According to the data, the US Etherum Spot ETF has just seen the biggest inflow day, which is mainly led by the demand for black rock and faithfulness.

Ethereum spot ETFs have increased rapid demand.

According to the data from FarSide Investors, July 16 was a big day for Ether Leeum branch ETF, and the total inflow exceeded $ 770 million, the new highest ATH. Spot Exchange-Traded Funds (ETF) refers to investment means that investors can expose to assets without owning assets directly. For Cryptocurrencies, this means that ETF owners do not need to manage digital asset wallets or explore the exchange. For traditional investors, this can be made in a convenient way for the ETF to explore the market.

Ethereum Spot ETFS was approved in the United States almost a year ago. Since then, demand has been diverse, but assets have recently been positively inflow, and the most recent number is to show momentum.

Below is a table that shows how the netflows related to various Etherum Spot ETFs look like a netflow over the last few weeks.

Looks like BackRock's ETF has consistently led in terms of inflows | Source: Farside Investors

As you can see, over the last week, the US Ether Leeum branch ETF has already had more than $ 200 million in notable inflow, indicating that the demand for institutional organizations was strong but the latest recorded day has begun to be a higher equipment.

Blackrock’s ETHA saw that the inflow of July 16 was almost $ 500 million. Fidelity’s FETH was a distant two seconds and bought about $ 133 million as a cryptocurrency on behalf of the user. Capital was poured into ETFS when Ethereum saw more than $ 3,000 more than $ 3,000.

Following this rally, the analytical company’s data of Santiment shows a surge in retail interests, so institutional investors are not the only person to pay attention to ETH.

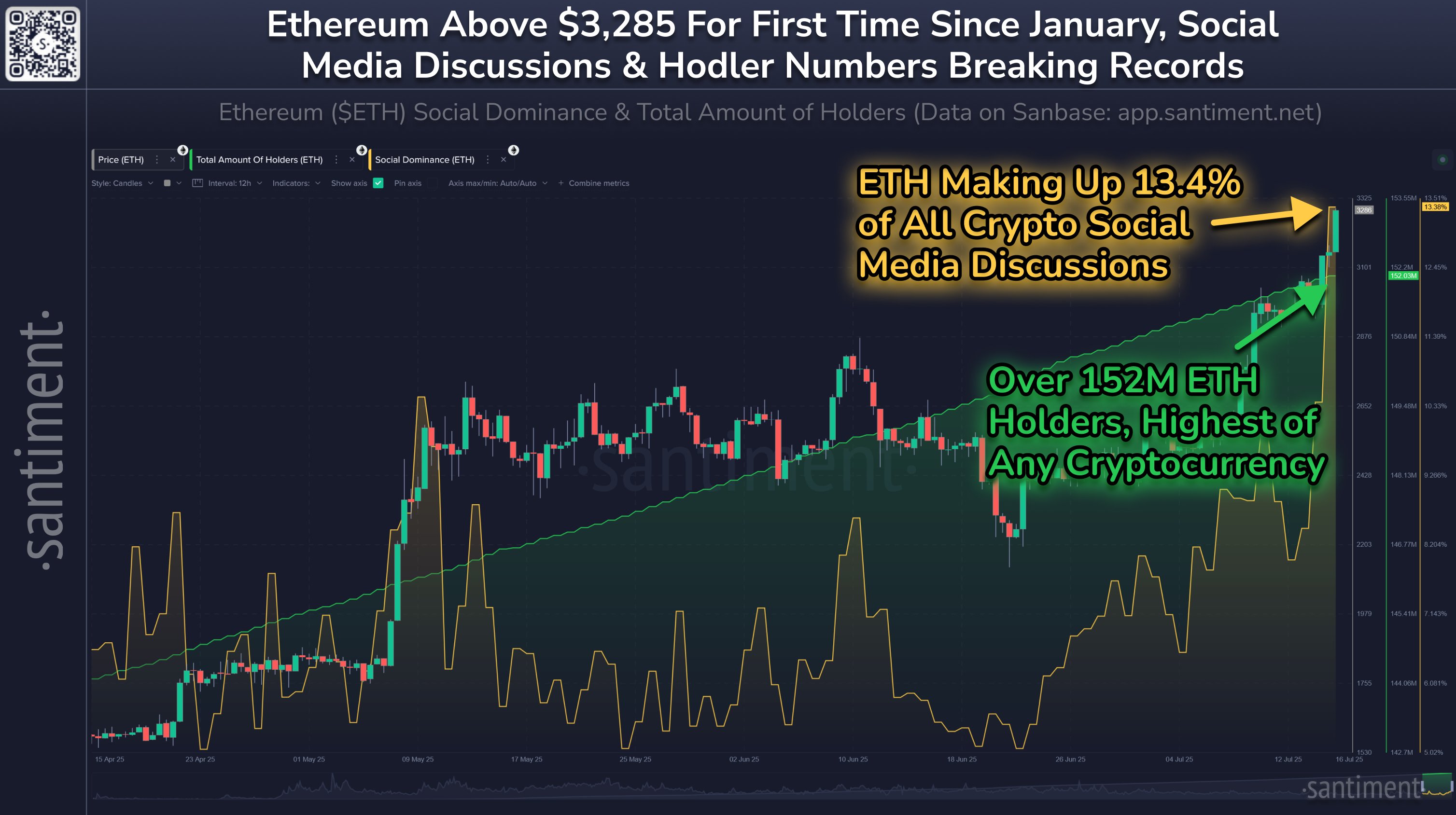

The trend in the Social Dominance and Total Amount Of Holders for ETH over the last few months | Source: Santiment on X

On the chart, Santiment attached data from social domination. This is an indicator of the discussion share of Ether Lee’s share of the major social media platforms compared to other cryptocurrencies.

Since retail investors are much larger than the larger holders in terms of numbers, this metrics reflect the behavior of small hands. In the graph, ETH social dominance has surged with the surge in prices, and there are 13.4%of all digital asset discussions on social media related to coin.

Obviously, retailers are currently paying attention to their assets, but historically, over -advertising between the crowd tends to end with cryptocurrency, so this trend can be noted.

ETH price

At the time of writing, Ether Lee Rium trades $ 3,400, up more than 23% from last week.

The price of the coin appears to have sharply been going up | Source: ETHUSDT on TradingView

DALL-E, Santiment.net’s main image, TradingView.com chart

Editorial process focuses on providing thorough research, accurate and prejudice content. We support the strict sourcing standard and each page is diligent in the top technology experts and the seasoned editor’s team. This process ensures the integrity, relevance and value of the reader’s content.