Uniswap has carried out a major token burn following approval of the long-anticipated fee burn proposal, removing 100 million UNI from the protocol’s treasury, equivalent to approximately $596 million at current prices.

Analyst EmberCN said on-chain data shows the burn transaction was completed around 4:30 a.m. UTC on December 28, confirming the first large-scale implementation of the governance decision passed earlier this week. This transaction permanently reduced the token supply of Uniswap (UNI), making it one of the largest burns ever undertaken by a decentralized finance protocol.

The highly anticipated Uniswap protocol fee switch, dubbed “UNIfication,” passed with 99.9% support on Thursday. More than 125 million UNI tokens voted in favor of the proposal, while only 742 tokens voted against it, highlighting the broad consensus among token holders.

Several crypto executives with significant voting power supported the unification plan, including Jesse Waldren, founder and managing partner of cryptocurrency-focused venture capital firm Valiant. Kain Warwick, founder of decentralized finance protocols Infinex and Synthetix. and Ian Lapham, who previously worked as an engineer at Uniswap Labs.

Related: US senator questions DeFi oversight over delay in crypto bill

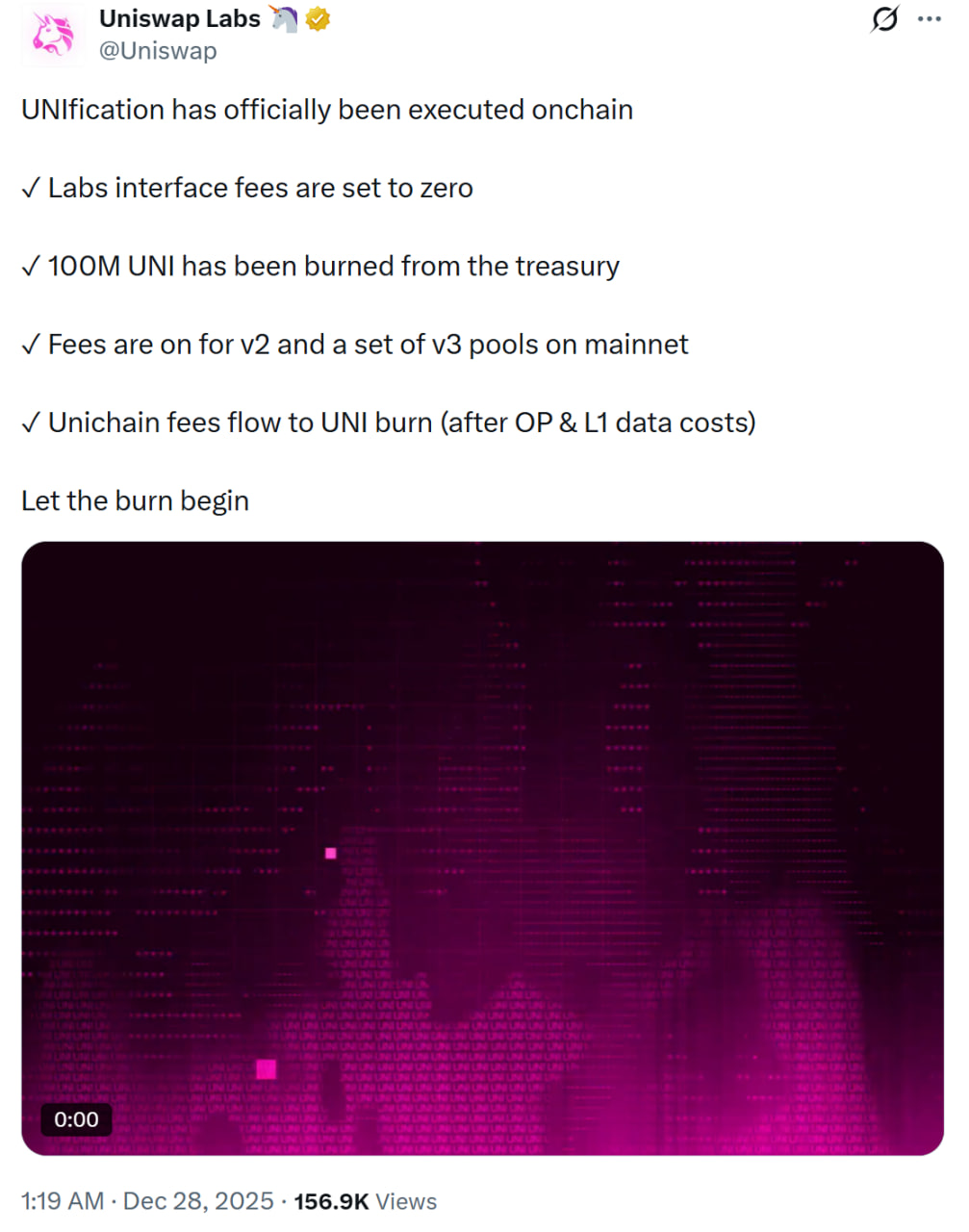

Uniswap Labs confirms 100 million posts

Uniswap Labs confirmed the execution in a post to X, stating that “UNIfication has officially been executed on-chain.”

Uniswap Labs has confirmed the token burn. sauce: uniswap lab

As part of the update, interface fees charged by Uniswap Labs have been set to zero, while fees have been enabled for Uniswap v2 and some v3 pools on Ethereum mainnet. The fees generated by Unichain are set to go to UNI Burn after covering the cost of optimism and layer 1 data.

According to data from CoinMarketCap, UNI rose more than 5% in the past 24 hours after the fire, with trading volume and market capitalization both increasing. The circulating supply of tokens currently stands at approximately 730 million UNI out of a total supply of 1 billion.

Related: Bitcoin rises to $88,000 as Aave faces governance drama: redefining finance

Uniswap Foundation sets aside 20 million UNI for growth

When the proposal was introduced, the Uniswap Foundation said it would continue funding builders and would not stop its grant program supporting protocol development. The foundation said supporting developers remains a key priority.

To support this plan, the Uniswap Foundation will create a growth budget that will distribute 20 million UNI tokens to fund the development and expansion of the entire Uniswap ecosystem.

magazine: 2026 is the year of practical privacy in cryptocurrencies — Canton, Zcash, and more