The US-led trade war has had a major impact on Bitcoin mining, and the looming dispute with the Customs and Border Protection (CBP) could expose American companies to massive debt.

This is a key point from Miner Mag’s latest Bitcoin mining update, examining how mining companies are navigating the complex tariff environment shaped by ongoing US-China trade tensions.

As the White House has changed tariff charges in several Asian countries, it is now reaching 57.6% for mining machines in China and Origin, and 21.6% for Indonesia, Malaysia and Thailand, according to the report.

Miner Mag also revealed that two publicly available US mining companies, Iren and Cleanspark, have recently received an invoice from CBP for allegations that some of their equipment had occurred in China.

CleanSpark warned that potential debt could face up to $185 million, but Iren challenged a $100 million dispute with the agency.

Beyond tariffs, the report said mining revenues are “under pressure,” with the network’s hash price falling below $60, with two-second peta hash and trading fees falling below 1% of block’s reward.

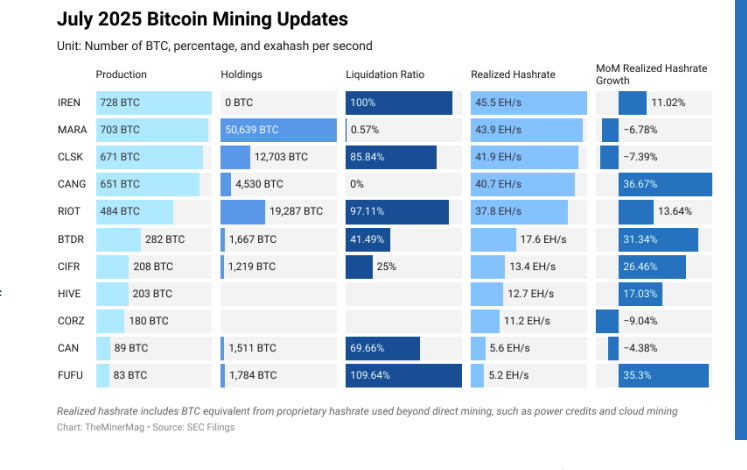

Iren and Mara Holdings each produced more than 700 BTC in July. Source: Minor magazine

Amid the trade war, American Bitcoin — supported by members of President Donald Trump’s family — exercised the option to acquire more than 16,000 mining rigs from Chinese manufacturer Bitmain earlier this month. As reported by Cointelegraph, the contract excludes potential price impacts from customs duties.

Related: Jack Dorsey’s Block targets the 10-year life cycle of Bitcoin mining rigs

Bitcoin mining suppliers are also forced to adapt

Bitcoin mining is facing constant pressure to adapt. They are tackling rising costs, lower margins and increasing regulatory risks. The ongoing trade war only accelerated this trend, and miners became more sophisticated importers while diversifying their supply chains.

Some analysts suggest that US tariffs on mining equipment could attenuate domestic demand for rigs and favor overseas operators. But the ultimate impact will depend on how US tariff policy develops.

On the hardware front, Chinese manufacturers Bitmain, Canaan and Microbt have begun establishing facilities in the US to mitigate the impact of tariff escalation.

Canaan’s strategy stands out. Not only has the company moved its headquarters to Singapore, it has also announced US investments aimed at side-tipulating trade barriers.

https://www.youtube.com/watch?v=xkvojawp688

magazine: An invisible tug of war between a bitcoin suit and cypherpunks