Republic, a leading global investment platform, has announced plans to tokenize Solana’s Animoca brand stocks. The launch will further link traditional funding to Animoca’s diversified activities.

After Investment Company Republic announces plans to tokenize the assets, the Animoca brand may soon have stock in Solana. The new drive to tokenize Solana’s stocks aims to wider outreach to investors.

. @Joinrepublic, a leading global investment platform, today announced plans to tokenize our fairness.

This initiative by the Republic provides a new way for global investors to get exposed to the Animoca brand. This has a huge portfolio of over 600 major Web3s…pic.twitter.com/taduyr81ot

– Animoca Brands

The Animoca brand combines traditional investor exposure, but also functions as a complete Web3 company with native tokens. Recently, the Animoca brand has supported the tokenization, Preview of the existing stock tokenization ecosystem. The fund noted that tokenized stocks were growing exponentially in 2025, but after starting from the initial foundation.

Republic launches a wait list for stocks in the Animoca brand

Although AB1 shares trade on the Australian Stock Exchange (ASX), the assets have been inactive since 2020. The new token-based version could leverage the company’s crypto fame and take advantage of the new liquidity.

The offer for tokenized stocks from the Animoca brand is still in the waiting list stage. The Republic may still be restricted in some jurisdictions, and some stock market regulators may not accept new types of assets.

Existing shareholders can request on-chain tokens, but the Republic Waiting list For new buyers.

Solana is leading the asset tokenization

Adding Solana as a platform for tokenization highlights its important role in setting the RWA standard. Solana already has XStocks, with over $81 million in managed assets and approximately $1 billion in chain transfers. Since its launch, XStocks has achieved a total of over $400 million in DEX and intensive markets.

Solana is still behind Ethereum and Algorand RWA tokenization Although it’s a stock, the platform aims to increase its influence with the most high-profile offers. For now, the Republic has not announced plans for the exact criteria for trading or tokenization of AB1 stocks.

Other data shows that Solana has a low total balance of tokenized inventory, but that chain is capturing 58% of trading volume. 24/7 market availability could boost AB1 tokenized stocks after years of no trading activity.

The Animoca brand remains a VC powerhouse

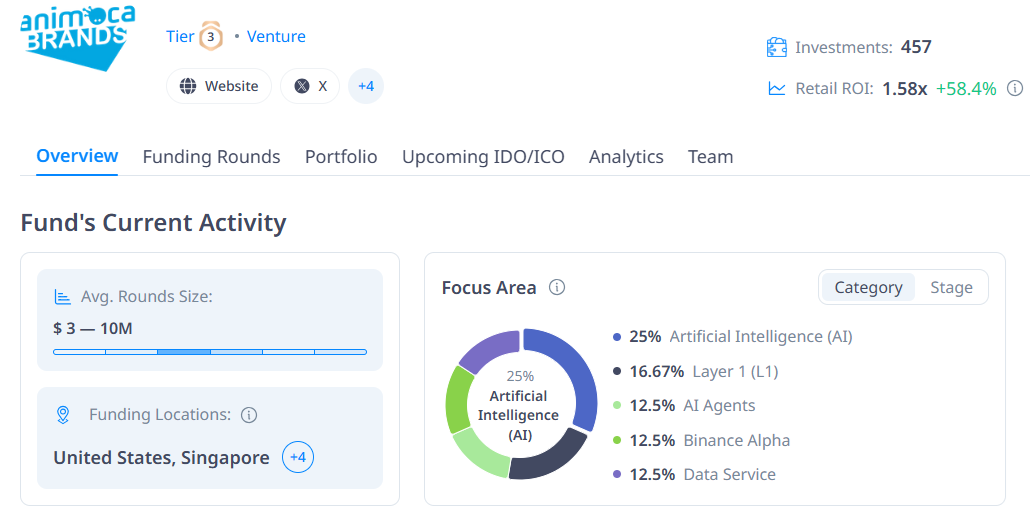

Animoca Brands is also constantly involved in the crypto ecosystem that serves as a Tier 3 investment fund. After the first Web3 Bull Market, I switched to support AI projects and joined Binance Alpha as a partner.

Animoca Brands shifted focus from Web3 games, turning their eyes to AI, infrastructure, and supporting other large VC rounds. |Source: Cryptorank

Animoca Brands announced 24 funding rounds over the past month, with Solana’s $500 million in funding. Helius Medical. The fund has participated in a total of 457 investors, with an average return rate of over 58%.

Despite the fact that Animoca Brands launched the MOCA chain as a native network, the fund also shows a growing interest in the major ecosystem, particularly Solana.