One of the largest public real estate companies in the United Arab Emirates, Rak Properties, begins accepting cryptocurrencies for international real estate transactions.

According to a Monday announcement, RAK Properties will begin accepting payments for Bitcoin (BTC), Ether (ETH), and Tether USDT (USDT) in particular. The move highlights the growing adoption of digital assets in the UAE, which is projected to become one of the nation’s largest in the coming years.

Cryptocurrency transactions are processed by Hubpay, a global payment platform based in the region. Hubpay converts digital assets into local Fiat currency in the UAE and then deposits them in your Rak account.

“By enabling and supporting the use of digital assets, we are involved in a new ecosystem of digital and investment-savvy customers (…),” said Rahul Jogani, Chief Financial Officer, Rak Properties.

https://www.youtube.com/watch?v=d7tl4gxowfw

Ras Al Khaimah is the fourth largest emirate in the United Arab Emirates by region, with a population of about 400,000.

According to TradingView, Rak Properties, which has been listed on the Abu Dhabi Stock Exchange since 2005, has a market capitalization of 4.7 billion dirhams ($1.3 billion).

The developers are expanding in 2025 with 12 new projects, but the total portfolio size remains unknown. Its net profit rose 39% year-on-year, rising to 281 million in 2024 from 202 million in the previous year.

Related: Dubai and the UAE will move to coordinate crypto frameworks under new partnerships

Increased adoption of cryptography in the UAE

Crypto adoption in the United Arab Emirates is growing steadily. The country is one of the most progressives in the crypto industry and has become a sought after destination for web 3 companies and investors as well.

According to Chase Ergen, a board member of Digital Asset Investment Company Defi Technologies, Crypto is predicted to be the second largest sector in the country in five years.

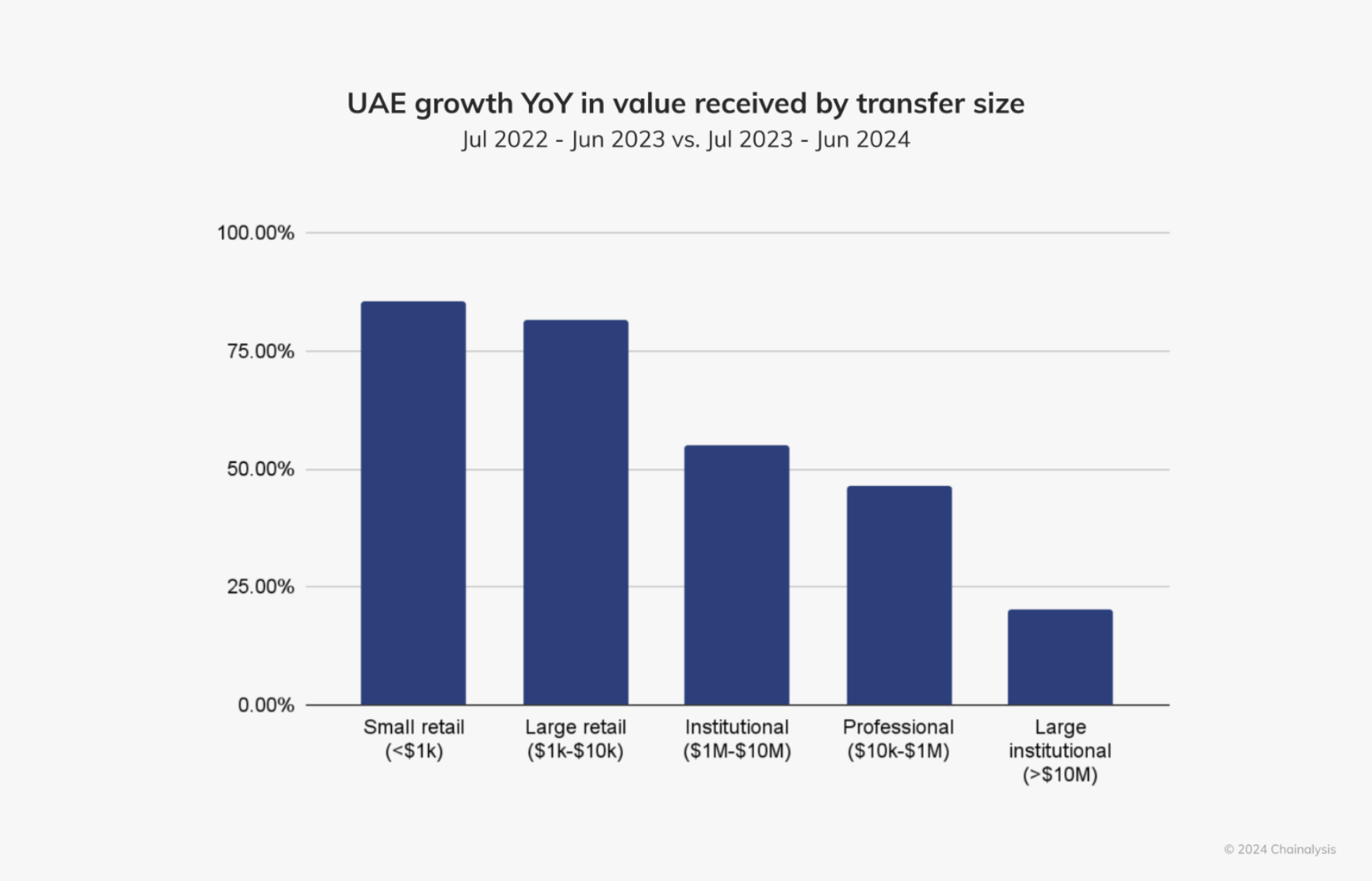

According to chain analysis, UAE’s crypto activity has grown across all transaction size brackets over the past few years, with small retail transactions jumping more than 75% year-on-year since June 2024.

Compared to the previous year, the value increased due to transfer size. Source: Chain Analysis

magazine: Bitcoin payments are undermined by centralized stubcoins