Tom Lee, head of research at Fundstrat, argues that Ether’s recent downturn should be viewed as “attractive” because its fundamentals remain strong, and that it was only driven down by a lack of leverage and a flight to precious metals.

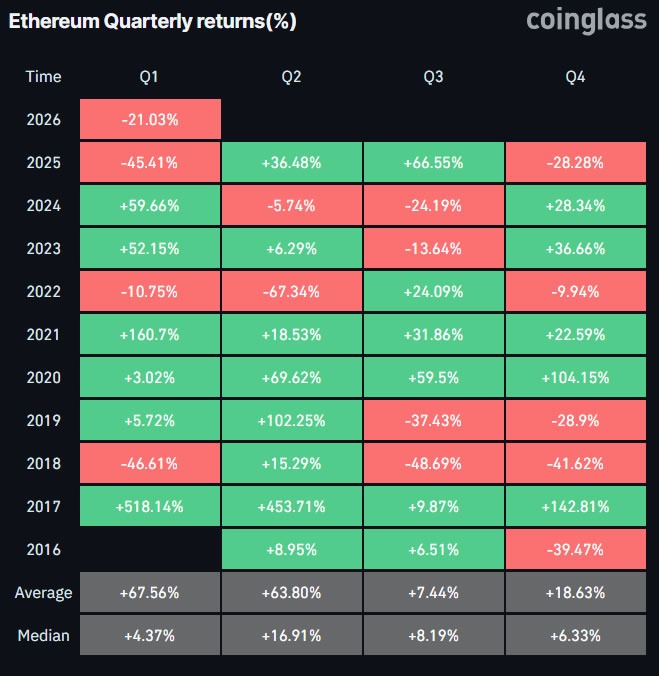

The first quarter of 2026 is becoming the era of ether ($ETHAssets have fallen 21% so far this year, according to CoinGlass, the third-worst first quarter on record.

However, Lee said the price decline occurred at a time when the network’s on-chain activity and fundamentals continue to grow.

He said the number of Ethereum transactions per day hit a record high of 2.8 million on January 15, and active addresses have soared to a peak of 1 million per day in 2026.

During the crypto winters of 2018 and 2022, Ethereum trading activity and active wallets declined, which is “the opposite of what we’ve seen over the past 12 months,” Lee said.

“So non-fundamental factors are probably more of an explanation for the economy’s weakness.” $ETH price. ”

Lee said there are two factors contributing to the suppression of Ether prices. While crypto leverage has not returned since the October 10 crash, soaring precious metal prices are “acting as a ‘vortex’ sucking risk appetite away from cryptocurrencies.”

BitMine buys the boost $ETH 25% down in 1 week

Lee’s Ethereum treasury firm appears to be betting on a recovery. Last week, BitMine gained an additional 41,788 $ETH.

“We think this pullback is attractive given the strengthening fundamentals, and Bitmine is steadily buying Ethereum,” he said.

“In our view, $ETH does not reflect the high utility of $ETH and its role as the future of finance. ”

BitMine currently holds 4.28 million pieces $ETH The token represents 3.55% of the total supply, reaching 70% towards a goal of 5%. Approximately 2.87 million $ETH The bet is on.

However, due to the collapse of Ether prices, unrealized losses on the digital asset vault approached $7 billion.

Most of the price declines have occurred in the past week alone; $ETH It fell more than 25% from about $3,000 on Monday to a bear market low of $2,200, before recovering slightly.

$ETH is having its third-worst first quarter in history. sauce: coin glass