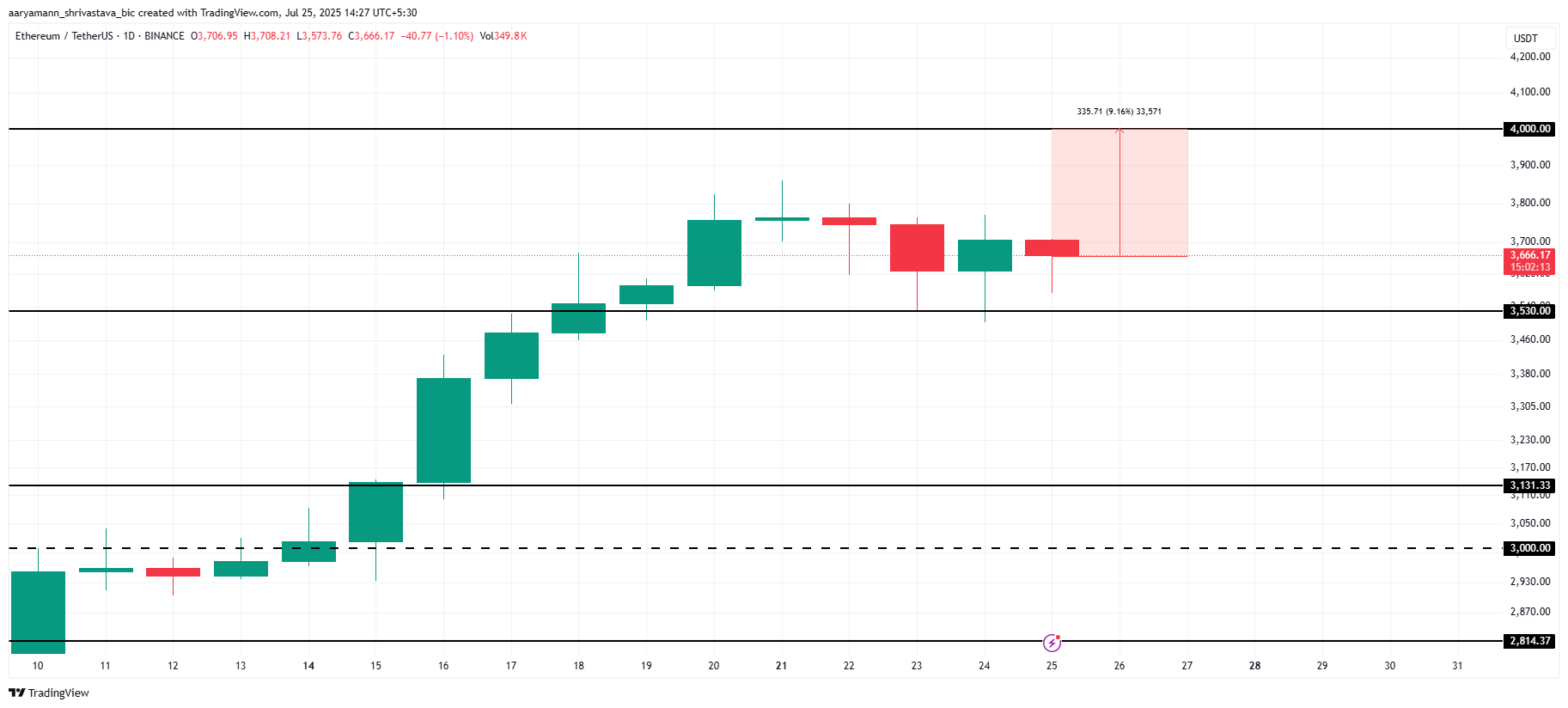

Ethereum is currently trading at $3,666, just 9% off the $4,000 resistance that many investors have been waiting for for the past seven months. Altcoin is expected to continue its upward momentum despite recent integrations and could soon break the $4,000 mark.

The continued bullish trend is supported by strong market sentiment and technical indicators. As long as Ethereum exceeds its main support level, the price could skyrocket to $4,000.

If Ethereum can maintain its momentum, the $4,000 violation could serve as a catalyst for further profits.

ETH price analysis. Source: TradingView

However, in the event of unexpected sales pressure, Ethereum prices could fall below the $3,530 support level. In such a scenario, Ethereum could drop to $3,131, negating the current bullish outlook. The key is to support and capitalize the retail-driven surge.