The Rex-Sosprey Solana Staking ETF (SSK), the first Solana Staking ETF in the United States, made a big splash at launch. SSK finished the day with a $33 million volume, according to Bloomberg ETF expert Eric Balknath. This diagram is much higher than the Sol Futures ETF and XRP Futures ETF numbers. The debut volume is incredible, but Bulknath emphasizes that this number is far lower than the number of spot ETFs in Bitcoin (BTC) and Ethereum (ETH).

Solana is profiting as the market shows signs of reversal

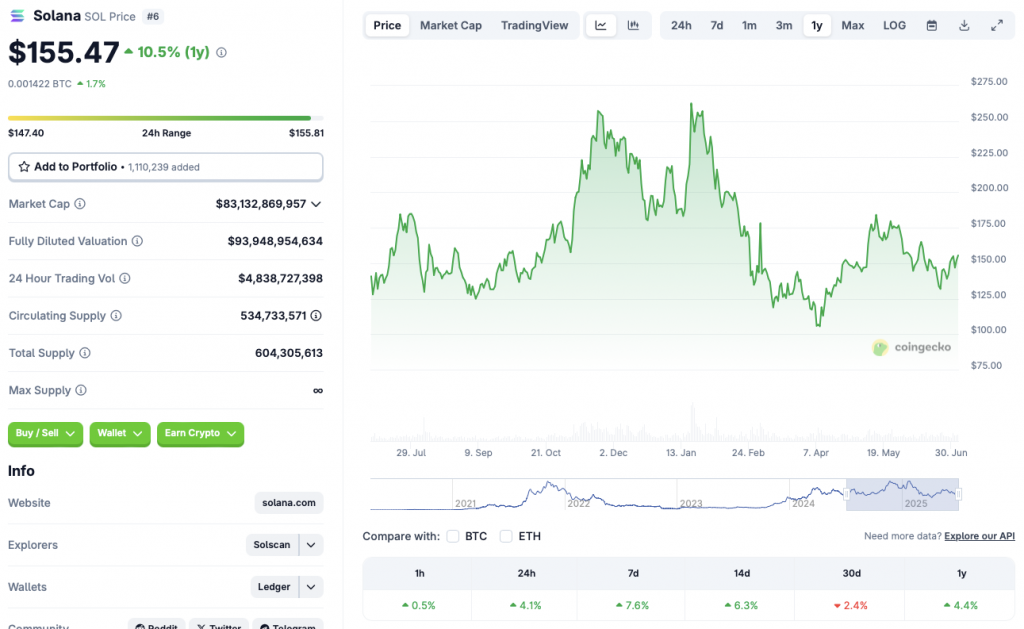

The cryptocurrency market appears to be breaking past resistance. SOL has collected 4.1% on the daily chart, 7.6% on the weekly chart, 6.3% on the 14-day chart, and 4.4% since July 2024.

The market revival could be due to an increased institutional influx into Spot Bitcoin (BTC) ETFs. BTC is in violation of the $109,000 mark. SOL and other crypto assets may be following the trajectory of BTC. The original code is currently down just 2.2% from its all-time high of $111,814.

Will the market maintain this gathering?

The current market is maintained by a large institutional influx. If financial companies are consistent with increasing exposure to crypto, the rally could continue. According to Standard Chartered’s digital assets expert Geoffrey Kendrick, BTC could continue to meet in the coming weeks. Kendrick expects the asset to hit a high of $135,000 in the third quarter of this year. If BTC hits a new peak, SOL could be at a new monthly high.

There are several Solana (Sol) ETF applications awaiting approval in the SEC. It is likely that the SEC will approve at least one Sol ETF within this year. ETH launches could lead to a major surge in institutional investment in the project. This development could lead to a massive price spike for SOL. It has not yet been seen how the SEC will make decisions.

Markets could face corrections. Trade wars and geopolitical tensions can cause fear among investors.