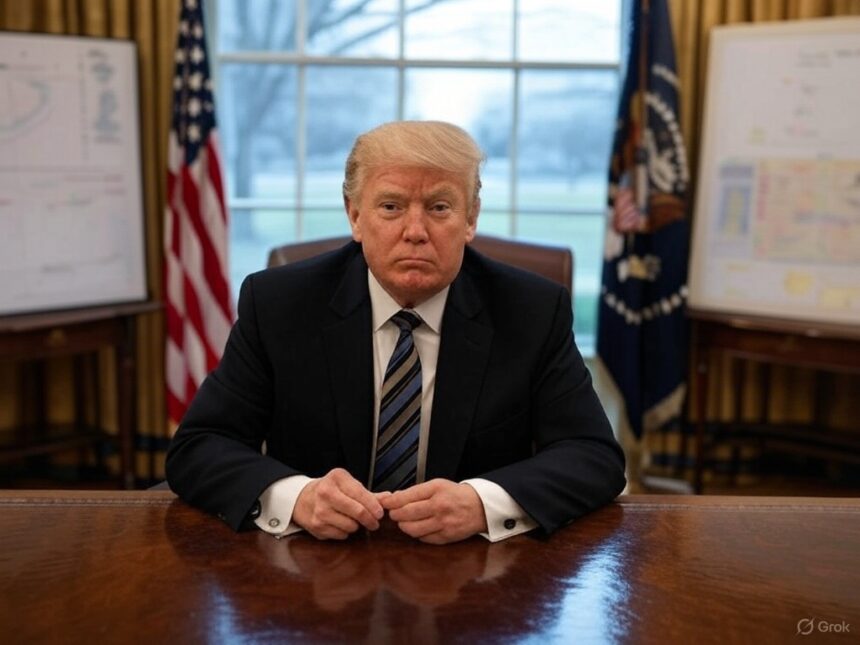

Everything shows that a new commercial storm is coming, lighting up US President Donald Trump and international warnings.

With an overwhelming message published on social networks’ true social networks, Trump warns about mass tariff levies if he recognizes that the European Union and Canada will act together To hurt your country’s economic interests.

Three months after he planned his mission, The President reaffirms his protectionist position, This line marked commercial policy from the beginning.

market They are inhale, but it appears to be tempered, but resurfaces strongly.

A clear and direct message

Trump wrote: «If the European Union works with Canada to damage the US economically, they will both be subject to much greater tariffs than is currently planned to protect the best friends each of these countries have had! ».

With these words, the president points it out. He does not tolerate what he interprets An alliance to US interests.

The threat is intended to overcome measures already planned. 25% customs duties on imported cars, It will come into effect on April 2, 2025.

Additionally, the White House is preparing advertisements for new pricing for the timber, semiconductor and drug sectors scheduled for next week, Bloomberg says.

The April 2nd customs round is medium than expected. However, this message changes the panorama. The commercial disputes that were believed near the solution will be in turn and strengthened.

Trigger: Conferences in Europe

Trump’s response arrives after the first official trip of new Canadian Prime Minister Mark Kearney, who visited the UK and France last week.

In Paris, Carney met President Emmanuel Macron Advocated for strengthening the strategic associations of Canada and France They faced foreign policy challenges that arise after Trump returned to the White House.

“It’s more important now that Canada is strengthening its relationships with trustworthy allies,” Carney said. He added: “I want to make sure that France and Europe are all working with enthusiasm with Canada, the most European in the non-European nation.”

These statements and meetings appear to have encouraged Trump’s suspicions of interpreting diplomatic manipulation as an attempt to counter his economic agenda. In response, the US President raises a bet with his tariff warning.

Impact on the market and Bitcoin

Commercial warfare is not an unknown land for the market. Over the past few months, Trump has announced an increase in import duties from Mexico, Canada and China. It caused a decline that raised the price of Bitcoin to $76,000lowest level for 2025.

Now, new tensions can replicate its effects. Tariffs interfere with economic stability by procuring imports and supplying inflation. Press central banks such as the Federal Reserve to adjust monetary policy. This creates uncertainty and usually prevents investment.

Bitcoin is considered a shelter asset, but its prices are not affected by these dynamics. In a high volatility context, investors tend to move towards safer options And there will be less performance, such as treasure bonds.

Furthermore, commercial disputes strengthen the dollar. This puts bearish pressure on “risk” assets such as stocks, Bitcoin and other cryptocurrencies.

so far, However, the digital currency is stable, at around $87,00020% below the historic maximum of $109,300 in January, matching Trump’s property.

Deep rooted policy

Trump’s vision is nothing new. Since his first term, he has argued that the commercial deficit reflects a disadvantage to the United States and accuss other countries of “fraud.”

In January, the US commercial deficit reached a record of $13.1 billion, with the EU and Canada becoming one of the leading commercial partners.

For Trump, tariffs are a tool that “levels the playing field.” However, these measurements also have internal costs. Imports are more expensive, affect supply chains and create economic tensions In the United States.

The market is analysing each word from Trump, but the international panorama is tense. The coming weeks will be key to determining whether the president’s warning will be translated into concrete actions or whether negotiations are deactivating this commercial bomb. For now, Bitcoin and major stock market indexes resist, but a shadow of tariffs is planned on them.